Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

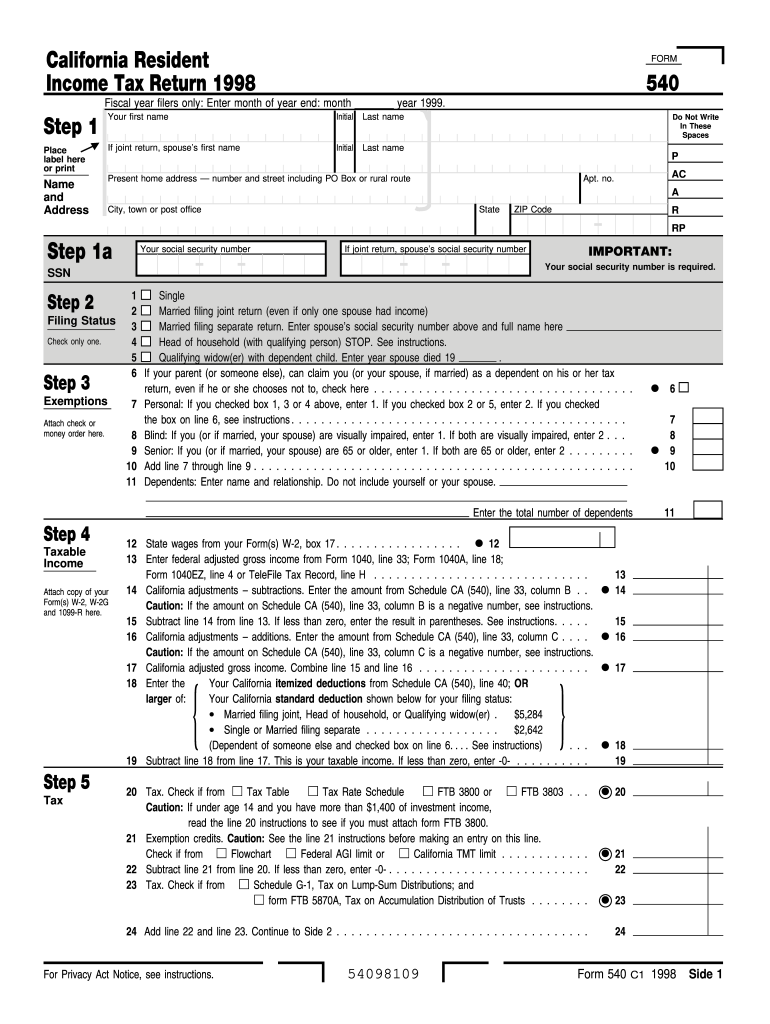

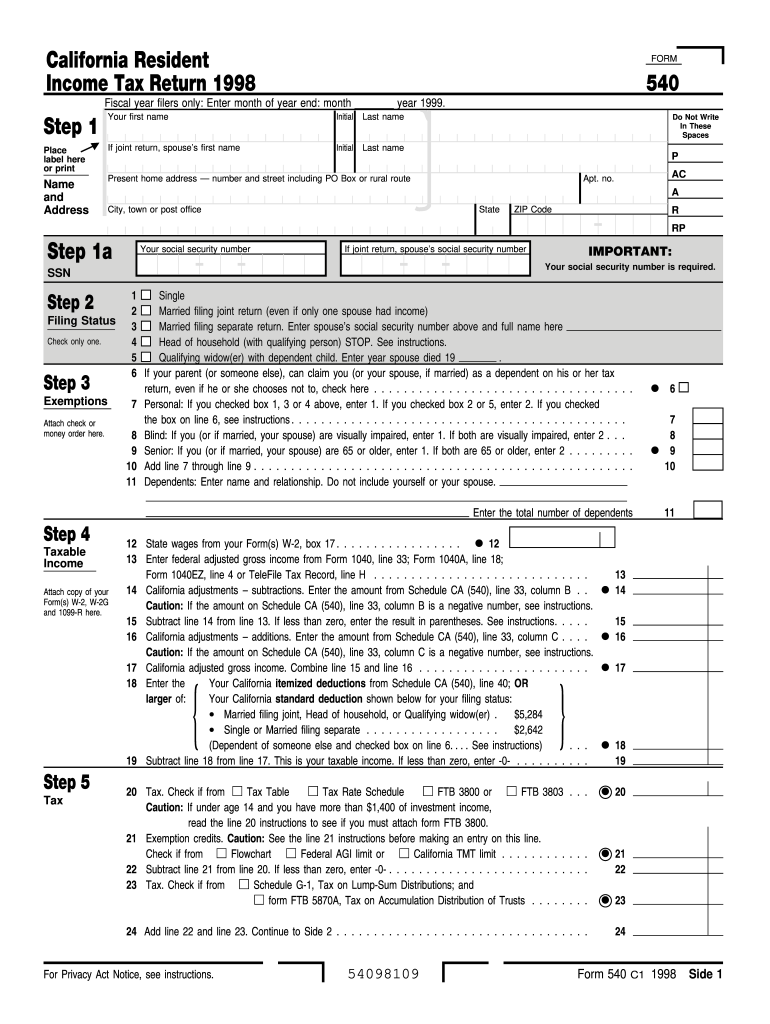

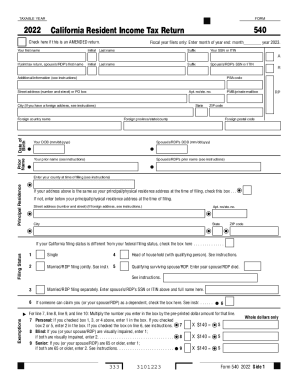

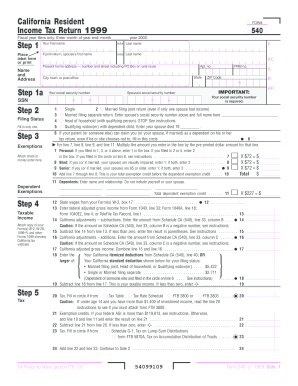

What is form 540 - california?

Form 540 is the California Resident Income Tax Return form used by individuals who are residents of California to report their income and claim any applicable tax credits and deductions. This form is used to calculate and determine the amount of state income tax owed by the taxpayer. It requires the taxpayer to provide information on their income, deductions, and credits, as well as any taxes already paid throughout the year. The form also includes sections for reporting federal adjustments and other additional information.

Who is required to file form 540 - california?

Individuals who are residents of California and have a certain level of income or meet certain filing requirements are required to file Form 540. This form is used for filing California Resident Income Tax Return.

How to fill out form 540 - california?

To fill out Form 540 for California, follow these steps:

1. Gather your documents: You will need your W-2 forms, 1099 forms, and any other relevant tax documents.

2. Provide personal information: Enter your name, Social Security number, and filing status at the top of Form 540.

3. Calculate your income: Fill in the income section of the form, including wages, salaries, dividends, business income, and any other taxable income.

4. Claim deductions and credits: In the deductions and credits section, you can claim various deductions like student loan interest, education expenses, retirement contributions and credits like child tax credit or earned income credit.

5. Calculate taxes owed or refund: Use the tax table provided with Form 540 to determine your tax liability or refund amount based on your taxable income and filing status.

6. Make payments or request refund: If you owe taxes, provide payment details on how you will be paying. If you are due a refund, you can choose to have it directly deposited into your bank account or mailed to you.

7. Sign and date the form: After reviewing your filled-out form for accuracy, sign and date it.

8. Attach necessary forms and documents: Use the checklist provided in the instructions to ensure you have attached all the required documents.

9. Mail the form: Send the completed Form 540 to the appropriate California Franchise Tax Board address, which can be found in the instructions.

It is highly recommended that you refer to the official instructions provided by the California Franchise Tax Board for a more detailed and accurate filling out of Form 540.

What is the purpose of form 540 - california?

Form 540 is the individual income tax return form used by residents of California to report their annual income and calculate their state income tax liability. The form is used to report various types of income, deductions, and credits, and to determine whether the taxpayer owes a tax or is eligible for a tax refund. This form is specifically designed for California residents who need to file their state income tax return.

What information must be reported on form 540 - california?

Form 540 is the resident income tax return for California residents. In order to complete this form, you must report the following information:

1. Personal Information: This includes your name, Social Security number, filing status, address, and other basic personal details.

2. Income: You are required to report all types of income you received during the tax year, including wages, salaries, self-employment income, rental income, dividends, interest, unemployment compensation, pensions, and any other type of taxable income.

3. Adjustments to Income: Certain expenses or deductions can be claimed to reduce your taxable income. Examples of adjustments include contributions to retirement plans (like an IRA), self-employment tax, alimony paid, and student loan interest.

4. Credits: There are various tax credits available for California residents. These can include the Earned Income Credit, Child Tax Credit, Credit for Taxes Paid to Other States, and various other credits related to education, child care expenses, renewable energy, and low-income housing.

5. Taxes and Payments: You need to report any taxes you owe, such as self-employment tax or use tax, along with any payments you made throughout the year, such as estimated tax payments or tax withheld from your paycheck.

6. Refund or Amount Due: Based on the information you provide, the form will calculate whether you owe additional taxes or are due a refund.

Note: Depending on your individual circumstances, you may need to include additional schedules, attachments, or forms along with Form 540 to report certain types of income, deductions, or credits. It is recommended to review the instructions for Form 540 or consult a tax professional for guidance.

When is the deadline to file form 540 - california in 2023?

The deadline to file Form 540 for California state taxes in 2023 is April 17, 2024. Please note that tax deadlines can occasionally change, so it's always a good idea to verify the exact deadline with the California Franchise Tax Board or a tax professional.

What is the penalty for the late filing of form 540 - california?

The penalty for late filing of Form 540 in California is usually 5% of the amount due for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. Additionally, there may be interest charges on any unpaid tax amounts.

How do I execute 1998 form 540 online?

pdfFiller makes it easy to finish and sign 1998 form 540 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit 1998 form 540 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 1998 form 540.

How do I edit 1998 form 540 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 1998 form 540 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.