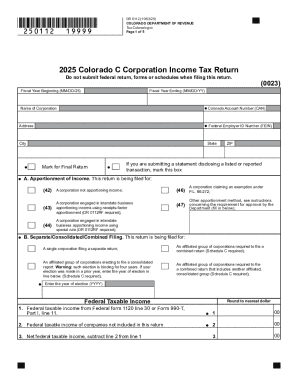

CO DoR 112 2016 free printable template

Show details

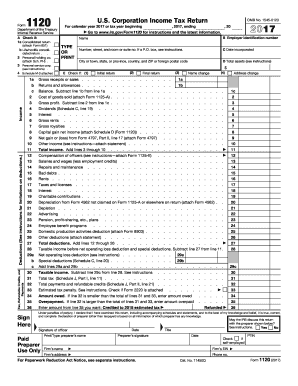

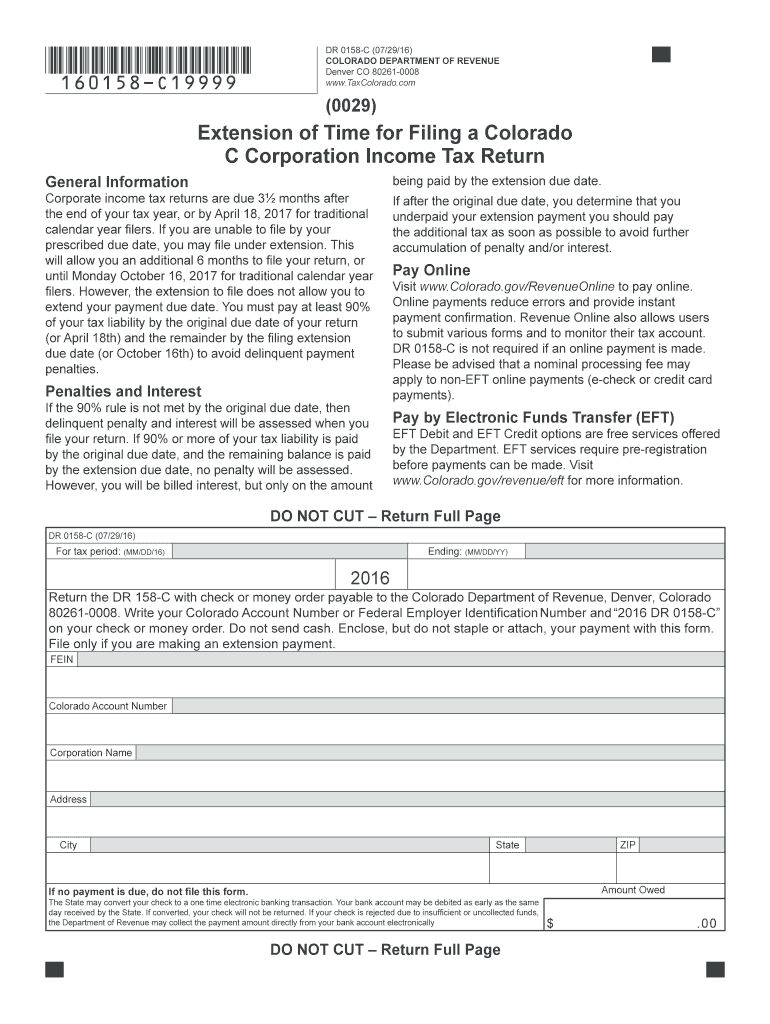

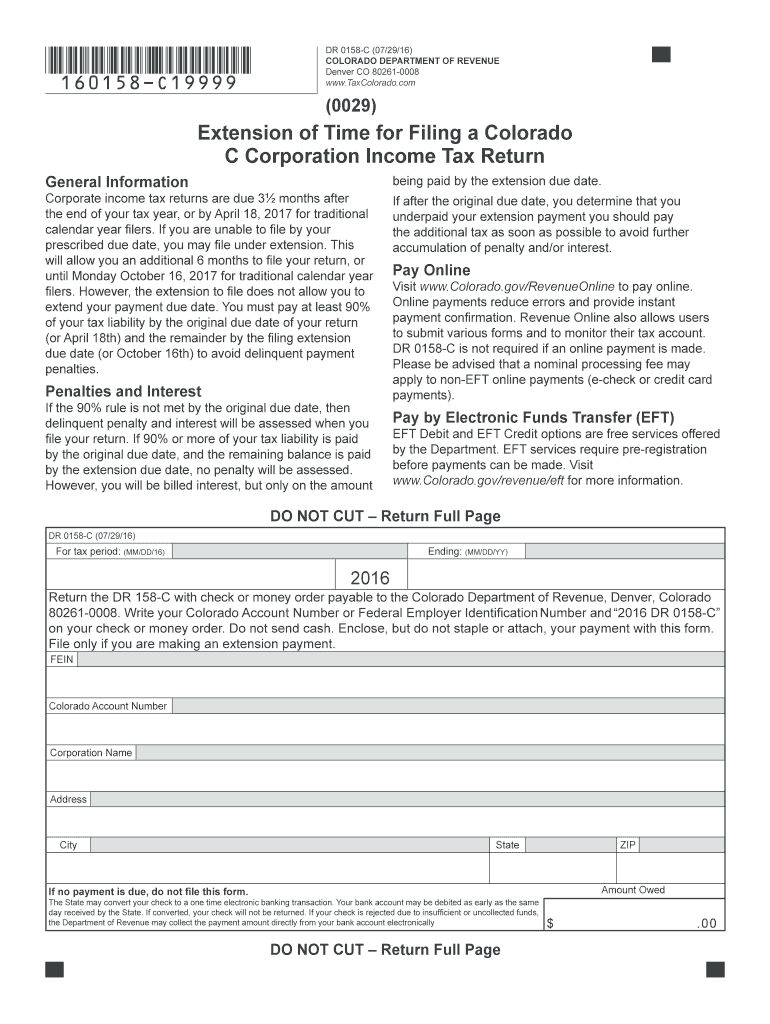

11/15/16 08/24/16 Form 112 C Corporation Colorado C Corporation Income Tax Filing Guide 1. First complete your federal income tax return IRS Form 1120. Total income apportioned to Colorado line 14 plus line 15. Enter on line 15 page 2 Form 112 Pursuant to 39-22-303. Total modified federal taxable income from line 14 page 2 Form 112 Business Income Apportioned to Colorado By Use of the Sales Factor Do not include foreign source revenues modified out on line 9 page 1 Form 112 Total 2. Please...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR 112

Edit your CO DoR 112 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR 112 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DoR 112 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DoR 112. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR 112 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR 112

How to fill out CO DoR 112

01

Obtain the CO DoR 112 form from the appropriate government website or office.

02

Begin by filling out the personal information section, including your name, address, and contact information.

03

Provide details about the specific incident or situation that requires the DoR.

04

Clearly state the purpose of the request and any relevant dates or events.

05

Sign and date the form to confirm the accuracy of the information provided.

06

Submit the completed form to the designated agency or office.

Who needs CO DoR 112?

01

Individuals or organizations needing to document a specific incident in Colorado.

02

Residents seeking to obtain records for legal, personal, or informational purposes.

03

Those involved in a situation that requires official acknowledgment from the state.

Fill

form

: Try Risk Free

People Also Ask about

Does Colorado have their own W 4 form?

Does Colorado have a W-4 form? Yes. Starting in 2022, an employee may complete a Colorado Employee Withholding Certificate (form DR 0004), but it is not required. If an employee completes form DR 0004, the employer must calculate Colorado withholding based on the amounts the employee entered.

Does Colorado require a state tax form?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Do I need to file a CO return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

How much do you have to make in co to file taxes?

In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

Do I need to file a CO extension?

If you cannot file your Colorado income tax return by the deadline, you may take advantage of the state's automatic six-month extension of time to file. There is no form to fill out to notify the Department of Revenue that you are taking the extension, however, there is no extension for tax due.

Do I need to file an extension if I don't owe?

Most states don't require you to file separate state extension forms if you don't owe any additional taxes. When you file your state return, you only need to attach a copy of your federal extension form. If you owe state tax, you typically must file state tax extension to avoid penalties.

What is the minimum income to file taxes in 2022?

ing to a draft of IRS Publication 501, you must file a tax return for 2022 under any of the following circumstances if you're single, someone else can claim you as a dependent, and you're not age 65 or older, or blind: Your unearned income was more than $1,150. Your earned income was more than $12,950.

Does co have a state tax form?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

Does a single member LLC need to file a Colorado tax return?

The State of Colorado requires you to file a periodic report annually for your SMLLC. You must file the report online at the SOS website. The report is due during the three-month period beginning with the first day of the anniversary month of your SMLLC's formation.

Does Colorado automatically extend with federal extension?

Unlike the IRS, Colorado grants all taxpayers a 6-month extension (which means you do not file an extension form in Colorado) of time to file penalty free beyond the April 18, 2023 deadline.

Does Colorado accept federal extension for C corporations?

Calendar year returns are due by April 18, 2022. If you are unable to file by your prescribed due date, you may file under extension. This will allow you an additional six months to file your return, or until October 15th for calendar year filers.

Does Colorado grant automatic extension for corporations?

Filing extensions are granted automatically, only return this form if you need to make an additional payment of tax.

Is Colorado state tax ID the same as Ein?

Your Colorado Account Number (CAN) is an account number that is issued by the Department. It is different from your Social Security Number (SSN), Federal Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Not sure what your CAN is with the Colorado Department of Revenue?

What is the Colorado state tax form?

This filing guide will assist you with completing your Colorado Income Tax Return.

How to file Colorado state tax form?

File Individual Income Tax Online Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You may opt to e-file through a paid tax professional or purchase tax software to complete and file returns.

Does co have a state income tax?

The new Colorado income tax rate is 4.40%, beginning in the 2022 tax year. In 2020, proposition 116 reduced the income tax rate to 4.55%. In 2019, the Colorado income tax rate was temporarily reduced to 4.50%, because a TABOR refund mechanism was triggered.

Does Colorado have a state tax ID?

The Colorado Account Number is listed on the Sales Tax License as the first eight (8) digits of the Use Account Number. The CAN is located on the upper left portion of the sales tax license.

Does an C corp have to file a tax return if no income?

All corporations are required to file a corporate tax return, even if they do not have any income. If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CO DoR 112 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your CO DoR 112 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the CO DoR 112 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CO DoR 112 in minutes.

How do I edit CO DoR 112 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing CO DoR 112.

What is CO DoR 112?

CO DoR 112 is a form used in Colorado for reporting the distribution of income earned by pass-through entities to the Colorado Department of Revenue.

Who is required to file CO DoR 112?

Pass-through entities such as partnerships, S corporations, and limited liability companies (LLCs) that are treated as partnerships for tax purposes in Colorado are required to file CO DoR 112.

How to fill out CO DoR 112?

To fill out CO DoR 112, gather necessary information regarding income and distributions, enter the details in the designated fields of the form accurately, and ensure all required signatures are provided before submission.

What is the purpose of CO DoR 112?

The purpose of CO DoR 112 is to ensure that income distributed to individuals or entities from pass-through entities is reported for state tax purposes, allowing the Colorado Department of Revenue to assess proper taxation.

What information must be reported on CO DoR 112?

CO DoR 112 requires reporting information such as the names and identification numbers of the entity and recipients, amounts distributed, and any other relevant tax information necessary for accurate tax reporting.

Fill out your CO DoR 112 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR 112 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.