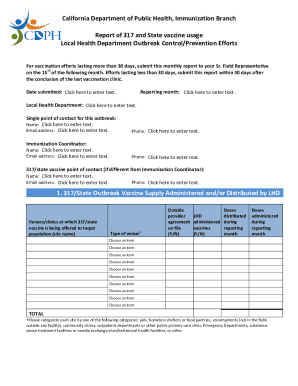

AL ADoR 40 2014 free printable template

Show details

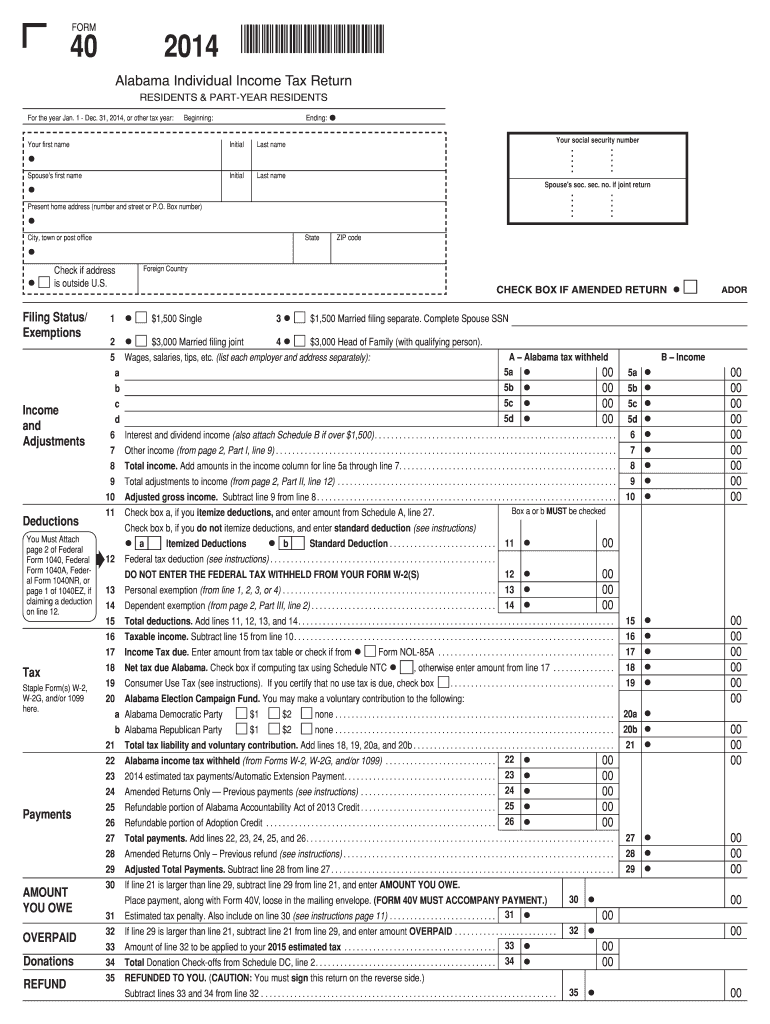

FORM 2014 14000140× 40 Alabama Individual Income Tax Return RESIDENTS & PART-YEAR RESIDENTS For the year Jan. 1 Dec. 31, 2014, or other tax year: Ending: Beginning: Your first name Initial Last name

pdfFiller is not affiliated with any government organization

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

How to fill out AL ADoR 40

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

To edit AL ADoR 40, use a digital platform that supports form editing, such as pdfFiller. This tool allows you to easily add or modify information required on the form. Ensure that any changes made do not alter the essential content or lead to discrepancies in reporting.

How to fill out AL ADoR 40

Follow these steps to fill out AL ADoR 40:

01

Gather all necessary information such as business details, income amounts, and any relevant taxpayer identification numbers.

02

Start from the top section, entering identification information and ensuring accuracy.

03

Complete all income and payment reporting sections while cross-referencing your financial records for accuracy.

About AL ADoR 40 2014 previous version

What is AL ADoR 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AL ADoR 40 2014 previous version

What is AL ADoR 40?

AL ADoR 40 is a tax form used by Alabama's Department of Revenue for specific income reporting requirements. It is primarily utilized by businesses and individuals to report payments to independent contractors or other sources of earned income. This form plays a crucial role in ensuring proper state tax reporting and compliance.

What is the purpose of this form?

The purpose of AL ADoR 40 is to report certain income that may be subject to state taxation. This includes income payments to individuals or entities that are not classified as employees. By accurately completing this form, filers help maintain transparent financial records while allowing the state to collect appropriate taxes.

Who needs the form?

Any business or individual that has made qualifying payments to independent contractors or other service providers during the tax year must file AL ADoR 40. This includes microbusinesses, freelancers, and larger corporations alike, as long as the payments exceed the threshold set by state tax regulations.

When am I exempt from filling out this form?

Exemptions from filing AL ADoR 40 may apply if total payments to a contractor fall below the established reporting threshold. Additionally, payments made to exempt organizations or government entities typically do not require this form. Always consult current regulations for detailed criteria on exemptions.

Components of the form

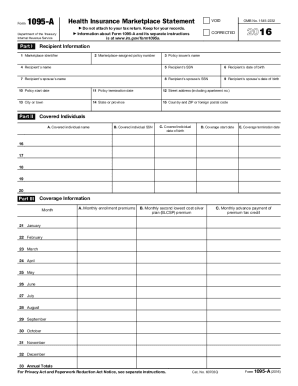

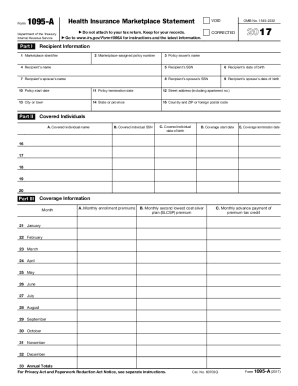

AL ADoR 40 includes several key components such as the taxpayer's identification information, the contractor's details, and sections to report payment amounts. Each component is essential for accurately conveying financial information to the Alabama Department of Revenue.

What are the penalties for not issuing the form?

Failing to issue AL ADoR 40 when required can result in penalties imposed by the Alabama Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential audits. Timely and accurate filing is crucial to avoid these repercussions.

What information do you need when you file the form?

When filing AL ADoR 40, ensure you have the following information:

01

The payer's name and Tax Identification Number (TIN).

02

The recipient's name and TIN.

03

The amount of payment made during the tax year.

04

Any applicable tax codes or specific notes required by the state.

Is the form accompanied by other forms?

AL ADoR 40 may not necessarily need to be accompanied by other forms unless there are specific transactions or adjustments involved that require additional documentation. Filing requirements can vary, so it's prudent to check any related forms that might be necessary based on your unique circumstances.

Where do I send the form?

After completing AL ADoR 40, send the form to the Alabama Department of Revenue at the designated address provided in the form instructions. This location varies based on the filer’s regional office, so confirm the correct address to ensure proper submission and processing.

See what our users say