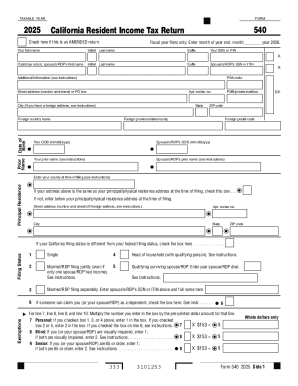

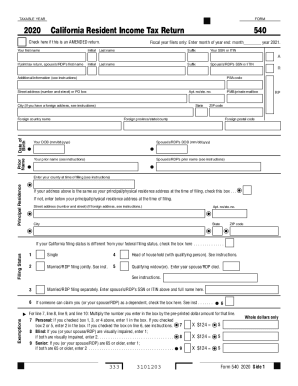

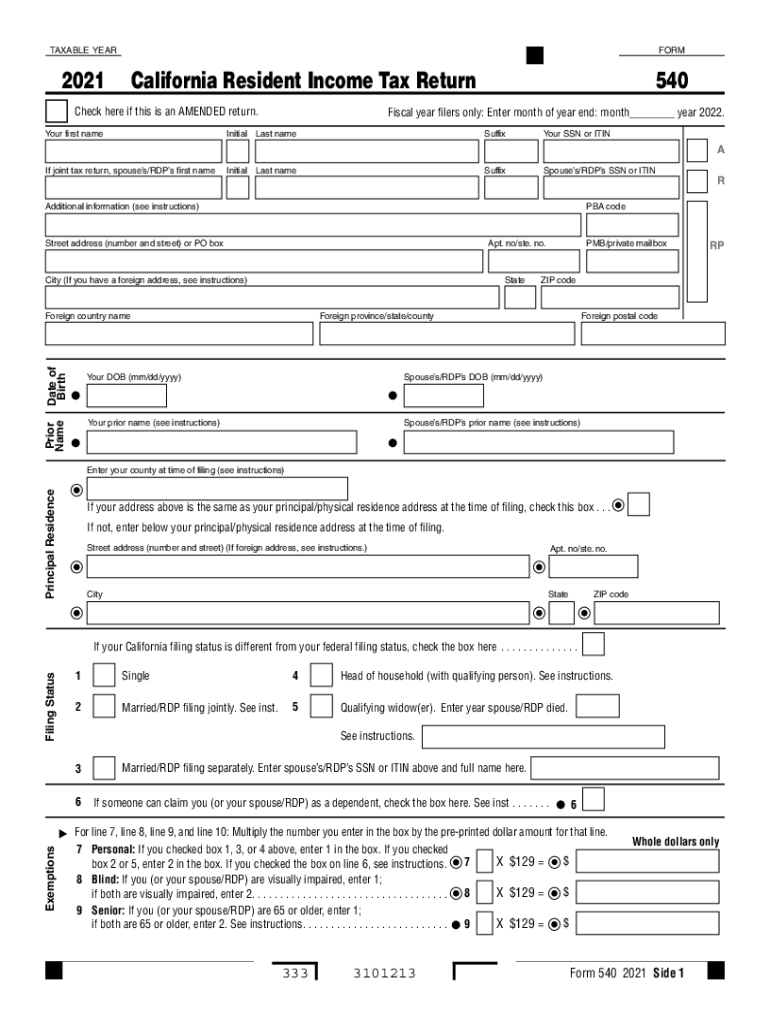

CA FTB 540 2021 free printable template

Instructions and Help about CA FTB 540

How to edit CA FTB 540

How to fill out CA FTB 540

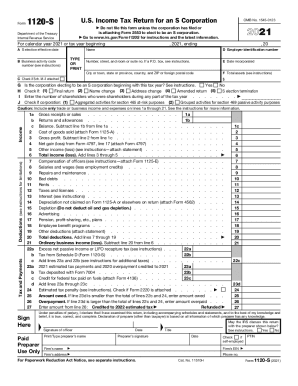

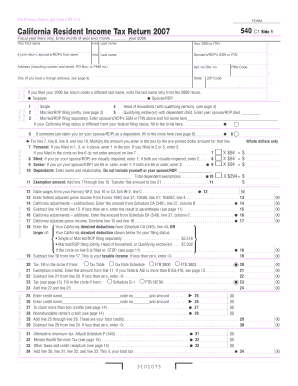

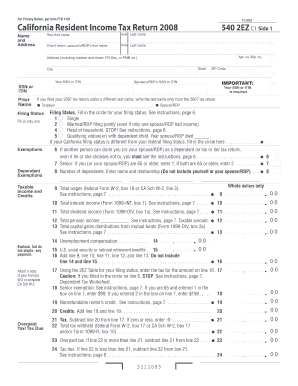

About CA FTB previous version

What is CA FTB 540?

Who needs the form?

Components of the form

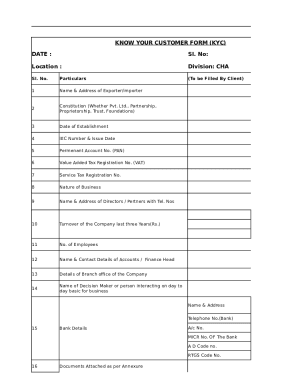

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about CA FTB 540

What steps should I take if I need to submit an amended CA FTB 540?

If you discover an error after submitting your CA FTB 540, you must file an amended return using the appropriate form. Clearly indicate that it's an amended return, include the changes, and submit it to the California Franchise Tax Board. Ensure you also rectify any associated payments or credits based on the changes made.

How can I track the status of my CA FTB 540 submission?

You can verify the status of your CA FTB 540 submission by using the California Franchise Tax Board's online tracking tool. Additionally, keep an eye out for any notifications or correspondence from the FTB regarding processing issues or acceptance of your submission.

What are common errors to look out for when filing CA FTB 540?

When filing the CA FTB 540, be alert for common errors such as mismatched Social Security Numbers, incorrect income reporting, or missing signatures. Double-checking your entries and utilizing e-filing can help minimize these mistakes.

Can I use an e-signature when filing my CA FTB 540?

Yes, electronic signatures are acceptable for the CA FTB 540 as long as they comply with the state’s e-signature standards. Ensure your e-filing software supports e-signatures and follow the provided guidelines to confirm compliance.

See what our users say