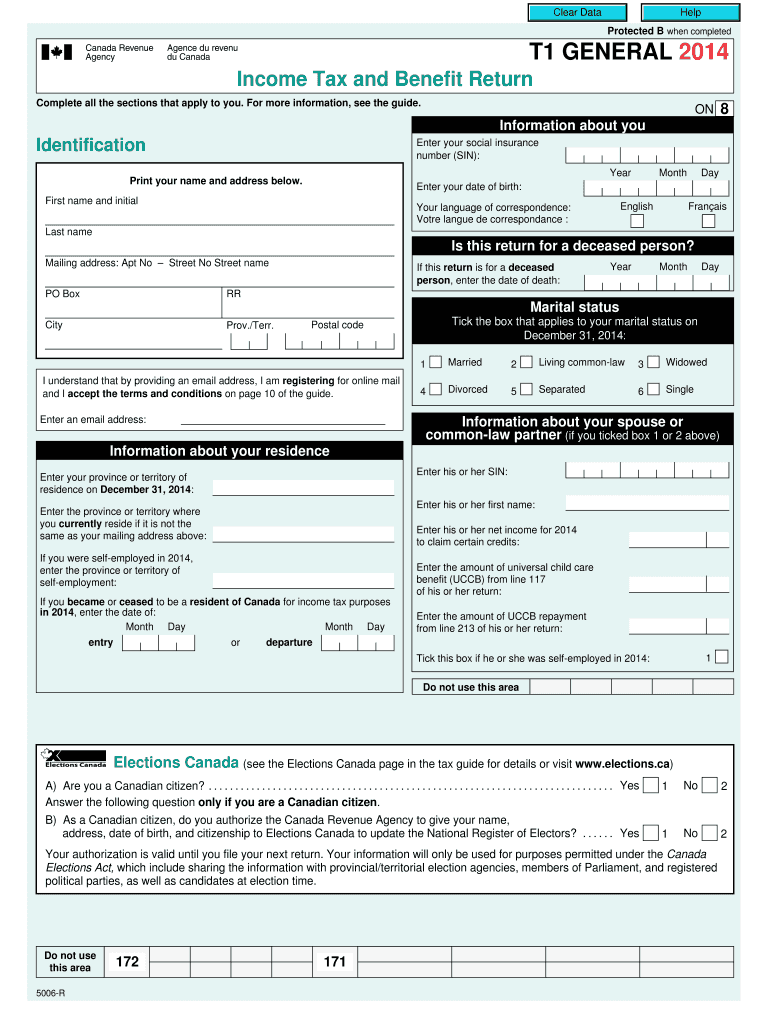

Who needs a form T1?

Form T1 (general) is an Income Tax and Benefit Return for taxpayers in Canada. This return is to be filed annually. This particular copy is for 2013, but you can find other versions for 2014, 2015 and 2016 in the filler library.

What is form T1 for?

It is used to report income and applicable taxes to the revenue agency. The revenue agency usually issues a book with a package of tax forms and schedules. You can download it from PDF or from the official website or look for attachments in your filler account.

Is it accompanied by other forms?

Attach Schedule 1 for federal tax, Form 428 for provincial or territorial tax, other schedules, information slips, receipts and forms to page 3 of this tax return.

When is form T1 due?

Usually the due date to income tax and benefit return is April, 30th of the year following the reported period.

How do I fill out a form T1?

Besides general information on page 1, the taxpayer must fill out the following sections: a schedule for total income on page 2, a schedule for net income and a schedule for taxable income on page 3, and a schedule for refund or balance owing and boxes regarding taxpayer’s direct deposit and contributing to Ontario Opportunities Fund on page 4.

Where do I send it?

Find out how to file your tax and benefit return online at www.cra.gc.ca/getready. The Revenue Agency provides Net file software, if you want to submit your return without printing and mailing. You must pay for it and then install it on your computer in order to file form T1 and other tax forms.