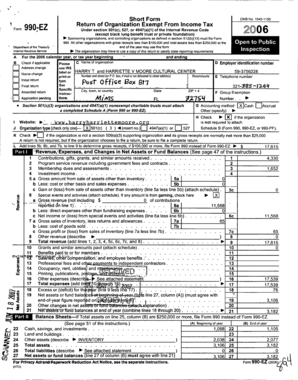

Income Tax Return Form 2017-18

What is income tax return form 2017-18?

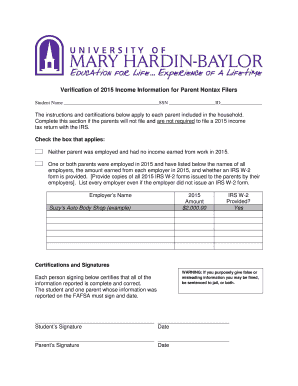

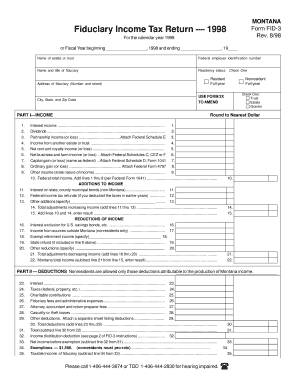

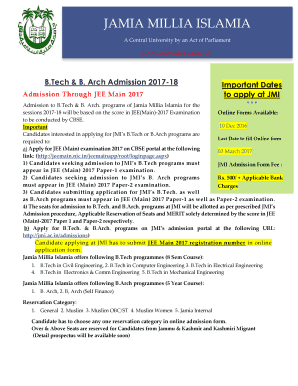

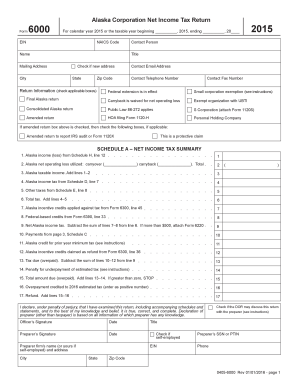

The income tax return form for the year 2017-18 is a document that individuals and businesses need to fill out in order to report their income earned and taxes paid for that specific financial year. It includes various sections and fields where taxpayers need to provide accurate information about their income sources, deductions, and tax liabilities. This form is important for the assessment of taxes and ensures that individuals and businesses fulfill their tax obligations.

What are the types of income tax return form 2017-18?

The income tax return form for the year 2017-18 is available in different types, depending on the nature of income and the status of the taxpayer. The common types of income tax return forms for the year 2017-18 include:

How to complete income tax return form 2017-18

Completing the income tax return form for the year 2017-18 may seem daunting, but with the right approach, it can be simplified. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online, including income tax return forms for the year 2017-18. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.