AL ADoR 40 2021 free printable template

Show details

Reset Form2021 *21000140×FORM40Alabama Individual Income Tax Return

RESIDENTS & PARTNER RESIDENTS

For the year Jan. 1 Dec. 31, 2021, or other tax year:Ending: Beginning:Your first nameInitialSpouses

pdfFiller is not affiliated with any government organization

Instructions and Help about AL ADoR 40

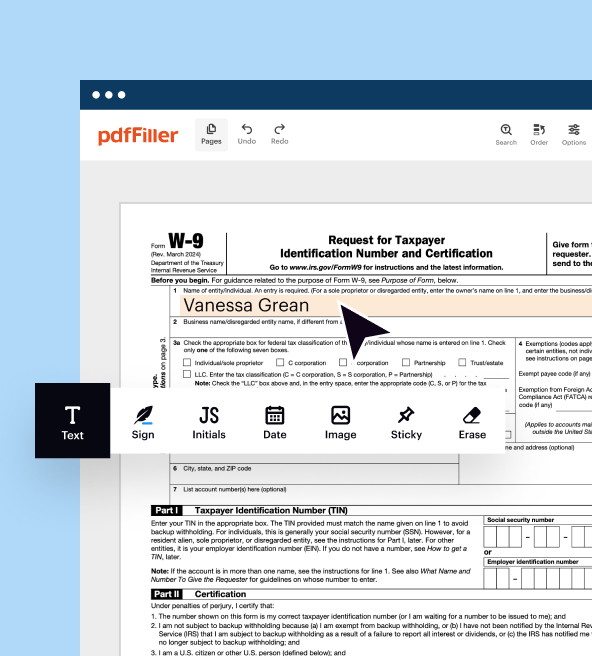

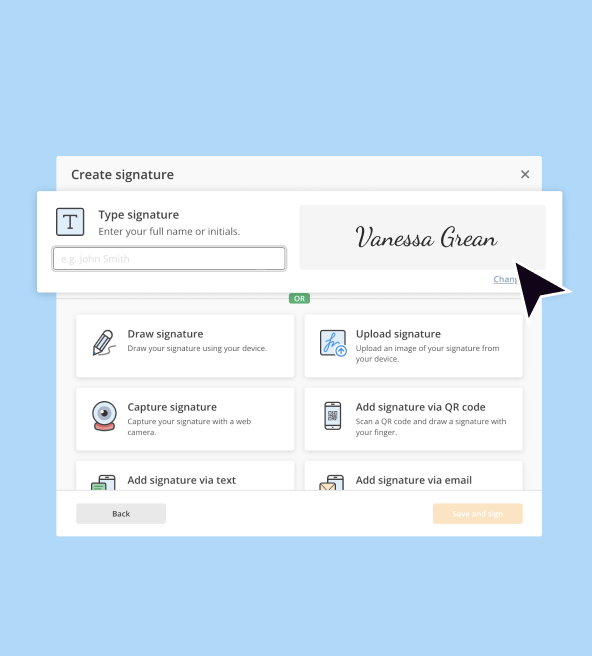

How to edit AL ADoR 40

How to fill out AL ADoR 40

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

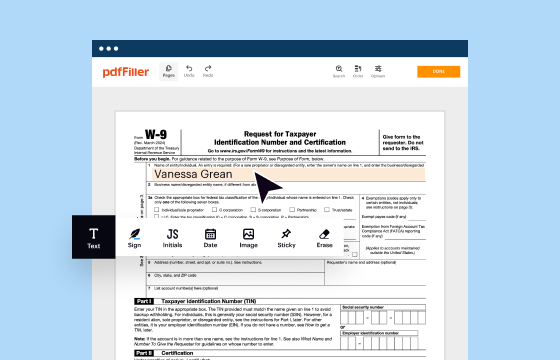

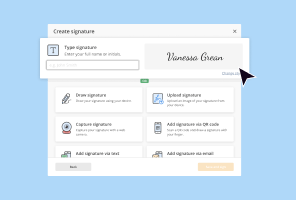

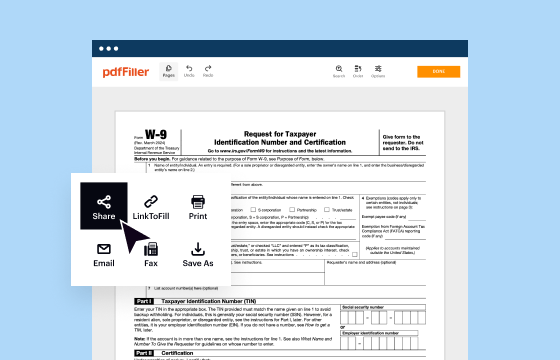

To edit the AL ADoR 40 Tax Form, you can utilize pdfFiller, which allows for easy modifications. Simply upload the completed form to the platform, and use the editing tools to adjust any required fields. Ensure that all information is accurate and up to date before finalizing the changes.

How to fill out AL ADoR 40

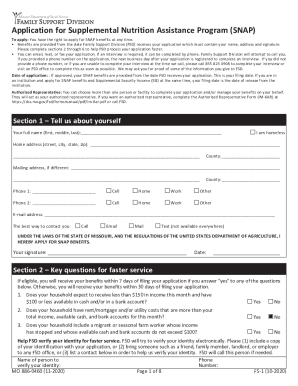

Filling out the AL ADoR 40 Tax Form requires specific details regarding income sources and tax deductions. Follow these steps to complete the form:

01

Gather all necessary documents such as W-2s, 1099s, and receipts for deductions.

02

Start by entering your personal information, including name, address, and Social Security number.

03

List all income received during the tax year on the designated sections of the form.

04

Calculate total deductions and enter the information accurately in the corresponding sections.

05

Review the entire form for accuracy before submission.

About AL ADoR 40 2021 previous version

What is AL ADoR 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AL ADoR 40 2021 previous version

What is AL ADoR 40?

AL ADoR 40 is a tax form used by residents and businesses in Alabama to report various income types and calculate tax liability. This form is essential for ensuring compliance with state tax regulations.

What is the purpose of this form?

The purpose of the AL ADoR 40 Tax Form is to document taxable income and calculate the corresponding state tax owed by individuals and businesses. Proper completion of this form helps taxpayers fulfill their legal obligations and avoid penalties.

Who needs the form?

Taxpayers who reside in Alabama or earn income from Alabama sources are required to file the AL ADoR 40 Tax Form. This includes individuals, partnerships, and corporations. If you have a tax liability, it is essential to submit this form, regardless of the amount owed.

When am I exempt from filling out this form?

Exemptions from filing the AL ADoR 40 include individuals whose total income is below the taxable threshold established by the state. Additionally, those who are solely dependents or meet specific qualifications may be exempt from submitting this form.

Components of the form

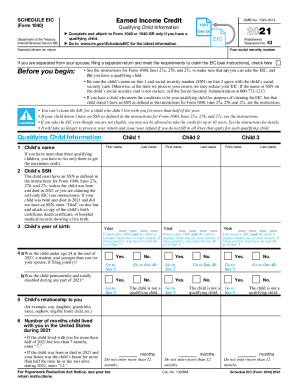

The AL ADoR 40 comprises several key sections: personal information, income reporting, deductions, and tax calculation. Each component must be completed accurately to ensure that the form serves its purpose effectively.

What are the penalties for not issuing the form?

Failing to file the AL ADoR 40 Tax Form by the deadline can lead to various penalties, including fines and interest on unpaid taxes. The Alabama Department of Revenue may impose these penalties to encourage compliance and ensure tax responsibility.

What information do you need when you file the form?

When filing the AL ADoR 40, you will need various pieces of information, including your Social Security number, total income for the tax year, details of any deductions, and records of payments made toward any estimated taxes.

Is the form accompanied by other forms?

While the AL ADoR 40 can be filed independently, it may be accompanied by other forms, such as income statements or schedules that detail specific deductions. It’s important to include any necessary additional documentation to support the information reported on the form.

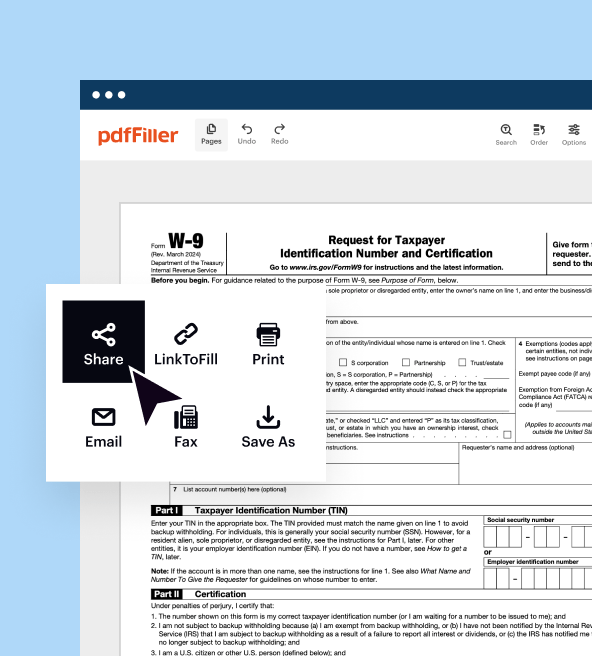

Where do I send the form?

You should send the completed AL ADoR 40 Tax Form to the Alabama Department of Revenue. The mailing address may vary based on your location or whether you are including a payment. Ensure you verify the correct address on the official state website before submission.

See what our users say