MD SDAT Form 4A 2016 free printable template

Show details

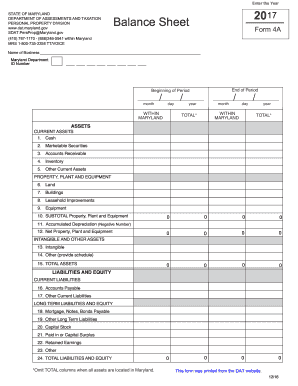

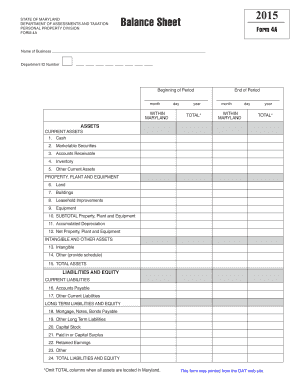

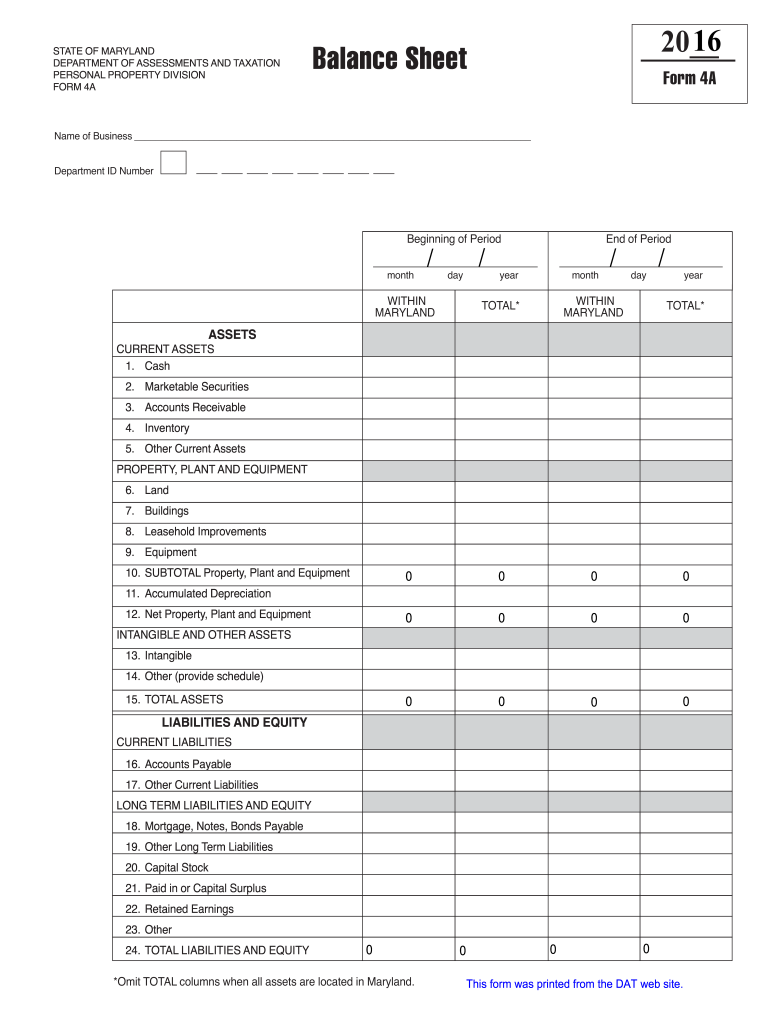

STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION PERSONAL PROPERTY DIVISION FORM 4A 20 Balance Sheet Form 4A Name of Business Department ID Number Beginning of Period month / WITHIN MARYLAND ASSETS CURRENT ASSETS 1. B. Total line must equal Line 10 on the Balance Sheet Form 4A. C. Include all expensed property located in Maryland not reported on the Depreciation Schedule Form 4B. Cash day End of Period year TOTAL 2. Marketable Securities 3. Accounts Receivable 4. Inventory 5. Other...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD SDAT Form 4A

Edit your MD SDAT Form 4A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD SDAT Form 4A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD SDAT Form 4A online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MD SDAT Form 4A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD SDAT Form 4A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD SDAT Form 4A

How to fill out MD SDAT Form 4A

01

Visit the official Maryland Department of Assessments and Taxation (SDAT) website.

02

Download the MD SDAT Form 4A from the website.

03

Read the instructions provided on the form carefully.

04

Fill out the sections with your personal information, including your name, address, and contact details.

05

Provide details regarding the property, including its address, parcel identification number, and type of property.

06

Indicate the nature of your application, such as registration of a business entity or claiming an exemption.

07

Review all the entered information for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the completed form to the Maryland SDAT office by mail or electronically if available.

Who needs MD SDAT Form 4A?

01

Individuals or businesses looking to register a personal property or business with the Maryland Department of Assessments and Taxation.

02

Property owners seeking to claim property tax exemptions.

03

Any parties involved in business transactions requiring documentation of property ownership.

Fill

form

: Try Risk Free

People Also Ask about

What is Form D-4A?

Form D-4A Certificate of Nonresidence in the District of Columbia. If you work in the District of Columbia, but do NOT live in the District of Columbia, you MUST fill out Form D-4A Certificate of Nonresidence to waive D.C. taxes.

What is the difference between D 4 and D-4A?

Every new employee who resides in DC and who is required to have taxes withheld, must fill out Form D-4 and file it with his/her employer. If you are not liable for DC taxes because you are a nonresident you must file Form D-4A (Certificate of Nonresidence in the District of Columbia) with your employer.

Can all nonresidents who work in DC claim exemption from withholding for the DC income tax?

All non-residents who work in DC can claim exemption from withholding for the DC income tax by filing Form D-4A - Certificate of Nonresidence in DC, with their employer.

What is a Form D-4A certificate of nonresidence in DC?

If you are not a resident of DC you must f le a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

What is form D-4A?

Form D-4A Certificate of Nonresidence in the District of Columbia. If you work in the District of Columbia, but do NOT live in the District of Columbia, you MUST fill out Form D-4A Certificate of Nonresidence to waive D.C. taxes.

Who is a DC resident for tax purposes?

(A resident is an individual domiciled in DC at any time during the taxable year); You maintained a place of abode in DC for a total of 183 days or more even if your permanent home was outside of DC; You were a part-year resident of DC (see instructions for part-year residents);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MD SDAT Form 4A?

The editing procedure is simple with pdfFiller. Open your MD SDAT Form 4A in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the MD SDAT Form 4A electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MD SDAT Form 4A in minutes.

Can I create an electronic signature for signing my MD SDAT Form 4A in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your MD SDAT Form 4A and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is MD SDAT Form 4A?

MD SDAT Form 4A is a document used in Maryland for reporting changes related to the entities registered with the State Department of Assessments and Taxation.

Who is required to file MD SDAT Form 4A?

Entities that have undergone changes such as a name change, change in address, or change in ownership are required to file MD SDAT Form 4A.

How to fill out MD SDAT Form 4A?

To fill out MD SDAT Form 4A, provide the entity's name, identification number, details of changes made, and other required information as specified on the form.

What is the purpose of MD SDAT Form 4A?

The purpose of MD SDAT Form 4A is to update the state’s records regarding entities, ensuring accurate information for legal and taxation purposes.

What information must be reported on MD SDAT Form 4A?

Information that must be reported includes the entity's identification number, description of the changes, and any relevant dates associated with the changes.

Fill out your MD SDAT Form 4A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD SDAT Form 4a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.