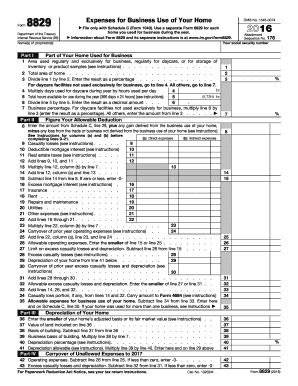

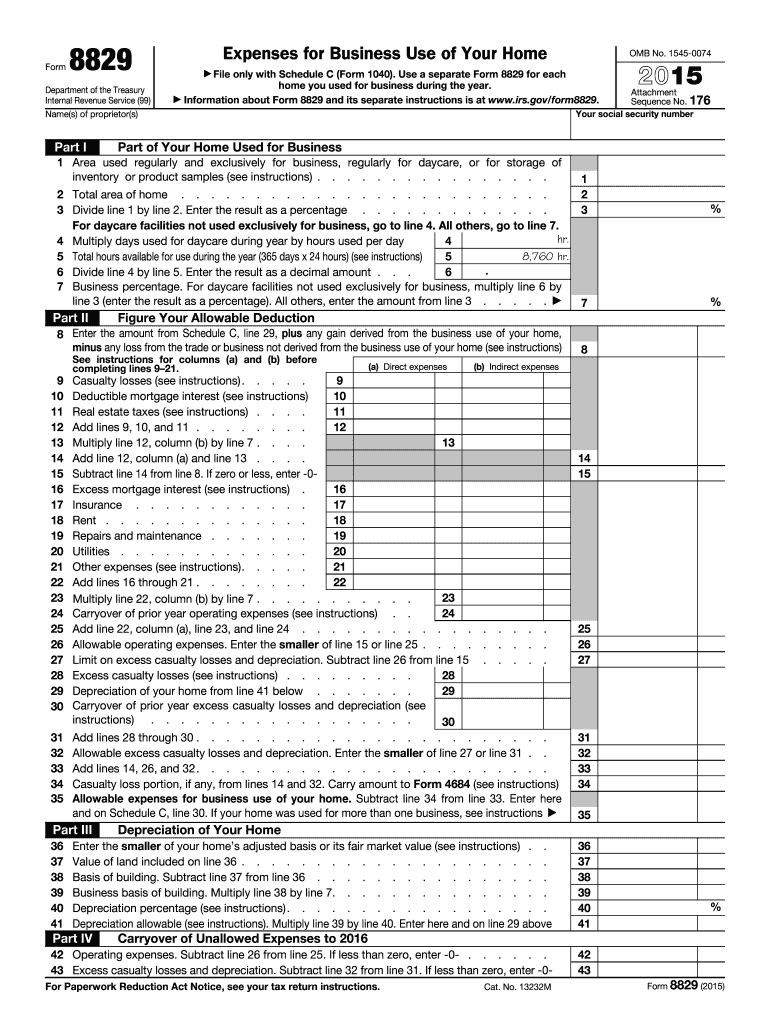

IRS 8829 2015 free printable template

Instructions and Help about IRS 8829

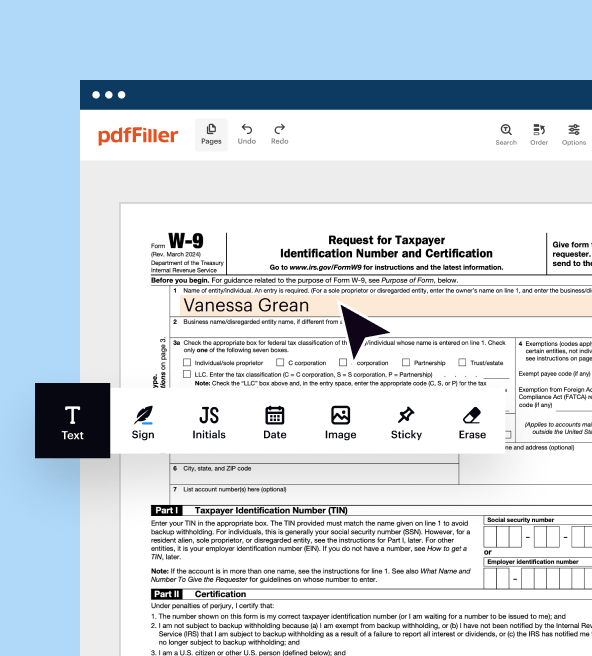

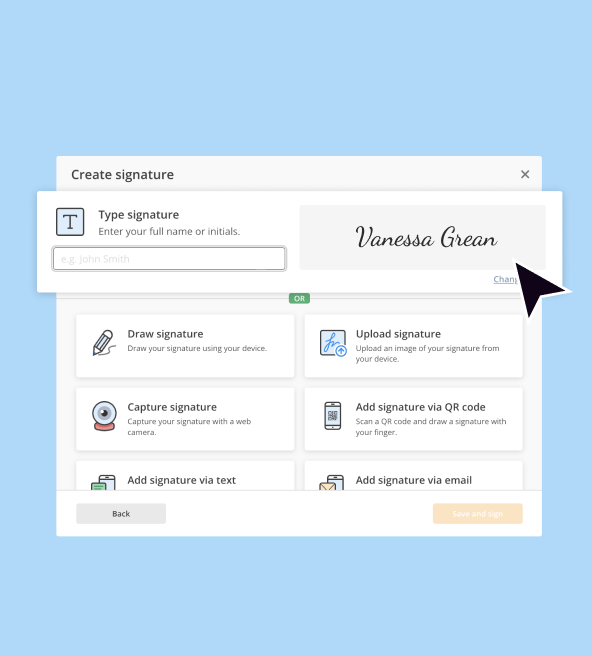

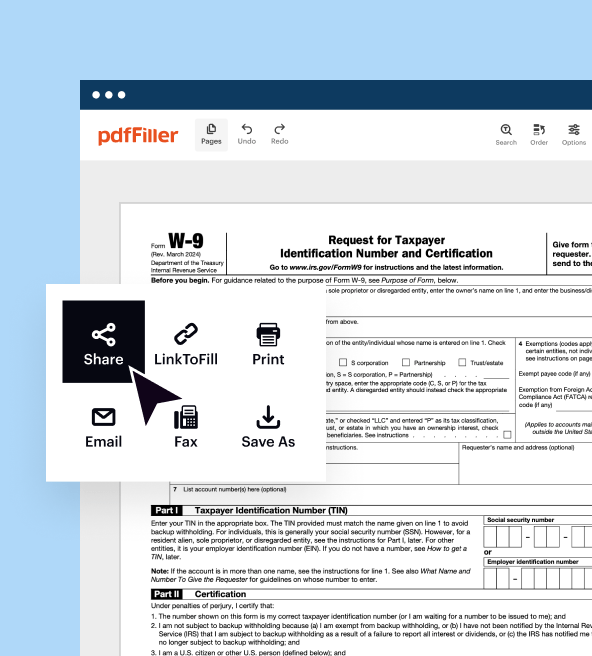

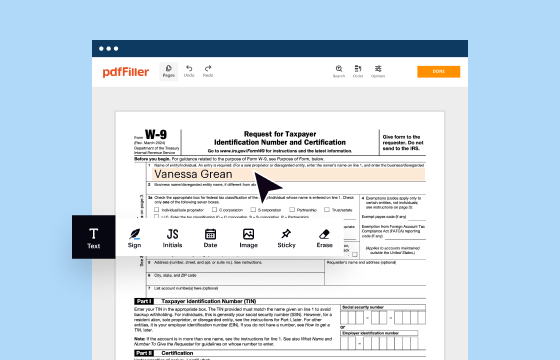

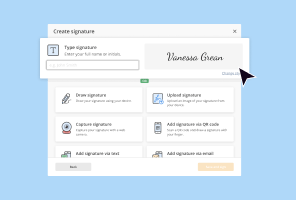

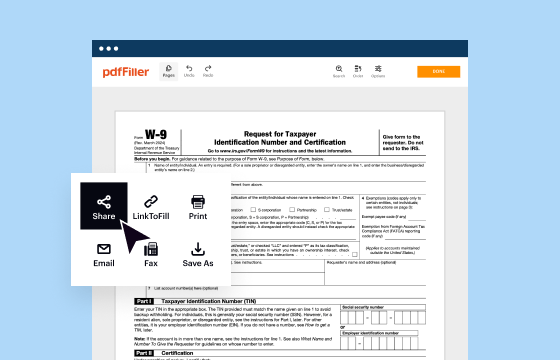

How to edit IRS 8829

How to fill out IRS 8829

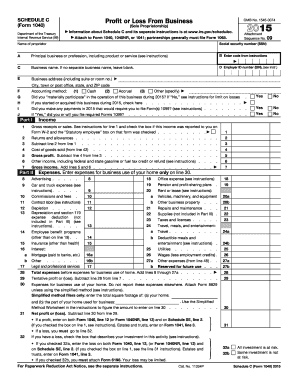

About IRS 8 previous version

What is IRS 8829?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8829

What should I do if I realize I've made a mistake on my IRS 8829 after filing?

If you've made an error on your IRS 8829, you must file an amended return using Form 1040-X to correct the mistake. Ensure you include the corrected IRS 8829 with your amended return. It’s important to act quickly to minimize any potential penalties or interest.

How can I check the status of my submitted IRS 8829?

To verify the status of your IRS 8829, you can use the IRS 'Where's My Refund?' tool if you filed for a refund, or contact the IRS directly. Keep track of your e-file confirmation and any notices you might receive as they provide valuable insights on your filing status.

What should I do if I receive a notice from the IRS regarding my IRS 8829?

If you receive an IRS notice related to your IRS 8829, carefully read the letter to understand the issue. Gather relevant documentation to support your case, and respond by the specified deadline, either by phone or in writing, addressing the concerns raised in the notice.

Are there any common errors I should avoid while preparing my IRS 8829?

Common errors on the IRS 8829 include incorrect calculations for home office space and expenses, failing to substantiate expenses adequately, and inaccuracies in reporting square footage. Review each section carefully and consider consulting with a tax professional to minimize mistakes.

What are the technical requirements for e-filing the IRS 8829?

To e-file the IRS 8829, ensure you are using compatible tax software that supports this form. Check for the latest updates from the software provider and confirm your files are correctly formatted and complete to avoid rejections. Additionally, keep your internet browser up to date.

See what our users say