Canada T3010 E 2014 free printable template

Show details

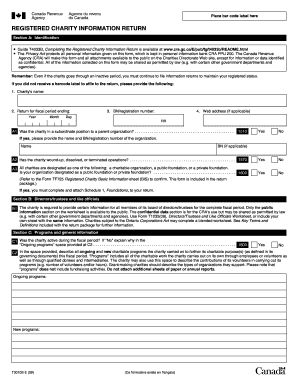

Ongoing programs New programs T3010 E 14 Ce formulaire existe en fran ais. W Page 1 of 9 organizations described in the Income Tax Act. Place bar code label here Registered Charity Information Return Protected B when completed Section A Identification To help you fill out this form refer to Guide T4033 13 Completing the Registered Charity Information Return* It can be found on our Web pages at www. cra*gc*ca/charities under Charities-related forms and publications. The Privacy Act protects...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T3010 E

Edit your Canada T3010 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T3010 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T3010 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada T3010 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T3010 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T3010 E

How to fill out Canada T3010 E

01

Gather the necessary information about your charity, including its registration number, address, and activities.

02

Download the T3010 E form from the Canada Revenue Agency (CRA) website.

03

Fill out the charity's identification information including name, address, and year-end date.

04

Complete the financial information section, providing details on revenue, expenses, and assets.

05

Report on your charity's activities, including social programs, fundraising activities, and how funds were used.

06

Complete the ‘Issues of Public Benefit’ section, ensuring that your charity's activities meet the public benefit test.

07

Provide details of your board of directors and their qualifications.

08

Sign and date the form to certify its accuracy.

09

Submit the completed T3010 E form to the CRA by the due date.

Who needs Canada T3010 E?

01

Registered charities in Canada that are required to file an annual information return with the Canada Revenue Agency.

02

Charitable organizations that want to maintain their registered status with the CRA.

03

Newly registered charities who need to fulfil their reporting obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a T3010 form?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Where do I send my charity return Canada?

Mail the return to: Charities Directorate. Canada Revenue Agency. Ottawa ON K1A 0L5.

What is the due date of T3010?

Many charities that receive government funds have a March 31 year-end. It is important the T3010 is filed both accurately and on time. We assist charities in reviewing their T3010.

What is a T3010 annual return?

Why file a T3010 Return? It is published by Canada Revenue Agency (CRA) and available to the public. It provides information to the CRA regarding activities and/or assets held for assessment of sanctions and/or revocation of charity status. It is used to calculate the disbursement quota.

What is form T3010?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

What is a T3010 form for registered charities in Canada?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I adjust my T3010?

Form T3010, Registered Charity Information Return. You can also use Section B to change the charity's mailing address. canada.ca/charities-giving, select Operating a registered charity, and see Making changes, or call Client Service at 1-800-267-2384.

What is a T3010 annual return?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I submit a T3010?

You or an authorized representative can file your charity's return online using My Business Account. You can also file a paper return. To find Form T3010 and other forms and publications, go to CRA forms and publications. You can also call Client Service at 1-800-267-2384.

What is a T3010 return?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T3010 E to be eSigned by others?

Once your Canada T3010 E is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get Canada T3010 E?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific Canada T3010 E and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit Canada T3010 E on an iOS device?

Create, edit, and share Canada T3010 E from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is Canada T3010 E?

The Canada T3010 E is an annual information return that registered charities in Canada are required to file with the Canada Revenue Agency (CRA). It provides details about the charity's activities, finances, and compliance with tax regulations.

Who is required to file Canada T3010 E?

All registered charities in Canada with a registered charity status are required to file the T3010 E form annually, regardless of their revenue level.

How to fill out Canada T3010 E?

To fill out the Canada T3010 E, charities must provide information about their organization, including financial statements, activities, and governance information. They can obtain the form and instructions from the Canada Revenue Agency's website.

What is the purpose of Canada T3010 E?

The purpose of the Canada T3010 E is to provide transparency and accountability for registered charities. It allows the CRA to monitor compliance with the Income Tax Act and helps the public assess the charity's activities and financial situation.

What information must be reported on Canada T3010 E?

The information that must be reported on the Canada T3010 E includes details on the charity's income, expenditures, specific programs, fundraising activities, and governance structure, as well as any changes to its status or operations.

Fill out your Canada T3010 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t3010 E is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.