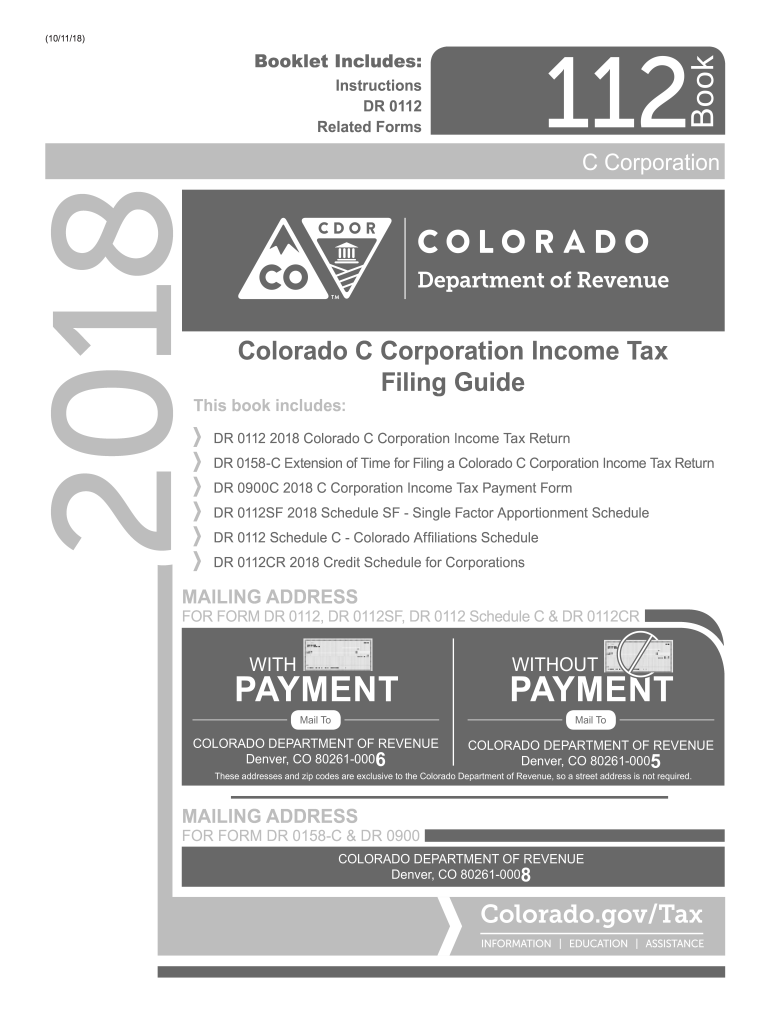

CO DoR 112 2018 free printable template

Get, Create, Make and Sign colorado dept of revenue

Editing colorado dept of revenue online

Uncompromising security for your PDF editing and eSignature needs

CO DoR 112 Form Versions

How to fill out colorado dept of revenue

How to fill out CO DoR 112

Who needs CO DoR 112?

Instructions and Help about colorado dept of revenue

Laws calm legal forms guide form i T dash 540 individual income tax return resident Louisiana residents file their state income taxes using a form I teach 540 this document can be obtained from the website of the Louisiana Department of Revenue step 1 at the top of the first page give your name and social security number as well as that of your spouse if filing jointly step to enter your current home address city state and zip code provide a daytime phone number step 3 five numbers are listed corresponding to possible filing statuses and to the number corresponding to your filing status step 4 indicate all exemptions being claimed if claiming dependents you must give their names Social Security numbers relationship to you and birthdates step 5 enter your federal adjusted gross income online 7 steps 6 enter your federal itemized deductions on line 8a your federal standard deductions on line 8 B then subtract the ladder from the former enter the difference on line 8 see step 7 complete schedule h in order to complete line 9 step 8 complete lines 10 and 11 as instructed to calculate your Louisiana income tax due before adjustments step nine lines 12a through 15 concerned non-refundable credits you will need to complete schedule G in order to complete line 14 step 10 lines 16 through 18 adjust your tax liability and add any use tax owed step 11 lines 19 through 23 concerned refundable tax credits to complete line 23 you will first need to complete schedule f step 12 lines 24 through 32 document payments already made step 13 lines 33 through 45 concerned voluntary donations step 14 in lines 46 through 58 perform the final calculations as instructed to determine your final balance due or refund owed sign and date the bottom of the fourth page if filing jointly with your spouse they must do the same to watch more videos please make sure to visit laws calm

People Also Ask about

What is Colorado E Filer attachment form?

What is the nonresident capital gain tax rate?

Does Colorado allow 100 meals deduction?

Does Colorado have efile form?

What form do I use to file Colorado state taxes?

What is the capital gains tax in Colorado for non residents?

Does co have a state withholding form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit colorado dept of revenue from Google Drive?

How can I send colorado dept of revenue to be eSigned by others?

How do I edit colorado dept of revenue online?

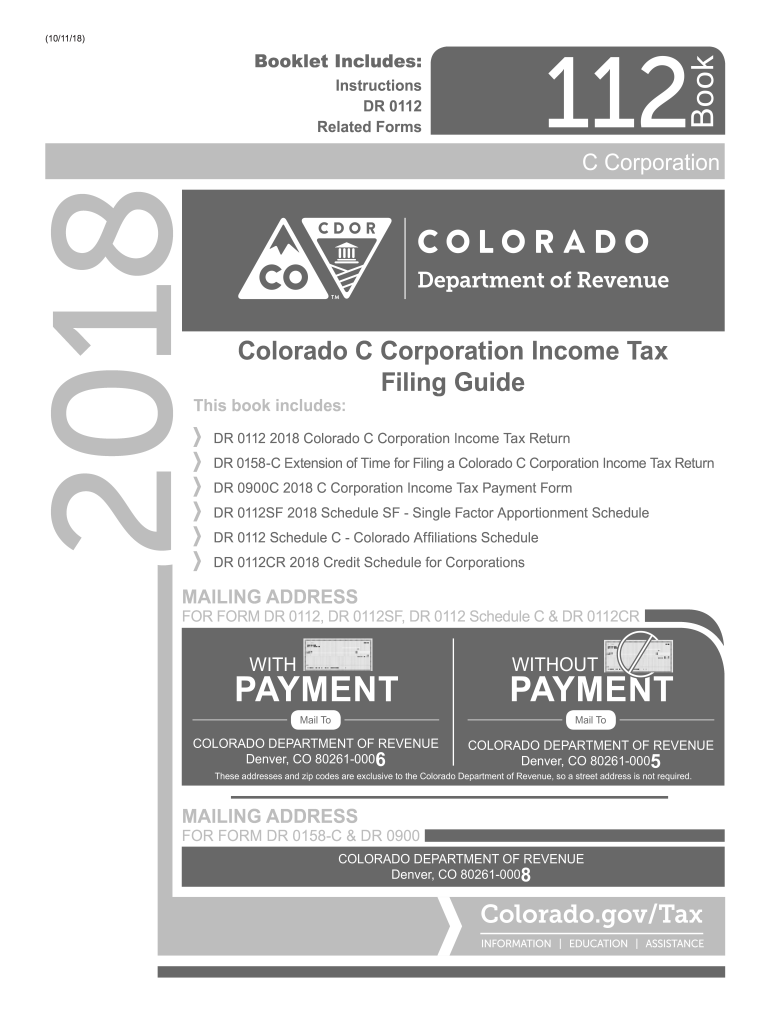

What is CO DoR 112?

Who is required to file CO DoR 112?

How to fill out CO DoR 112?

What is the purpose of CO DoR 112?

What information must be reported on CO DoR 112?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.