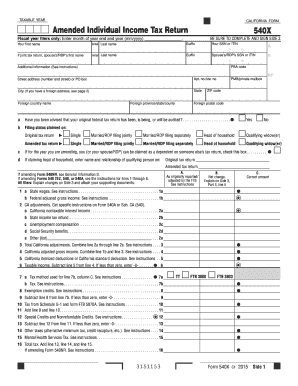

CA FTB 540X 2016-2025 free printable template

Get, Create, Make and Sign 3151153 income pdf 2016-2025

Editing 3151153 income pdf 2016-2025 online

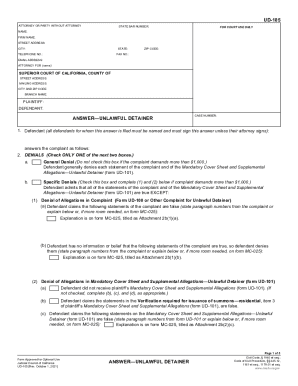

Uncompromising security for your PDF editing and eSignature needs

CA FTB 540X Form Versions

How to fill out 3151153 income pdf 2016-2025

How to fill out CA FTB 540X

Who needs CA FTB 540X?

Video instructions and help with filling out and completing 3151153 income pdf

Instructions and Help about 3151153 income pdf 2016-2025

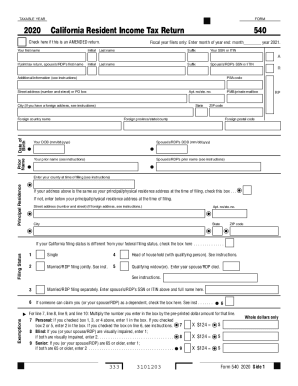

Laws dot-com legal forms guide form 540 California resident income tax return California residents file their state income tax by using a form 540 this document is available on the website of the California Franchise Tax Board which also provides a booklet of instructions this article discusses the form for calendar year 2011 step 1 if you are a fiscal year filer enter your starting and end dates step 2 at the top of the first page give your name tax identification or social security number and date of birth if you file jointly provide the same information for your spouse enter your address step 3 if your 2010 return was filed with a different last name for you or your spouse enter this where indicated step 4 indicate your filing status by choosing among lines one through five fill in the Oval next to the statement which applies to you step 5 if you can be claimed as a dependent fill in the Oval on line 6 step 6 on line 7 through 11 indicate and total all listed exemptions you are claiming step 7 lines 12 through 19 provide instructions for the computation of your taxable income step 8 lines 31 through 35 provide instructions for the initial calculation of your tax owed step 9 lines 41 through 48 concerned special tax credits step 10 lines 61 through 64 concerned other applicable taxes step 11 line 71 through 75 concerned payments already made on your tax liability step 12 lines 91 through 94 concern tax do step 13 if you owe use tax on products bought and used in the state on which no state sales tax was paid complete line 95 steps 14 follow instructions on the third page to determine your final amount due or the refund you are owed step 15 sign and date the third page to watch more videos please make sure to visit laws comm

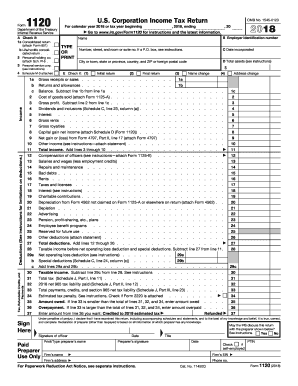

People Also Ask about

How do I get my California state tax transcript?

Do I need to attach 1040 to CA 540?

Can I file CA 540 online?

Where is my CA inflation check?

How do I know if I'm getting a California rebate?

How do I get my California rebate?

Is there a form 540X?

Do I need to fill out Schedule CA 540?

Can form 540X be filed electronically?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 3151153 income pdf 2016-2025?

Can I create an eSignature for the 3151153 income pdf 2016-2025 in Gmail?

How do I fill out 3151153 income pdf 2016-2025 using my mobile device?

What is CA FTB 540X?

Who is required to file CA FTB 540X?

How to fill out CA FTB 540X?

What is the purpose of CA FTB 540X?

What information must be reported on CA FTB 540X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.