MD SDAT Form 4A 2015 free printable template

Show details

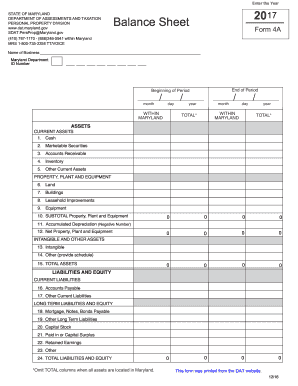

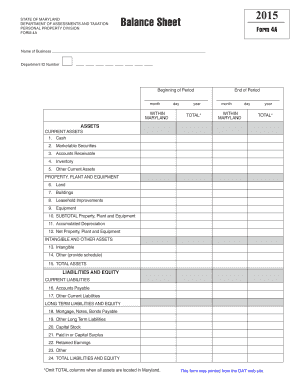

STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION PERSONAL PROPERTY DIVISION FORM 4A Balance Sheet Form 4A Name of Business __________________________________________________________________________ Department ID Number Enter dollar amounts without commas. ASSETS CURRENT ASSETS 1. Cash Beginning of Period month WITHIN MARYLAND day year TOTAL End of Period 2. Marketable Securities 3. Accounts Receivable 4. Inventory 5. Other Current Assets PROPERTY PLANT AND EQUIPMENT 6. Land 7....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD SDAT Form 4A

Edit your MD SDAT Form 4A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD SDAT Form 4A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD SDAT Form 4A online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD SDAT Form 4A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD SDAT Form 4A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD SDAT Form 4A

How to fill out MD SDAT Form 4A

01

Obtain the MD SDAT Form 4A from the official website or your local SDAT office.

02

Read the instructions carefully to understand the requirements.

03

Fill in the basic information section, including your name, address, and contact information.

04

Provide details about the property, including address, tax identification number, and owner information.

05

Indicate the purpose of the application clearly, following the guidelines provided.

06

Attach any necessary documents that support your application.

07

Review the completed form to ensure all information is accurate and complete.

08

Sign and date the form where indicated.

09

Submit the completed form either online, by mail, or in person as per the submission guidelines.

Who needs MD SDAT Form 4A?

01

Individuals or businesses seeking to file for a specific property application in Maryland.

02

Property owners looking to appeal property assessment values.

03

Entities needing to register a property for business tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is Form D-4A?

Form D-4A Certificate of Nonresidence in the District of Columbia. If you work in the District of Columbia, but do NOT live in the District of Columbia, you MUST fill out Form D-4A Certificate of Nonresidence to waive D.C. taxes.

What is the difference between D 4 and D-4A?

Every new employee who resides in DC and who is required to have taxes withheld, must fill out Form D-4 and file it with his/her employer. If you are not liable for DC taxes because you are a nonresident you must file Form D-4A (Certificate of Nonresidence in the District of Columbia) with your employer.

Can all nonresidents who work in DC claim exemption from withholding for the DC income tax?

All non-residents who work in DC can claim exemption from withholding for the DC income tax by filing Form D-4A - Certificate of Nonresidence in DC, with their employer.

What is a Form D-4A certificate of nonresidence in DC?

If you are not a resident of DC you must f le a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

What is form D-4A?

Form D-4A Certificate of Nonresidence in the District of Columbia. If you work in the District of Columbia, but do NOT live in the District of Columbia, you MUST fill out Form D-4A Certificate of Nonresidence to waive D.C. taxes.

Who is a DC resident for tax purposes?

(A resident is an individual domiciled in DC at any time during the taxable year); You maintained a place of abode in DC for a total of 183 days or more even if your permanent home was outside of DC; You were a part-year resident of DC (see instructions for part-year residents);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MD SDAT Form 4A?

With pdfFiller, the editing process is straightforward. Open your MD SDAT Form 4A in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit MD SDAT Form 4A on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit MD SDAT Form 4A.

How do I complete MD SDAT Form 4A on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MD SDAT Form 4A. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MD SDAT Form 4A?

MD SDAT Form 4A is a form used for reporting the status of a corporation or business entity in the state of Maryland, focusing on changes in ownership, structure, or status.

Who is required to file MD SDAT Form 4A?

Any business entity or corporation operating in Maryland that has experienced changes requiring an update to their registration or organizational records must file MD SDAT Form 4A.

How to fill out MD SDAT Form 4A?

To fill out MD SDAT Form 4A, provide accurate details about the entity, including changes in ownership, the type of entity, registered agents, and any amendments to the articles of incorporation or organization as required.

What is the purpose of MD SDAT Form 4A?

The purpose of MD SDAT Form 4A is to officially update the Maryland State Department of Assessments and Taxation on significant changes within a business entity, ensuring public records are accurate and current.

What information must be reported on MD SDAT Form 4A?

Information that must be reported on MD SDAT Form 4A includes the entity's name, address, type of change being reported (such as stock transfers or changes in officers), and any additional details pertinent to the amendments.

Fill out your MD SDAT Form 4A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD SDAT Form 4a is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.