Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

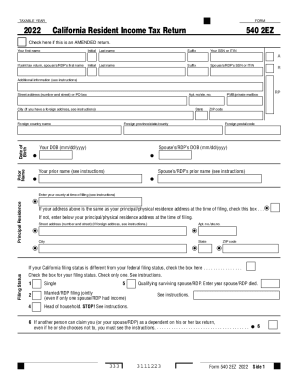

What is 1099 g california?

Form 1099-G is a tax form used to report certain government payments to individuals. In the context of California, Form 1099-G is typically used to report unemployment compensation and state income tax refunds received during the tax year. This form provides information about the amount of taxable income received from these sources, which individuals must report on their federal and state tax returns.

Who is required to file 1099 g california?

The state of California requires certain entities to file Form 1099-G, which reports payments received from the government. The entities that are required to file 1099-G forms in California include:

1. State and local government agencies

2. Universities and educational institutions

3. Non-profit organizations that receive government funding

4. Individuals or businesses that receive unemployment benefits or state income tax refunds

Please note that this list is not exhaustive, and there may be other entities that are also required to file 1099-G forms in California depending on the specific circumstances. It is advisable to consult the official guidelines or seek professional advice for accurate information based on your situation.

How to fill out 1099 g california?

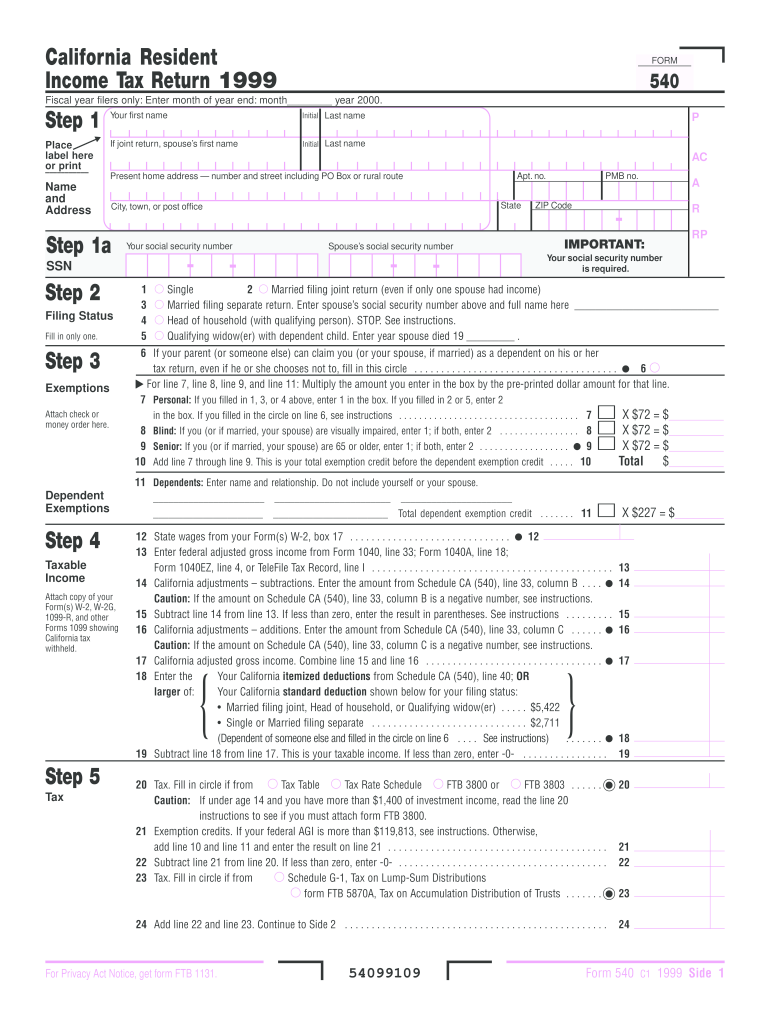

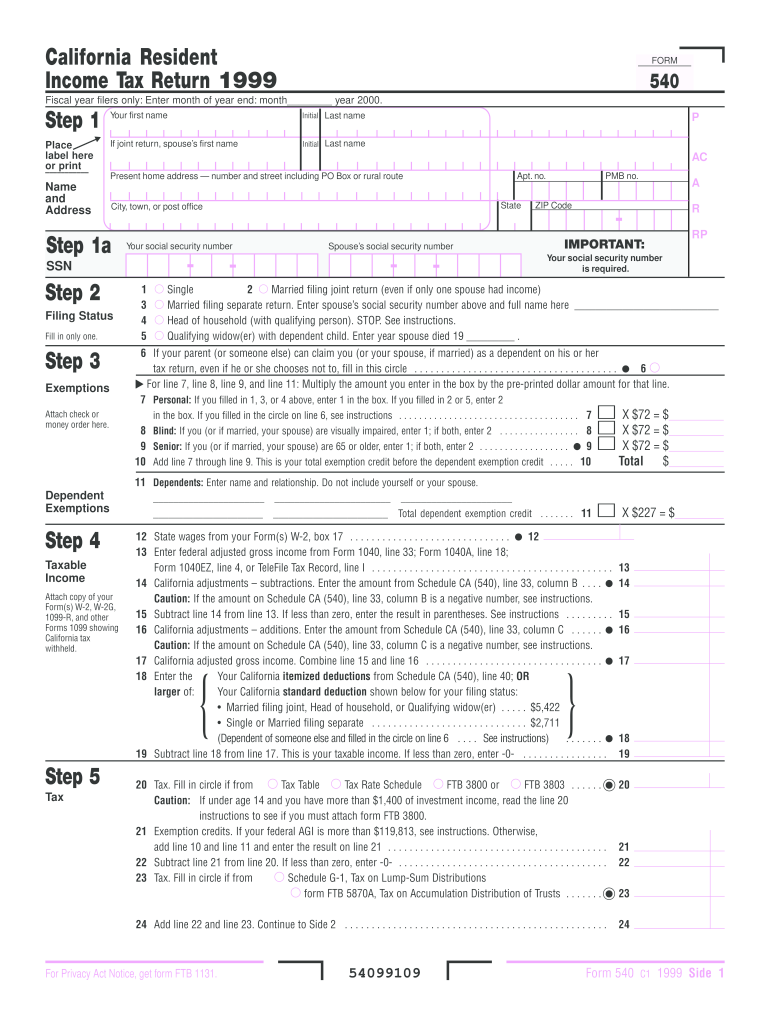

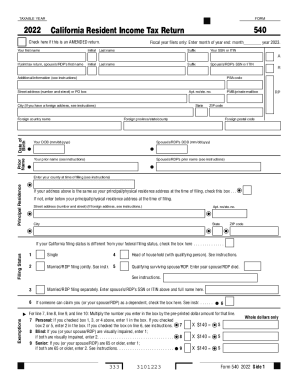

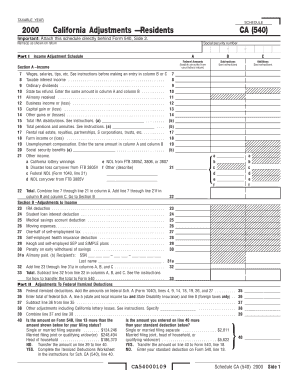

To fill out Form 1099-G for the state of California, follow these steps:

1. Obtain the necessary forms: You can download Form 1099-G from the California Employment Development Department (EDD) website or request a copy by calling their Customer Service line.

2. Enter the payer and recipient information: Include the name, address, and Social Security number (or taxpayer identification number) of both the payer and recipient of the taxable California unemployment compensation.

3. Complete Part I: In Part I of the form, report the total unemployment compensation paid to the recipient during the tax year. This information is provided by the California EDD.

4. Complete Part II: If any federal income tax was withheld from the unemployment compensation, enter the amount withheld in Part II of the form.

5. Complete Part III: If the recipient opted to have California state income tax withheld from the unemployment compensation, enter the amount withheld in Part III of the form.

6. Complete Part IV: Check the boxes in Part IV if any of the special situations mentioned apply to the recipient, such as repaid unemployment benefits, trade adjustment assistance, or disaster assistance.

7. Complete Part V: This part is specific to state tax departments. California does not require this section to be filled out, so you can leave it blank.

8. Sign and distribute the form: Sign and date the form before submitting it to the recipient. You should also provide a copy of the completed 1099-G form to the recipient for their tax records.

9. File with the appropriate tax authorities: Copy A of Form 1099-G should be filed with the California EDD, and Copy 1 should be filed with the California tax department.

Note: It is always recommended to consult with a tax professional or refer to the official instructions provided by the California EDD for the most accurate and up-to-date information.

What is the purpose of 1099 g california?

The purpose of Form 1099-G in California is to report any state or local government payments and income tax refunds received by individuals. This form is issued by the California Employment Development Department (EDD) to report unemployment compensation, disability insurance, and state income tax refunds. The recipient of the form must report the amounts shown on Form 1099-G as income on their federal tax return.

What information must be reported on 1099 g california?

Form 1099-G is used to report certain government payments, such as unemployment compensation, state or local income tax refunds, agricultural payments, and taxable grants. In California, the specific information that must be reported on Form 1099-G includes:

1. Payer's Name and Address: The name and contact details (address) of the organization or agency that made the payment.

2. Recipient's Name and Address: The name, address, and Social Security number (or taxpayer identification number) of the individual or entity receiving the payment.

3. Payment Amount: The total amount of the payment received by the individual or entity during the tax year.

4. Type of Payment: The specific type of payment being reported, such as unemployment compensation, state or local income tax refunds, or other taxable grants.

5. State Information: California-specific information might be required, such as the state income tax refund amount received.

It is important to note that the information reported on Form 1099-G may vary based on the specific type of government payment being reported and the requirements set by the California tax authorities.

When is the deadline to file 1099 g california in 2023?

The deadline to file Form 1099-G for California in 2023 would be January 31st, 2024. This is the deadline for mailing the form to the recipient and submitting the form to the California Franchise Tax Board (FTB).

How do I make changes in 1099 g california?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ftb form 540 year 1999 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit year1999 form 540 form income tax in Chrome?

1999 ca ftb form 540 fillable can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit 1099 g california on an Android device?

You can make any changes to PDF files, such as ftb form 540 year 1999, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.