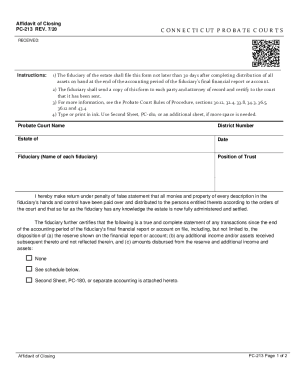

CT PC-213 2015 free printable template

Get, Create, Make and Sign connecticut probate pc 213

Editing connecticut probate pc 213 online

Uncompromising security for your PDF editing and eSignature needs

CT PC-213 Form Versions

How to fill out connecticut probate pc 213

How to fill out CT PC-213

Who needs CT PC-213?

Instructions and Help about connecticut probate pc 213

So normally I'd stand amidst the hardware to introduce the topic of the video but as you can tell today there's legitimately no room for me because this is by far the highest end machine that I have ever built and the hardware barely even fits on the table but what does this build for — you've been teasing this thing on social media for weeks well inspired by our two gamers one CPU build back in whenever the heck we did that this is taking it to the next level Michael Bay's sequel style we are doing seven gamers running off of one tower, but before we begin I should tell you something and that is that I legitimately don't know if this is gonna work at this time now I mean we've done some pretesting we've got four VMs working with you know the performance you'd expect from an AMD radon r9 NATO and a quad-core gaming processor, but we have no way of testing seven until we install all the custom water-cooling and gets the whole thing assembled so without further ado a huge thanks to Kingston for sponsoring this video providing 256 gigs of their kick-ass ddr4 ECC memory providing eight one terabyte SSD so all those gaming VMs have nice high speed storage and for demoing this machine at their booth at CES 2016 so if you're there at the show definitely go check it out you can see it in person let's get started, so it's 24 hours later and if I look like I haven't slept much it's probably because I didn't, but it's totally worth if it's working, so I'm going to take you guys through the journey now that I know that it's successful of how we created seven gamers one CPU it starts I guess actually with the CPU or I should say CPUs because there isn't a CPU on the market that could deliver a full-on high-end gaming experience to seven gamers all at the same time, so our system is equipped with two Intel Leon e5 2697 v3 processors, so these are 14 core processors that are clocked at up to 36 gigahertz when they're turbo as high as they can in they actually have hyper threading as well for a total of 56 threads meaning that each of our VMs has four cores and four hyper threads just like you would if you were running on something like a core i5 or a core i7 normal desktop processor for our motherboard obviously we needed something that could hold both of these CPUs and seven graphics cards so the Asus z10 PE d 8 WS is one of the few standard form factor boards that would fit in like a gaming case that is capable of carrying seven GPUs two sockets first and CPUs and that can hold all the RAM that we need, and it's got some other key features as well, so it has a VGA output for our unread console it's got enough SATA ports for us to throw in as many SSDs and hard drives as we pretty much want it can handle a total of 12 out of the box, and it's got an N dot two slots on it which could be useful in the future as like a cache for the array onto RAM actually Kingston hooked us the crap up for this machine and sent us because we could only have eight sticks of...

People Also Ask about

How do you avoid probate in CT?

How long does an executor have to settle an estate in CT?

Do I need a lawyer for probate in CT?

How to avoid probate fees in CT?

How do I file for probate in Washington state?

Is there a time limit to settle an estate?

How do you know if probate is necessary?

How long do you have to file probate after death in CT?

How do I get a probate certificate in CT?

How long before an executor can distribute the estate?

How much does an estate have to be worth to go to probate in Arizona?

How long can an estate stay open in CT?

What assets are subject to probate in CT?

What are the requirements for probate in California?

Are Connecticut probate records public?

How long does it take to settle an estate in CT?

How much does an estate have to be worth to go to probate in CT?

What forms are required for probate?

What does probate cost in CT?

How do I file probate in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit connecticut probate pc 213 from Google Drive?

How can I get connecticut probate pc 213?

How do I edit connecticut probate pc 213 straight from my smartphone?

What is CT PC-213?

Who is required to file CT PC-213?

How to fill out CT PC-213?

What is the purpose of CT PC-213?

What information must be reported on CT PC-213?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.