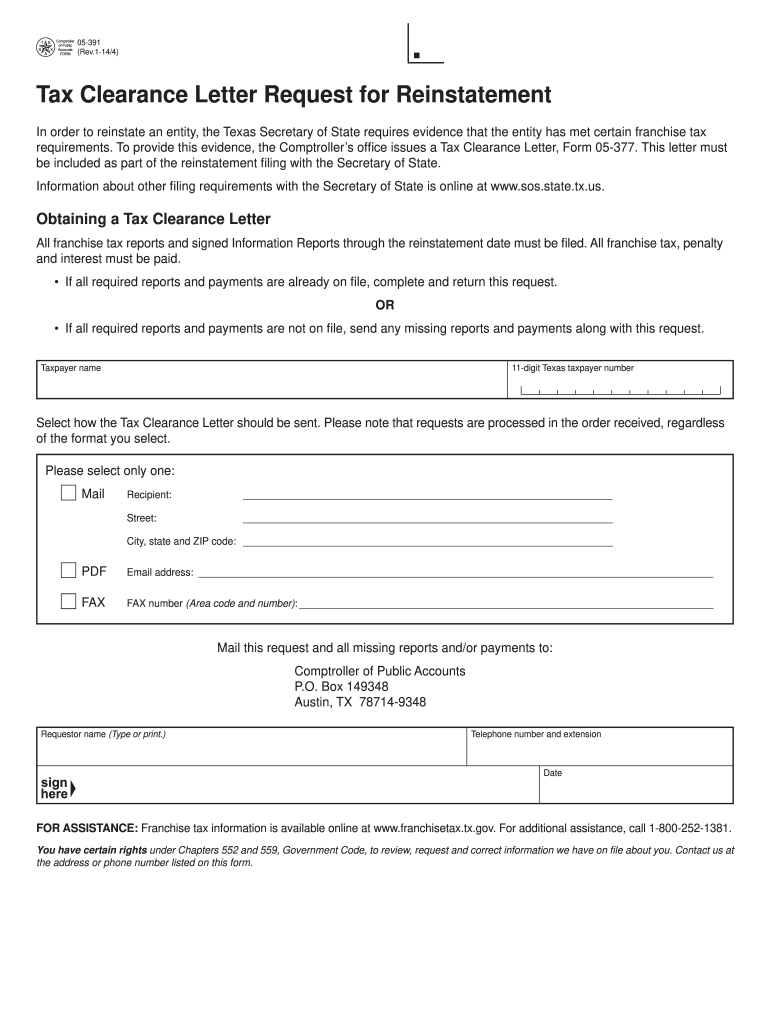

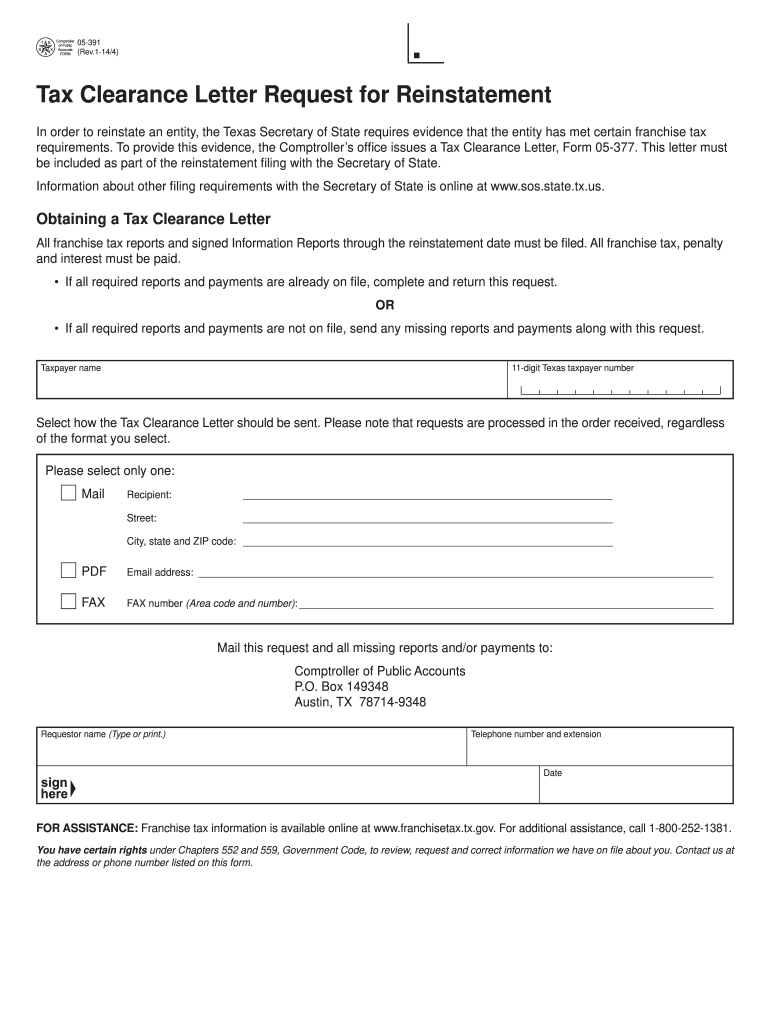

TX Comptroller 05-391 2014 free printable template

Get, Create, Make and Sign TX Comptroller 05-391

How to edit TX Comptroller 05-391 online

Uncompromising security for your PDF editing and eSignature needs

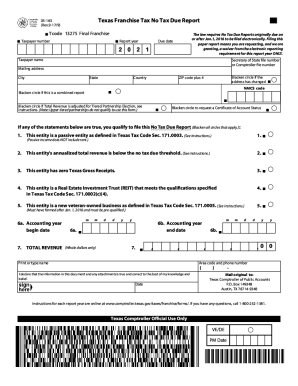

TX Comptroller 05-391 Form Versions

How to fill out TX Comptroller 05-391

How to fill out TX Comptroller 05-391

Who needs TX Comptroller 05-391?

Instructions and Help about TX Comptroller 05-391

I want you to understand this I'm proud to be a long I am so grateful to be back here and office of Texas at the University of Texas I'm thankful to be here with these young guys I continue to recruit the plaintiffs University back to where once was it was Sheila big this is a lady I know how to play football when I came here I think I wanted to learn now to be a man bio everything I've been able to achieve in life to the University of Texas why would you not want to come to Austin Texas tell me I mean the mother town of a great time about 20 years old hopefully living off some text to compare their mother place and this thing is going to invest education in that country you know when I first got here the person sitting there going to school I'm doing this pesticide so why you're going that way I want to go to university taxes, but I wasn't able to getting so at the same time if you are truly a student athlete and academics is truly important to you why would you not want to get an education for the best university in the country and one of the best cities in the country the Texaco UK and West's most watched football game right here one hundred and one thousand I mean I just told myself I signed me up right now I'm good to go take off by thirty years I'll go out there and play right now the University takes up a Coast walk, but a lot of guys didn't know Charlie Strong and what he's all about I think the work that out that cares about the kids we lost these guys to get an education get a degree you know I think Charlie Strong is one of the best coaches in all college football that man can flatten coach he's the man that the NFL and Roger Goodall come to learn about values if I'm a parent I want my kid to go play for Charlie Strong murder the greatest horse of all time is the secretary Jerry all the horse fit befouled body was there he had and all I said were the biggest hearts they there are times it's hard with you, he had no quite a great Drive and those are type of players we need hit the University of Texas so now no matter who you play where you play the pride that you have in the universe of Texas will always show we need more teeth and Dukes on his football team to play the guys with them had a same passion that fire that desire that want to be special that's kind of guys we don't have enough of a caliber team and those are the things that Co strong was trying to bring back to the University of Texas of the type of place we're trying to nothing right now you look our recruiting class that we have here now, and we need to get another one just like it beyond us, it needs to be better this staff don't believe in quitting attorney you're a freshman you have leadership qualities let's go do you what are your senior you have leadership part of the press'll or to enhance what you have to bring it out we don't want to squash it let's go I mean it that's why in my opinion you should come to University of Texas, and we're going to get better that's...

People Also Ask about

What is a Texas Comptroller letter?

How do I get a tax clearance letter from the Texas Comptroller?

What happens if you don't file franchise tax in Texas?

Do I have to file Texas franchise tax?

Do I need to file a state tax form for Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX Comptroller 05-391 in Gmail?

How do I complete TX Comptroller 05-391 online?

How do I fill out the TX Comptroller 05-391 form on my smartphone?

What is TX Comptroller 05-391?

Who is required to file TX Comptroller 05-391?

How to fill out TX Comptroller 05-391?

What is the purpose of TX Comptroller 05-391?

What information must be reported on TX Comptroller 05-391?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.