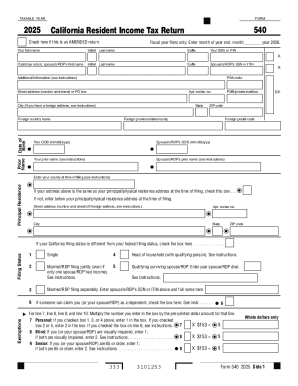

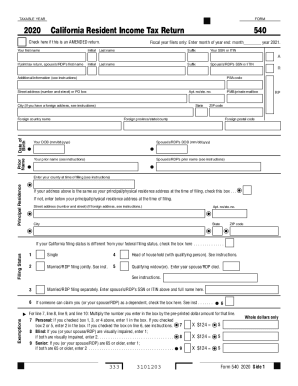

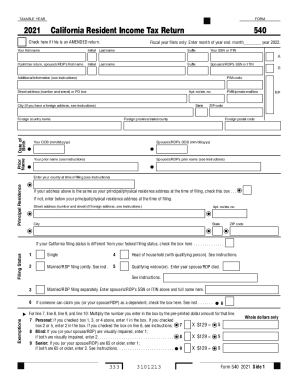

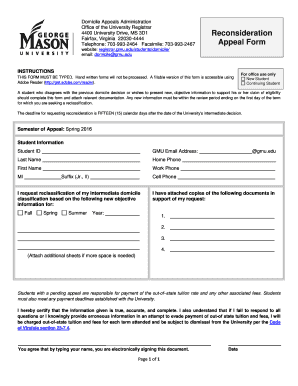

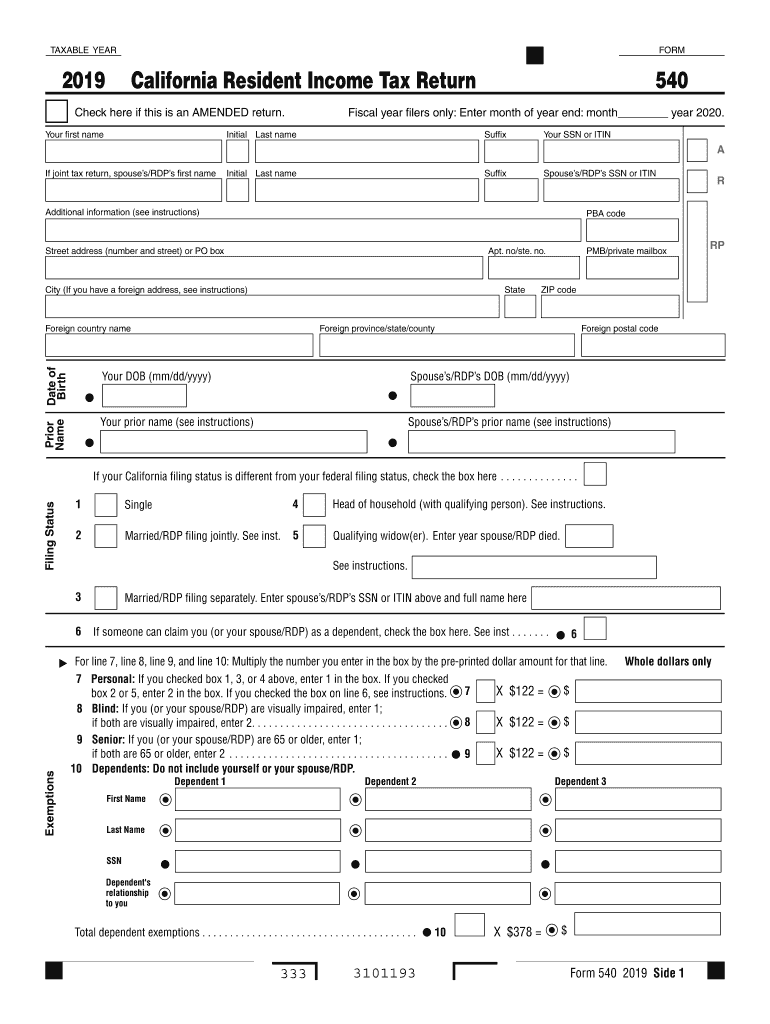

CA FTB 540 2019 free printable template

Instructions and Help about CA FTB 540

How to edit CA FTB 540

How to fill out CA FTB 540

About CA FTB previous version

What is CA FTB 540?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

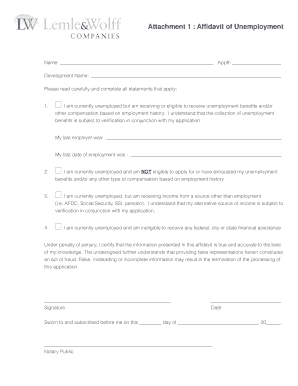

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about CA FTB 540

What should I do if I made a mistake on my CA FTB 540 after submission?

If you discover an error after submitting your CA FTB 540, you can file an amended return using Form 540X. Make sure to indicate the changes and provide a clear explanation for each correction. Keep in mind that you should send this amended form to the same address as your original submission.

How can I track the status of my CA FTB 540 filing?

To track the status of your CA FTB 540, visit the California FTB website and utilize their online service for checking refunds. You'll need your Social Security number, the amount of your refund, and your expected refund date to get the most accurate update. This service also offers insights into processing times.

What should I do if I receive a notice from the FTB after filing CA FTB 540?

If you receive a notice from the Franchise Tax Board regarding your CA FTB 540, carefully read the document to understand the issue. Be sure to gather any requested documentation or information before responding, and adhere to the deadline specified in the notice to avoid penalties.

Are there specific e-filing requirements for submitting the CA FTB 540?

Yes, when e-filing your CA FTB 540, ensure that your software meets the California e-file requirements. This includes compatibility with forms, necessary security requirements, and the capability to submit electronically. Additionally, it's essential to have your contact information accurately entered to avoid issues.

See what our users say