DE 200-01 2014 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE 200-01

Edit your DE 200-01 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE 200-01 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE 200-01 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DE 200-01. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE 200-01 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE 200-01

How to fill out DE 200-01

01

Begin by obtaining the DE 200-01 form from the appropriate state agency website or office.

02

Read the instructions provided with the form carefully.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide details regarding your employment history as necessary, including employer names and addresses.

05

Indicate the reasons for filling out the form and any relevant dates.

06

Review all information for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form according to the provided instructions, either electronically or via mail.

Who needs DE 200-01?

01

Individuals who are applying for unemployment benefits.

02

Workers who are seeking to report work-related injuries.

03

Employees who need to verify employment status for governmental assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

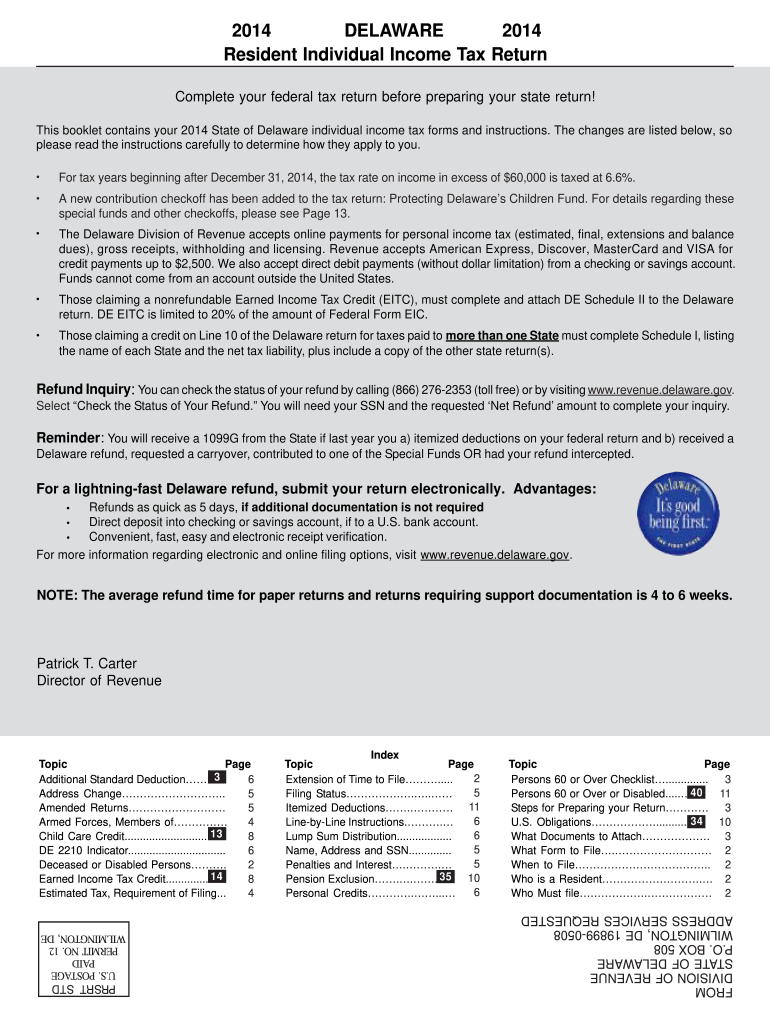

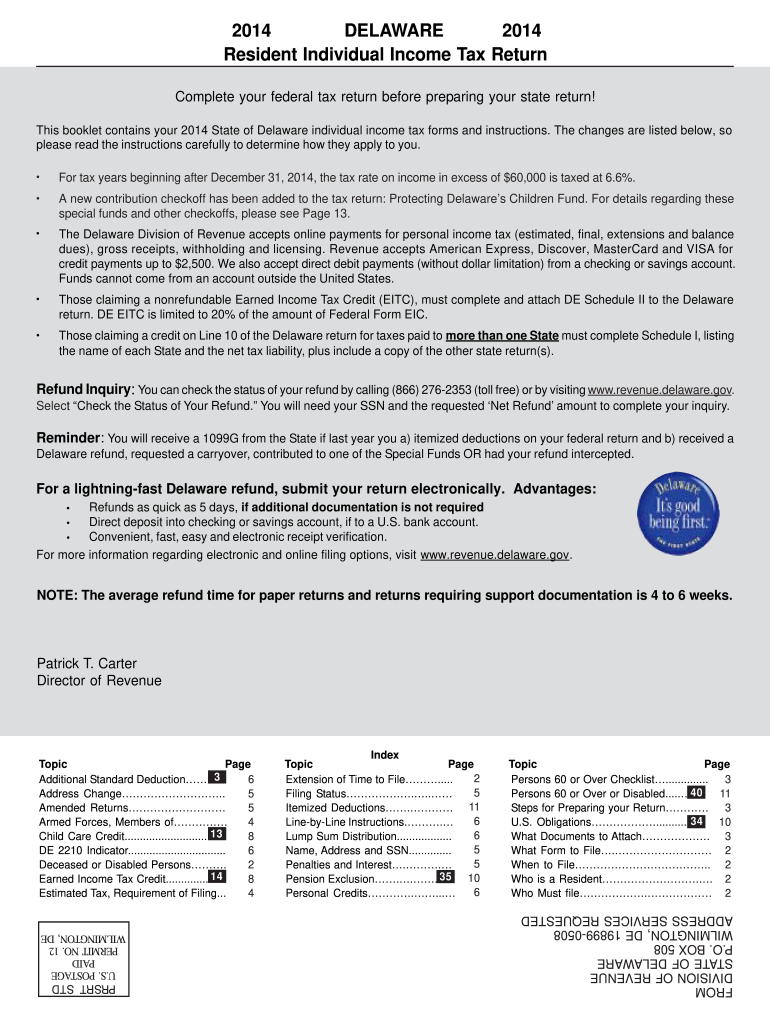

Why is Delaware tax free?

Delaware as a Tax Shelter For the following reasons, Delaware is considered a tax shelter, insofar as corporations are concerned: A company that is incorporated in Delaware, but actually doing business someplace else, does not have to pay income tax on goods and services. There is no sales tax in Delaware.

What is Delaware state tax 2019?

Delaware Tax Rates, Collections, and Burdens Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax. Delaware does not have any state or local sales taxes.

What is Delaware income tax rate?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateState6.60%4.94%Local0.00%0.00%Total Income Taxes25.01%Income After Taxes4 more rows • Jan 1, 2023

What was the corporate tax rate in 2019?

The corporate income tax raised $230.2 billion in fiscal 2019, accounting for 6.6 percent of total federal revenue, down from 9 percent in 2017. The United States taxes the profits of US resident C-corporations (named after the relevant subchapter of the Internal Revenue Code) at 21 percent.

What is the corporate tax rate for Delaware corporations?

There is also a jurisdiction that collects local income taxes. Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax. Delaware does not have any state or local sales taxes. Delaware's tax system ranks 16th overall on our 2023 State Business Tax Climate Index.

What is Delaware corporate tax rate 2019?

Corporate Income Tax Rate: 8.7% of federal taxable income allocated and apportioned to Delaware based on an equally weighted three-factor method of apportionment. The factors are property, wages and sales in Delaware as a ratio of property, wages and sales everywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my DE 200-01 in Gmail?

DE 200-01 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete DE 200-01 online?

pdfFiller has made it easy to fill out and sign DE 200-01. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in DE 200-01?

With pdfFiller, the editing process is straightforward. Open your DE 200-01 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is DE 200-01?

DE 200-01 is a form used by employers in California to report unemployment insurance and disability insurance information.

Who is required to file DE 200-01?

Employers who pay wages subject to California unemployment insurance and disability insurance taxes are required to file DE 200-01.

How to fill out DE 200-01?

To fill out DE 200-01, you must provide information such as your employer details, employee wages, and other relevant payroll information accurately.

What is the purpose of DE 200-01?

The purpose of DE 200-01 is to collect data for the unemployment insurance and disability insurance programs in California.

What information must be reported on DE 200-01?

Information required on DE 200-01 includes employer identification details, total wages, number of employees, and amounts withheld for unemployment and disability insurance.

Fill out your DE 200-01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE 200-01 is not the form you're looking for?Search for another form here.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.