KY DoR 740-X 2016 free printable template

Show details

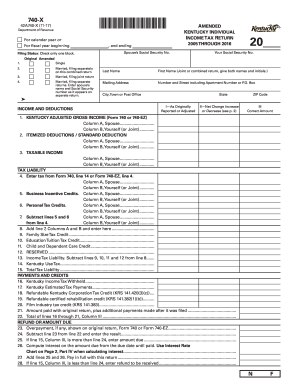

740-X 1600010008 42A740-X 11-16 Department of Revenue For calendar year or For fiscal year beginning and ending Filing Status Check only one block. 27. Add lines 25 and 26. Pay in full with this return.. N F Form 740-X 11-16 Page 2 PART I TAX CREDITS This section must be completed for any increase or decrease in the number of personal tax credits claimed on original return 1. Attach additional or corrected Kentucky and/or federal forms schedules or W-2s. If you do not attach the required...information processing of your Form 740-X may be delayed. PART IV INTEREST RATE CHART - Use the following rates when computing interest for amount on Page 1 Line 26. AMENDED KENTUCKY INDIVIDUAL INCOME TAX RETURN Spouse s Social Security No* 20 Your Social Security No* Original Amended Single Married filing separately on this combined return returns. Enter spouse s name and Social Security number as it appears on separate return* Last Name First Name Joint or combined return give both names and...initials. Mailing Address Number and Street including Apartment Number or P Box. O. City Town or Post Office State ZIP Code INCOME AND DEDUCTIONS I As Originally Reported or Adjusted II Net Change Increase or Decrease see p* 2 III Correct Amount 1. KENTUCKY ADJUSTED GROSS INCOME Form 740 or 740-EZ Column A Spouse. Column B Yourself or Joint. 2. ITEMIZED DEDUCTIONS / STANDARD DEDUCTION 3. TAXABLE INCOME TAX LIABILITY 4. Enter tax from Form 740 line 14 or Form 740-EZ line 4. 5. Business Incentive...Credits. Column A Spouse. 6. Personal Tax Credits. 7. Subtract lines 5 and 6 from line 4. 8. Add line 7 Columns A and B and enter here. 9. Family Size Tax Credit. 10. Education Tuition Tax Credit. 11. Child and Dependent Care Credit. 12. RESERVED. 13. Income Tax Liability. Subtract lines 9 10 11 and 12 from line 8. 14. Kentucky Use Tax. 15. Total Tax Liability. PAYMENTS AND CREDITS 16. Kentucky Income Tax Withheld. 17. Kentucky Estimated Tax Payments. 18. Refundable Kentucky Corporation Tax...Credit KRS 141. 420 3 c. 20. Film industry tax credit KRS 141. 383. 21. Amount paid with original return plus additional payments made after it was filed*. 22. Total of lines 16 through 21 Column III. REFUND OR AMOUNT DUE 23. Overpayment if any shown on original return Form 740 or Form 740-EZ. 25. If line 15 Column III is more than line 24 enter amount due. 26. Compute interest on the amount due from the due date until paid* Use Interest Rate Chart on Page 2 Part IV when calculating interest....Number of personal tax credits claimed on original return Form 740 Section B lines 3A and 3B. 3. Difference. Explain any difference in detail below. Include name and Social Security number. PART II FAMILY SIZE TAX CREDIT 4. Total Family Size claimed on original return 4 or more PART III CHANGES Explain changes to income deductions and tax from page 1 Column II in detail below. Jan* 1 2017 Dec* 31 2017 I the undersigned declare under penalties of perjury that I have examined this return...including all accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete.

pdfFiller is not affiliated with any government organization

Instructions and Help about KY DoR 740-X

How to edit KY DoR 740-X

How to fill out KY DoR 740-X

Instructions and Help about KY DoR 740-X

How to edit KY DoR 740-X

To edit the KY DoR 740-X, you can download the form from the Kentucky Department of Revenue's website. Once downloaded, open the form in a compatible PDF editor. If you use pdfFiller, you can fill in your information directly, enabling easy edits without needing to print and rewrite the form. Ensure that all updates reflect accurate information and align with your tax situation.

How to fill out KY DoR 740-X

Filling out the KY DoR 740-X requires careful attention to detail. Begin by entering your personal identification information, including your name, Social Security number, and address. Next, provide details about the income and deductions applicable to your tax year. It's crucial to follow the form's instructions meticulously to avoid errors that could delay processing.

About KY DoR 740-X 2016 previous version

What is KY DoR 740-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About KY DoR 740-X 2016 previous version

What is KY DoR 740-X?

KY DoR 740-X is the Kentucky Department of Revenue's tax form used for reporting corrections to previously filed individual income tax returns. This form allows taxpayers to amend their returns to ensure all income, deductions, and credits are accurately reported to the state.

What is the purpose of this form?

The purpose of KY DoR 740-X is to enable individuals to make amendments to their filed returns. Taxpayers can use this form to correct errors such as misreported income or missed deductions that may affect their tax liability. Accurate updates help the state maintain proper tax records and ensure compliance with tax laws.

Who needs the form?

Individuals who have previously filed a Kentucky income tax return and later discovered an error or omission will need to complete the KY DoR 740-X. This may include those who received additional income not initially reported or individuals who realized they qualified for deductions they did not claim.

When am I exempt from filling out this form?

You are exempt from filing KY DoR 740-X if you do not need to amend a prior tax return or if your tax situation remains unchanged. Additionally, if the original filing was accurate and complete, there is no need to submit this form. Always assess your prior filings before making any amendments.

Components of the form

KY DoR 740-X consists of several components, including sections for personal information, the details of the original filing, and the changes being reported. It requires clear documentation of the amendments to facilitate a smooth review process by the Kentucky Department of Revenue. Each section must be completed accurately, referencing the original return where necessary.

What are the penalties for not issuing the form?

If you fail to file KY DoR 740-X when required to amend an error, you may face penalties. The Kentucky Department of Revenue can impose fines for unreported income or failure to claim necessary deductions. Moreover, neglecting to amend your return can affect your tax audit risk and overall compliance standing with the state tax authority.

What information do you need when you file the form?

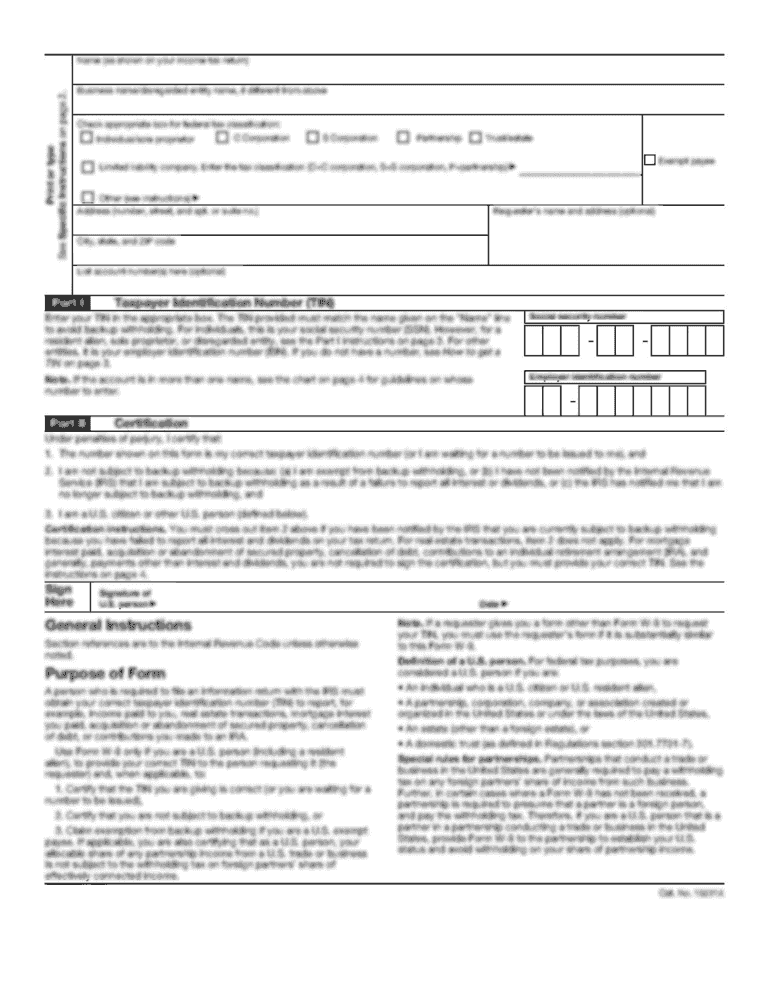

When filing KY DoR 740-X, gather your previously filed return, any supporting documents that validate your amendments, and any additional information specific to the changes you are making. This includes W-2s, 1099s, and receipts for deductions. Ensuring you have complete information will streamline the filing process and reduce the likelihood of rejection.

Is the form accompanied by other forms?

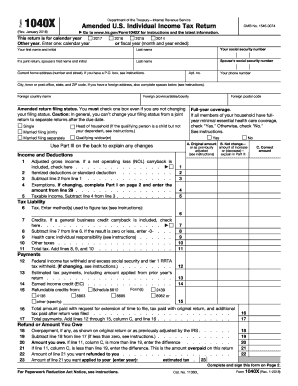

Generally, KY DoR 740-X can be submitted as a stand-alone document. However, if you are amending federal returns simultaneously or if your amendments require additional information, you may need to include other supporting forms. Always check the instructions for KY DoR 740-X to determine if any supplements are necessary for your specific case.

Where do I send the form?

Once completed, the KY DoR 740-X should be mailed to the Kentucky Department of Revenue at the address specified in the form's instructions. Ensure you send the form to the correct location to avoid delays in processing. It's advisable to use certified mail for tracking and confirmation of receipt.

See what our users say