Canada T3010 E 2015 free printable template

Show details

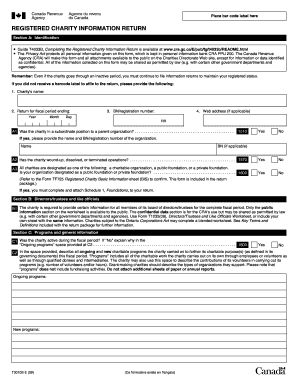

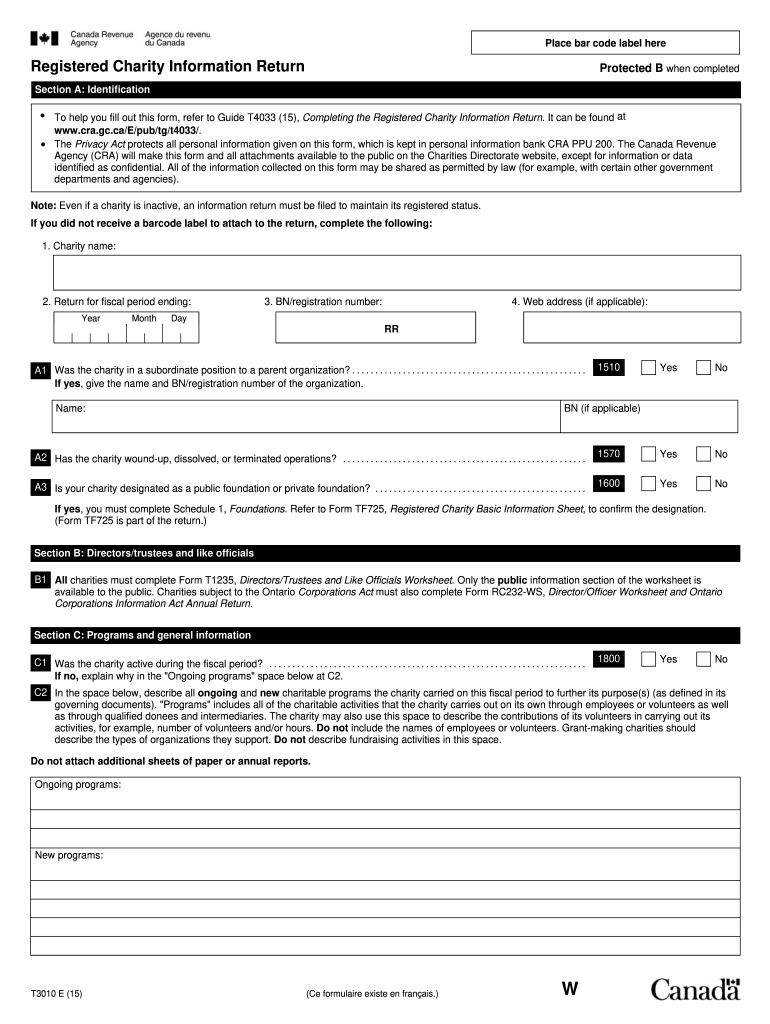

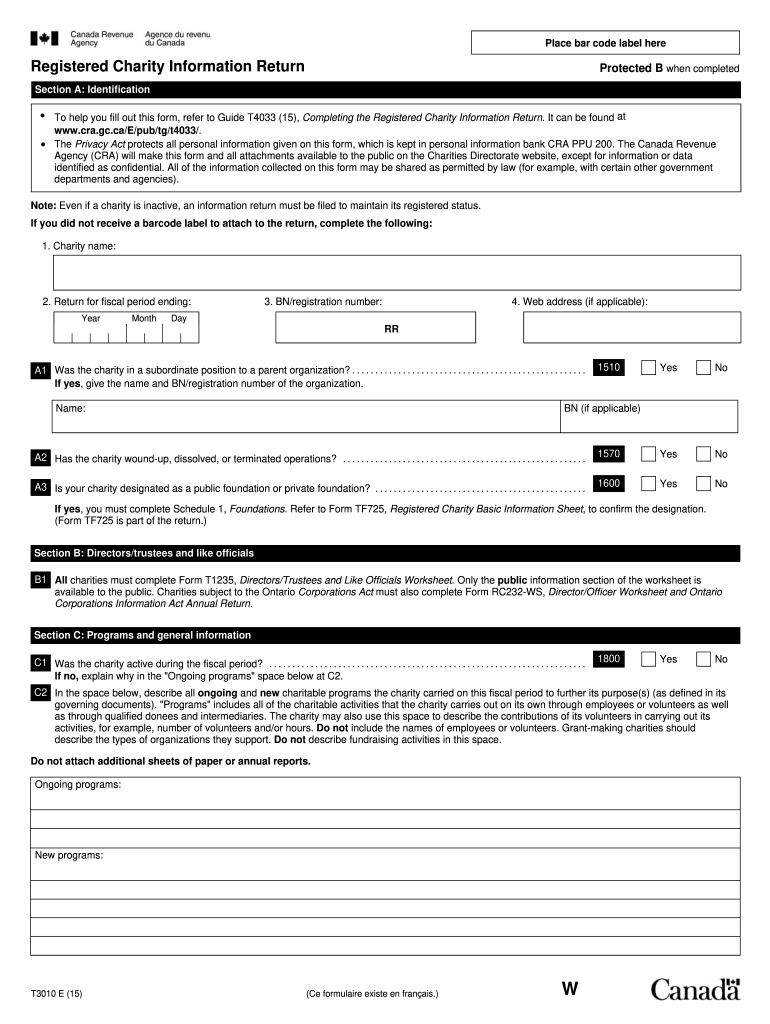

Ongoing programs New programs T3010 E 15 Ce formulaire existe en fran ais. W organizations described in the Income Tax Act. Post office box numbers and rural routes are not sufficient. Physical address of the charity Address for the charity s books and records Complete street address City Province or territory and postal code F2 Name and address of individual who completed this return. Company name if applicable City province or territory and postal code Is this the same individual who...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T3010 E

Edit your Canada T3010 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T3010 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T3010 E online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada T3010 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T3010 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T3010 E

How to fill out Canada T3010 E

01

Obtain the Canada T3010 E form from the Canada Revenue Agency (CRA) website.

02

Read the instructions provided with the form to understand the requirements.

03

Fill in your organization's information, including name, address, and registration number.

04

Complete the sections regarding your organization's activities, financial information, and revenue sources.

05

Report any changes in your organization's governance or membership.

06

Provide a list of the directors and their contact information.

07

Complete the financial statements section, detailing revenues and expenditures.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the form to the CRA either online or by mail before the deadline.

Who needs Canada T3010 E?

01

Registered charities in Canada.

02

Non-profit organizations that are required to file with the CRA.

03

Organizations seeking or maintaining registered charity status.

04

Any organization required to report on their activities and financials to the CRA.

Fill

form

: Try Risk Free

People Also Ask about

How do I file an amended T3010?

To amend your return Complete Form T1240, Registered Charity Adjustment Request for each T3010 return that you need to correct. Make sure you enter the fiscal year-end on each form. The form must be signed by a representative of your charity that the Charities Directorate has on file.

What is a T3010 annual return?

The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

What is the purpose of the T3010 form?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Where do I send my T3010 return?

For charities incorporated in Ontario Mail the complete information return to: Charities Directorate. Canada Revenue Agency. 105 – 275 Pope Road. Reminders. Do not attach correspondence or copies of governing documents to the charity's information return. These should be mailed separately to: Charities Directorate.

Where do I mail my T3010 return?

For charities incorporated in Ontario Mail the complete information return to: Charities Directorate. Canada Revenue Agency. 105 – 275 Pope Road. Reminders. Do not attach correspondence or copies of governing documents to the charity's information return. These should be mailed separately to: Charities Directorate.

How do I adjust my T3010?

Form T3010, Registered Charity Information Return. You can also use Section B to change the charity's mailing address. canada.ca/charities-giving, select Operating a registered charity, and see Making changes, or call Client Service at 1-800-267-2384.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada T3010 E directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your Canada T3010 E and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the Canada T3010 E electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Canada T3010 E.

How do I edit Canada T3010 E straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada T3010 E.

What is Canada T3010 E?

Canada T3010 E is an annual information return that non-profit organizations in Canada must file with the Canada Revenue Agency (CRA) to report their financial activities and confirm their status as a registered charity.

Who is required to file Canada T3010 E?

Registered charities in Canada are required to file the Canada T3010 E form annually with the CRA to maintain their registered status.

How to fill out Canada T3010 E?

To fill out Canada T3010 E, organizations must provide detailed information about their financial activities, governance, programs, and operations, following the guidelines and sections specified in the form.

What is the purpose of Canada T3010 E?

The purpose of Canada T3010 E is to ensure transparency and accountability of registered charities, providing the CRA with necessary information to monitor compliance with the Income Tax Act.

What information must be reported on Canada T3010 E?

Organizations must report financial statements, details on fundraising and program expenditures, information about directors/trustees, and any changes in governance or operations on Canada T3010 E.

Fill out your Canada T3010 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t3010 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.