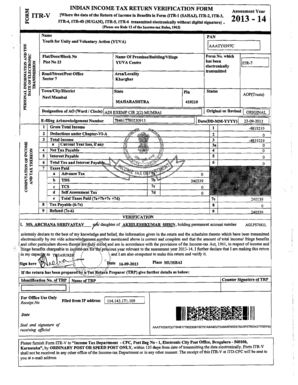

Itr 4s

What is itr 4s?

itr 4s is a specific income tax return form in India designed for individuals and Hindu Undivided Families (HUFs) with presumptive income from business or profession. It is used to report their income and taxes to the Income Tax Department.

What are the types of itr 4s?

The types of itr 4s include:

itr 4s SUGAM (ITR-4S)

itr 4s SUGAM (ITR-4S) with digital signature

itr 4s SUGAM (ITR-4S) with digital signature and EVC (Electronic Verification Code)

How to complete itr 4s

Completing itr 4s can be simplified by following these steps:

01

Gather all necessary financial documents and information.

02

Fill out the form accurately and completely.

03

Verify all information for accuracy and completeness before submission.

04

Submit the form electronically or physically to the relevant authorities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out itr 4s

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is difference between ITR 4 and ITR 4S?

The Sugam ITR-4S Form is the Income Tax Return form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD and Section 44AE of the Income Tax Act. However, if the turnover of the business mentioned above exceeds Rs 2 crores, the tax payer will have to file ITR-4.

What is ITR 4s form?

SUGAM. INDIAN INCOME TAX RETURN. [For Individuals, HUFs and Firms (other than LLP) being a resident having total income upto. Rs.50 lakh and having income from business and profession which is computed under sections.

Can I file ITR 4 Myself?

The pre-filling and filing of ITR-4 service is available to registered users on the e-Filing portal and through accesing offline utility. This service enables individual taxpayers, HUFs, and firms (other than LLPs) to file ITR-4 online through e-Filing portal.

How can I download ITR Form 4?

If you submit your ITR 4 form electronically through digital signature, the acknowledgement will be sent to your registered email id. You can also download ITR 4 manually from the income tax website. You are then required to sign it and send it to the Income Tax Department's office within 120 days of e-filing.

How can I download ITR 4 form?

If you submit your ITR 4 form electronically through digital signature, the acknowledgement will be sent to your registered email id. You can also download ITR 4 manually from the income tax website. You are then required to sign it and send it to the Income Tax Department's office within 120 days of e-filing.

What is the structure of ITR 4?

ITR 4 form has two parts, Part A and Part B. Part A has 5 sections and Part B has 35 Schedules. This must be in accordance to your official records. You must fill in the 10 digit PAN number here.