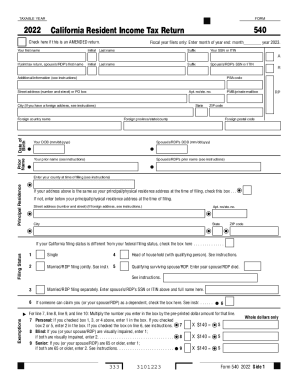

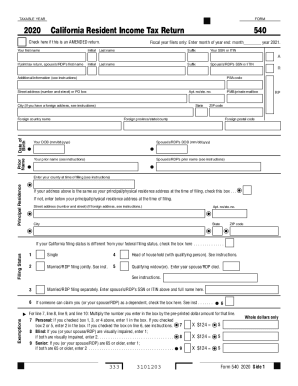

CA FTB 540 2005 free printable template

Get, Create, Make and Sign

How to edit 2005 california resident income online

CA FTB 540 Form Versions

How to fill out 2005 california resident income

How to fill out 2005 California resident income:

Who needs 2005 California resident income:

Instructions and Help about 2005 california resident income

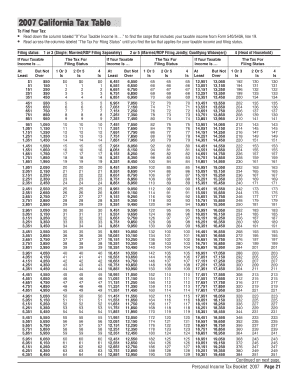

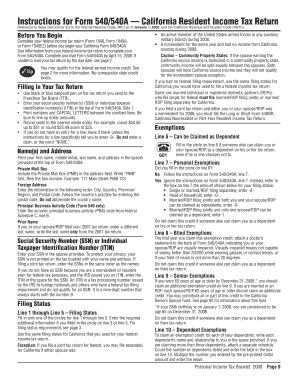

The other day I was trying to do my California taxes unlike most people who do it online I do it by paper, so I wanted to download a PDF which was the schedule ca California adjustments I couldn't find it on the California ft website you can see over here um the first thing I tried to do is I tried googling it, and it brought me to this link when I click on it is takes me to this page where it says this form is currently not available and so you can click on the forms and publication search and look for schedule ca, and you'll find it over here and when you click on it takes you here where it says you can only get this form by mail or email, so then you just can tap onto there um and once you're done with that it'll give you a confirmation and just check your email here I check my email and here's the PDF link and that's how you get the California adjustments uh 540 form schedule form you have to get it emailed to you and so just search for it uh i...

Fill form : Try Risk Free

People Also Ask about 2005 california resident income

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2005 california resident income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.