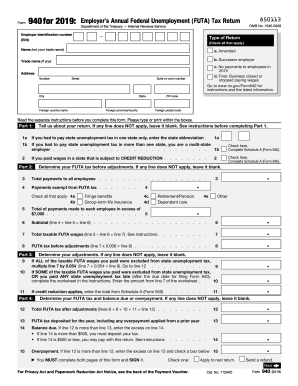

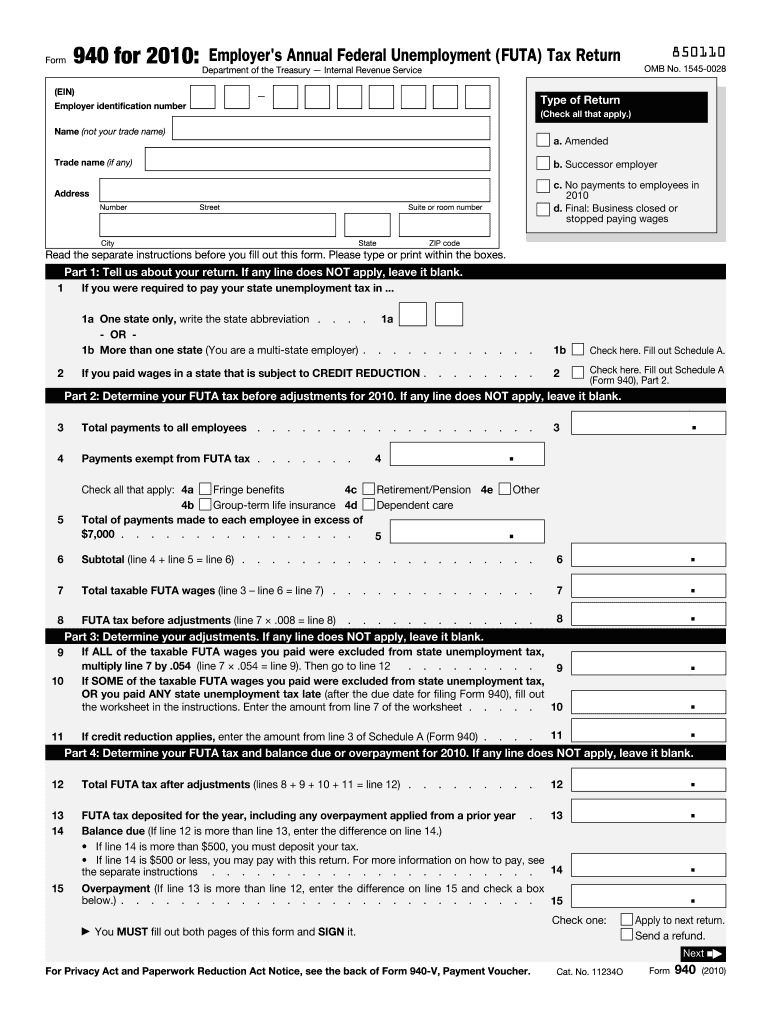

IRS 940 2010 free printable template

Instructions and Help about IRS 940

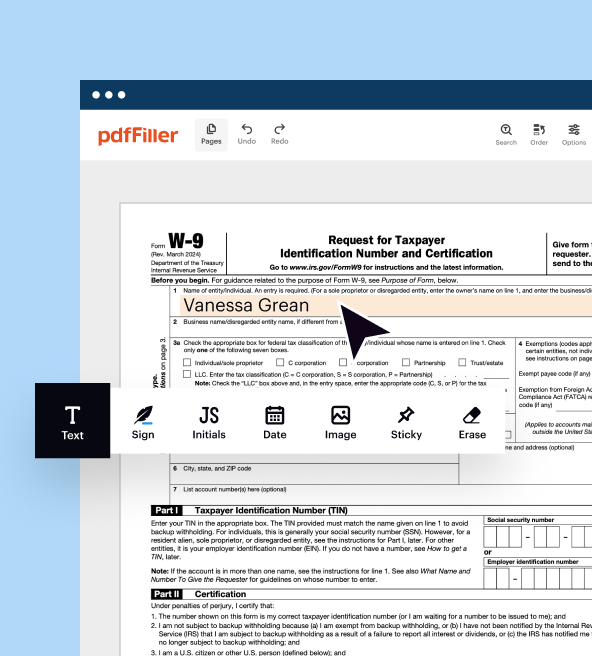

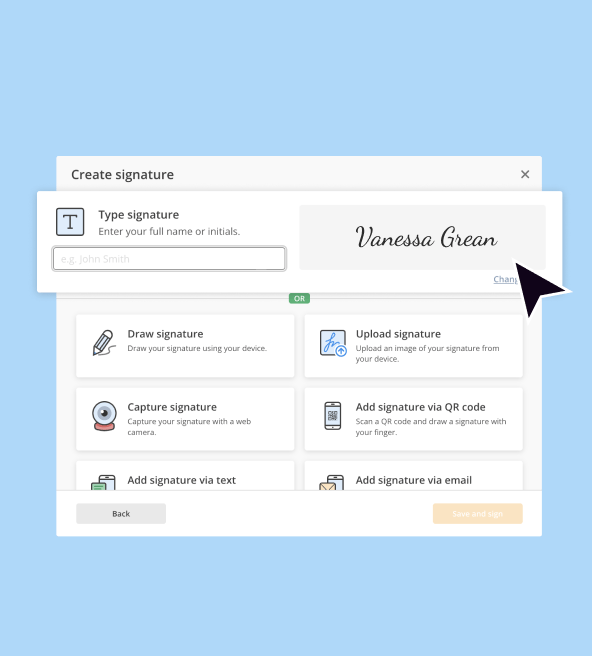

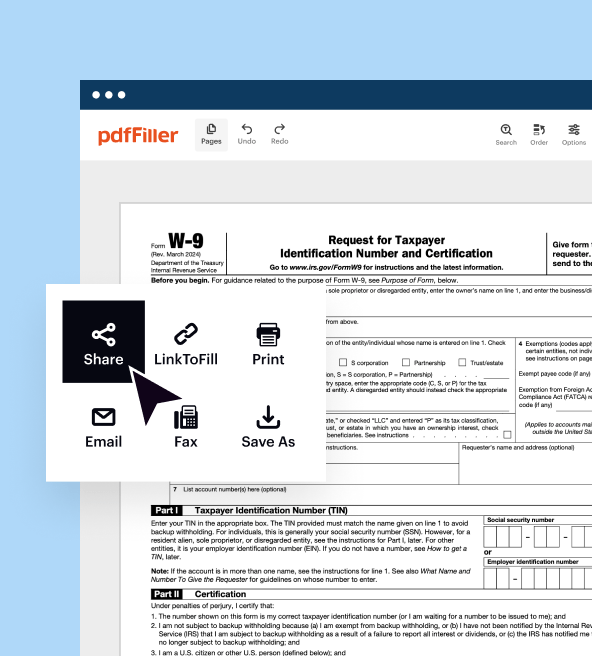

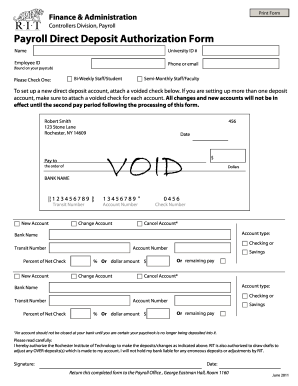

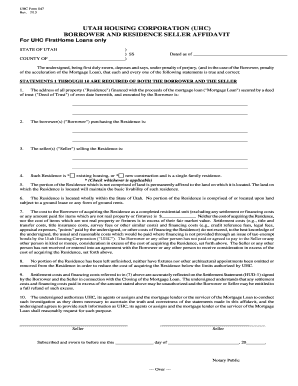

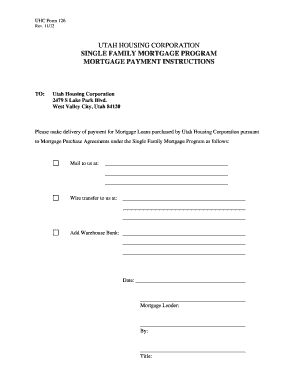

How to edit IRS 940

How to fill out IRS 940

About IRS previous version

What is IRS 940?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 940

What should I do if I realize I made a mistake on my submitted 2010 form 940?

If you find an error after filing the 2010 form 940, you can submit an amended return using Form 940-X. This allows you to correct any mistakes, such as changes in income or tax calculations. Ensure that you clearly explain the corrections made to avoid further issues.

How can I confirm that my 2010 form 940 was received and is being processed?

To verify the status of your 2010 form 940, you can contact the IRS directly or check their online resources. Keep your confirmation number and relevant details handy, as these will help expedite the inquiry process regarding your filing's status.

Are there any specific technology requirements or compatibility issues for e-filing the 2010 form 940?

When e-filing the 2010 form 940, ensure that your software is updated and compatible with the IRS e-file system. Using a reputable tax software can help ensure compliance with technical requirements, as these solutions are designed to guide you through the e-filing process.

What should I do if I receive an audit notice or letter from the IRS regarding my 2010 form 940?

If you receive an audit notice related to your 2010 form 940, respond promptly with the requested documentation. It is essential to keep records of all transactions and communications. Consider consulting a tax professional to assist in ensuring your response is complete and accurate.

Can foreign payees or nonresidents be reported on the 2010 form 940, and what should I be aware of?

Yes, foreign payees or nonresidents can be included on the 2010 form 940, but specific reporting requirements may apply. Ensure that you understand any tax treaties or obligations that may affect the filing, and consult a tax advisor if necessary to navigate these complexities accurately.

See what our users say