Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

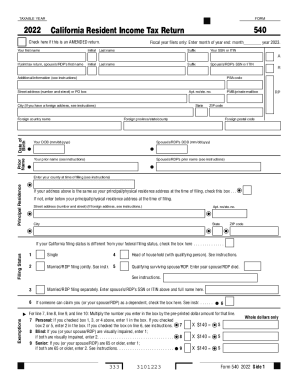

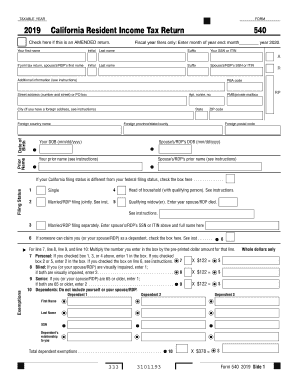

How to fill out form 540?

1. Fill in your personal information in the top portion of form 540. This includes your name, address, social security number, and filing status.

2. Enter your federal adjusted gross income from your federal tax return.

3. Fill in the total number of exemptions you are claiming.

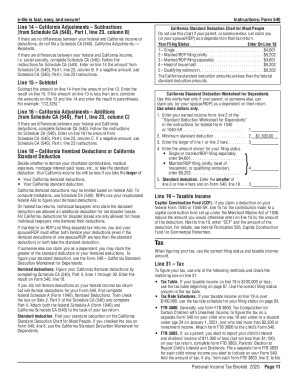

4. Subtract any credits you are eligible for from your taxable income.

5. Calculate your tax liability by using the tax rate schedules included in the form 540 instructions.

6. Enter your total tax liability on the form 540.

7. Calculate any payments you have already made. Subtract these payments from your total tax liability.

8. Enter the balance you owe on the form 540.

9. Sign and date the form 540.

10. Mail the form 540 with your payment to the address provided on the form.

What information must be reported on form 540?

Form 540 is the California Resident Income Tax Return. It must include income information for the taxpayer, such as wages, interest, and business and rental income. It must also include deductions, such as charitable contributions, mortgage interest, and medical expenses. Other information that must be reported includes the taxpayer's filing status, Social Security number, and any credits the taxpayer is eligible for.

Form 540 is an Income Tax Return form used in the state of California, United States. It is used by residents of California to report their income, deductions, and credits for the tax year. This form is used by individuals or families who are full-year residents of California. Additionally, there are different versions of Form 540 available such as Form 540 NR for nonresidents or part-year residents.

Who is required to file form 540?

The form 540 is a personal income tax return form used in the state of California. Individuals who are residents of California for the entire year or who have income from California sources are generally required to file this form. However, not everyone is required to file it, as there are certain income thresholds and filing requirements that determine whether an individual needs to file a California tax return. It is recommended to consult with a tax professional or refer to the California Franchise Tax Board (FTB) website for specific filing requirements.

What is the purpose of form 540?

Form 540 is an income tax form used by residents of California to report their annual income and calculate their state income tax liability. The purpose of this form is to determine the amount of state income tax owed or the refund due to the taxpayer. It includes information about the taxpayer's income, deductions, credits, and other relevant details required for tax calculations. The completed form is submitted to the California Franchise Tax Board along with any required payments or documentation.

When is the deadline to file form 540 in 2023?

The deadline to file Form 540 for the 2023 tax year would typically be April 17, 2024. However, please note that tax filing deadlines may vary and can be subject to change, so it's always best to confirm with the relevant tax authorities.

What is the penalty for the late filing of form 540?

The penalty for the late filing of California Form 540, which is the state individual income tax return, is determined based on the amount of tax owed and the number of days it is late.

1. If you file your return more than 60 days late, the minimum penalty is $135 or the total tax due, whichever is smaller.

2. If you file your return within 60 days but after the original due date, the minimum penalty is $135 or 100% of the tax due, whichever is smaller.

3. If you file your return after receiving a notice from the Franchise Tax Board (FTB) demanding that you file, the minimum penalty is $135 or 100% of the tax due, whichever is smaller.

It's important to note that interest is also charged on any unpaid tax from the original due date until the tax is paid in full.

How can I edit 2020 form 540 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ca 540 form 2020, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit 540 form 2020 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 540 tax form 2020.

How do I complete 540 tax form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2020 ca 540 tax form instructions, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.