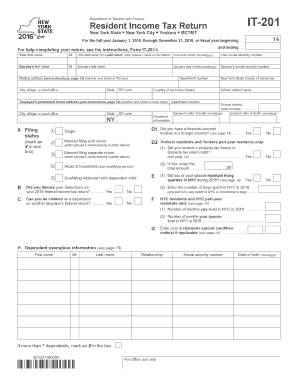

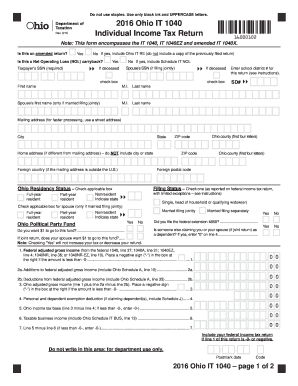

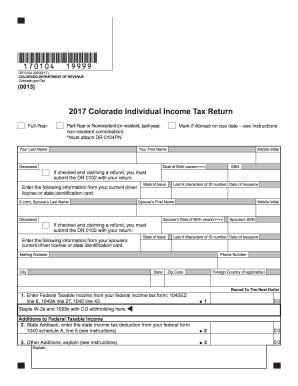

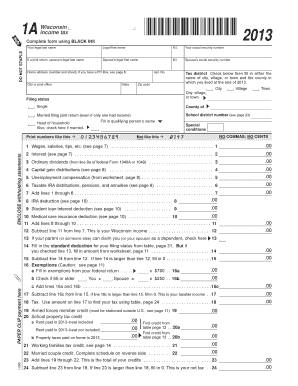

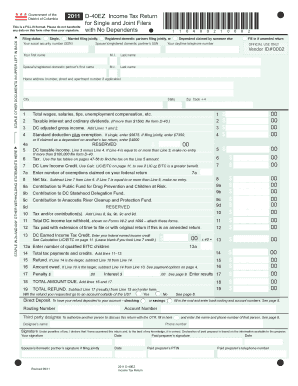

Income Tax Return Form 16

What is income tax return form 16?

Income tax return Form 16 is a document issued by employers to their employees that provides a summary of the income earned and the taxes deducted at source during a particular financial year. It is an important document that helps employees in filing their income tax returns accurately.

What are the types of income tax return form 16?

There are two types of income tax return Form 16: 1. Form 16 (Part A): This part contains the employer's details, employee's details, and a summary of the taxes deducted at source. 2. Form 16 (Part B): This part provides a detailed breakup of the salary components, exemptions, deductions, and other income details.

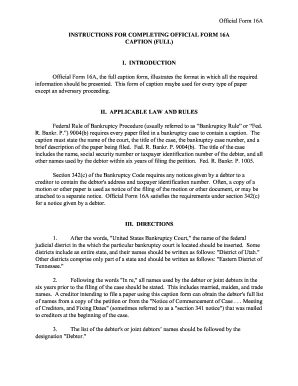

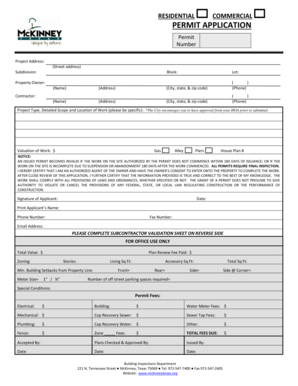

How to complete income tax return form 16

Completing income tax return Form 16 is a relatively straightforward process. Here are the steps you need to follow:

Taking the opportunity to mention that pdfFiller is a powerful online tool that empowers users to easily create, edit, and share documents online. With its unlimited fillable templates and robust editing tools, pdfFiller is the go-to PDF editor that users can rely on to efficiently complete their documents.