DE 200-01 2017 free printable template

Show details

2017

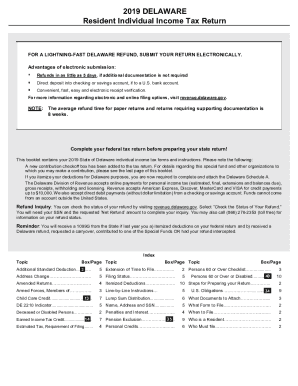

DELAWARE

2017

Resident Individual Income Tax Returner A LIGHTNINGS DELAWARE REFUND, SUBMIT YOUR RETURN ELECTRONICALLY.

Advantages of electronic submission:Refunds as quick as 5 days, if additional

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE 200-01

Edit your DE 200-01 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE 200-01 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE 200-01 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DE 200-01. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE 200-01 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE 200-01

How to fill out DE 200-01

01

Obtain the DE 200-01 form from the relevant agency or website.

02

Provide your personal information, including your name, address, and Social Security number.

03

Indicate the type of benefits you are seeking.

04

Complete the sections regarding your employment history.

05

Include any additional relevant information as requested in the form.

06

Review the form for accuracy and completeness.

07

Submit the completed form to the appropriate office via mail or online.

Who needs DE 200-01?

01

Individuals applying for disability benefits.

02

Workers who have become disabled and are seeking compensation.

03

Employees applying for state disability insurance.

Fill

form

: Try Risk Free

People Also Ask about

Why is Delaware tax free?

Delaware as a Tax Shelter For the following reasons, Delaware is considered a tax shelter, insofar as corporations are concerned: A company that is incorporated in Delaware, but actually doing business someplace else, does not have to pay income tax on goods and services. There is no sales tax in Delaware.

What is Delaware state tax 2019?

Delaware Tax Rates, Collections, and Burdens Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax. Delaware does not have any state or local sales taxes.

What is Delaware income tax rate?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateState6.60%4.94%Local0.00%0.00%Total Income Taxes25.01%Income After Taxes4 more rows • Jan 1, 2023

What was the corporate tax rate in 2019?

The corporate income tax raised $230.2 billion in fiscal 2019, accounting for 6.6 percent of total federal revenue, down from 9 percent in 2017. The United States taxes the profits of US resident C-corporations (named after the relevant subchapter of the Internal Revenue Code) at 21 percent.

What is the corporate tax rate for Delaware corporations?

There is also a jurisdiction that collects local income taxes. Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax. Delaware does not have any state or local sales taxes. Delaware's tax system ranks 16th overall on our 2023 State Business Tax Climate Index.

What is Delaware corporate tax rate 2019?

Corporate Income Tax Rate: 8.7% of federal taxable income allocated and apportioned to Delaware based on an equally weighted three-factor method of apportionment. The factors are property, wages and sales in Delaware as a ratio of property, wages and sales everywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete DE 200-01 online?

With pdfFiller, you may easily complete and sign DE 200-01 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in DE 200-01 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your DE 200-01, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit DE 200-01 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing DE 200-01 right away.

What is DE 200-01?

DE 200-01 is a form used in the State of California that employers file to report information regarding their employees' wages and unemployment insurance contributions.

Who is required to file DE 200-01?

Employers and business owners who have employees or who are subject to California payroll tax law are required to file the DE 200-01.

How to fill out DE 200-01?

To fill out DE 200-01, employers need to provide details such as their business information, employee information, wages paid, and other related data as per the instructions provided with the form.

What is the purpose of DE 200-01?

The purpose of DE 200-01 is to enable the State of California to track and manage unemployment insurance contributions and ensure compliance with state employment laws.

What information must be reported on DE 200-01?

The information that must be reported on DE 200-01 includes the employer's account number, employee details (name, social security number), total wages paid, and other deductions related to unemployment insurance.

Fill out your DE 200-01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE 200-01 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.