OK OW-8-ES 2014 free printable template

Show details

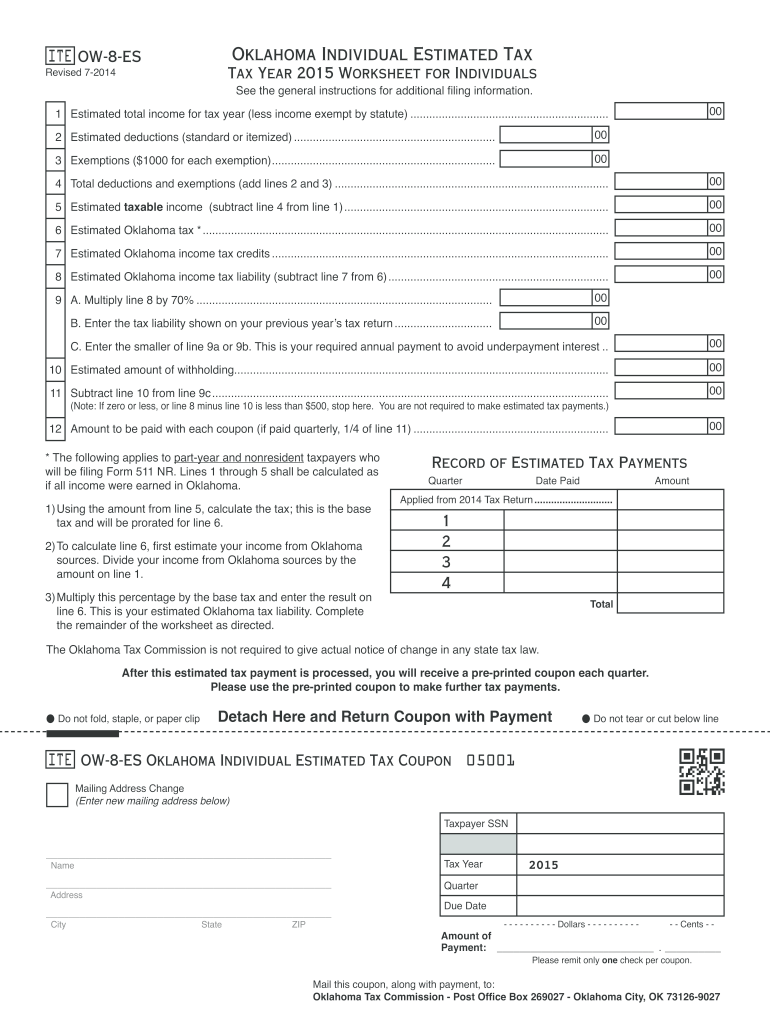

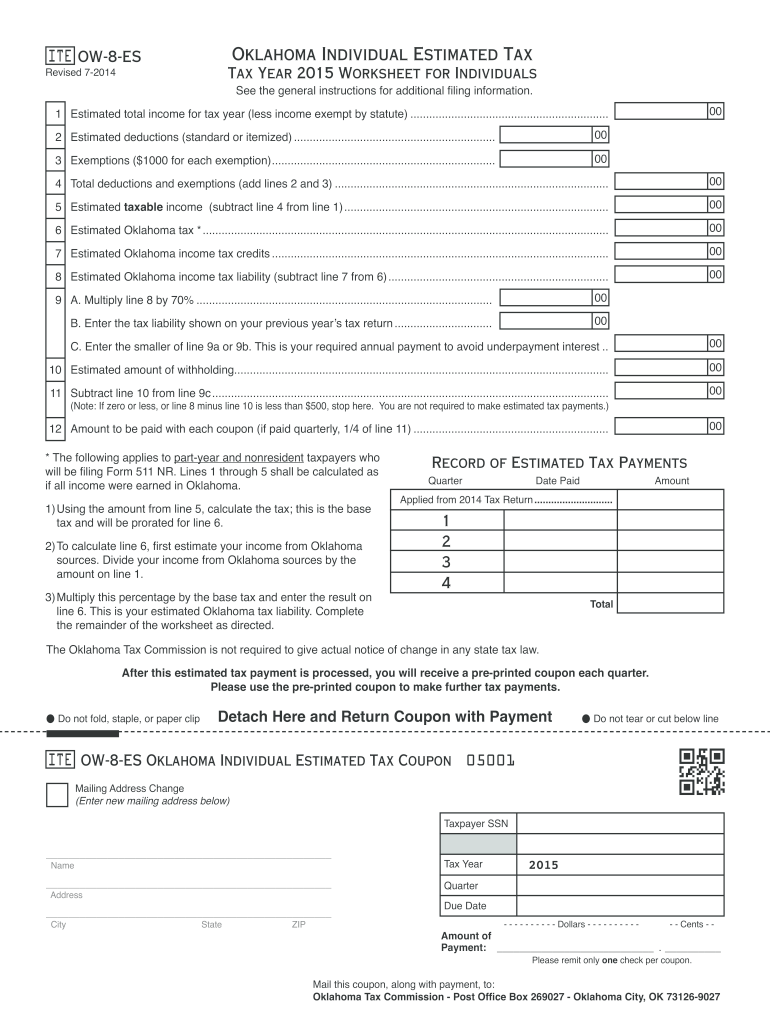

See Form OW-8-ES-SUP for details. Form OW-8-ES-SUP may be downloaded at www. tax. ok. gov. When To File and Pay A declaration of estimated tax should be filed and the first installment paid by April 15th for calendar year taxpayers. Oklahoma Individual Estimated Tax ITE OW-8-ES Tax Year 2015 Worksheet for Individuals Revised 7-2014 See the general instructions for additional filing information. 1 Estimated total income for tax year less income exempt by statute. Do not fold staple or paper...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OW-8-ES

Edit your OK OW-8-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OW-8-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OW-8-ES online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK OW-8-ES. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OW-8-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OW-8-ES

How to fill out OK OW-8-ES

01

Obtain the OK OW-8-ES form from the appropriate tax authority website or office.

02

Fill in the taxpayer identification information, including name, address, and identification number.

03

Provide the relevant tax year for which you are filing the form.

04

Complete the sections detailing income sources, deductions, and any applicable credits.

05

Review the filled form for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the form to the designated tax office either online or by mail, ensuring you keep a copy for your records.

Who needs OK OW-8-ES?

01

Any individual or entity that has income subject to Oklahoma state taxes.

02

Taxpayers seeking to claim tax credits or deductions specific to Oklahoma.

03

Those who are filing for tax refund situations related to Oklahoma taxation.

Instructions and Help about OK OW-8-ES

Fill

form

: Try Risk Free

People Also Ask about

How do I pay taxes on Oktap?

Make an EFT, credit card, or debit card payment online. Begin by clicking the Make an Online Payment link on the OKTAP home page. Complete the required fields on the Online Payment form. A description of the payment type will appear in the margin once you make a selection.

What is the underpayment of estimated tax interest in Oklahoma?

The tax liability is the tax due less all credits except amounts paid on withholding, estimated tax and extension payments. The amount of underpayment of estimated tax interest is computed at a rate of 20% per annum for the period of underpayment.

What is the estimated sales tax in Oklahoma?

Oklahoma sales tax details The Oklahoma (OK) state sales tax rate is currently 4.5%. Depending on local municipalities, the total tax rate can be as high as 11.5%.

Do you have to pay estimated taxes in Oklahoma?

A declaration of estimated tax should be filed and the first installment paid by April 15th for calendar year taxpayers. Other installments for calendar year taxpayers should be paid by the due dates shown below. A worksheet is included with the coupon for use in computing estimated tax liability.

How do I pay my Oklahoma estimated taxes online?

Direct Online Payment via Bank Account. Go to the Oklahoma TAP site to submit your payment. Credit or Debit Card Payment. Submit a tax payment through OK TAP site. Check or Money Order with Form 511-V. Estimated Tax Payment Options. Online IRS Tax Payment Options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OK OW-8-ES online?

With pdfFiller, you may easily complete and sign OK OW-8-ES online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my OK OW-8-ES in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your OK OW-8-ES and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the OK OW-8-ES form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign OK OW-8-ES and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is OK OW-8-ES?

OK OW-8-ES is an estimated tax payment voucher used by individuals and businesses in Oklahoma to remit estimated income tax payments to the state.

Who is required to file OK OW-8-ES?

Individuals and businesses that expect to owe $1,000 or more in taxes for the year, after deducting withholding and credits, are required to file OK OW-8-ES.

How to fill out OK OW-8-ES?

To fill out OK OW-8-ES, provide your name, address, Social Security Number or Tax ID Number, and the estimated tax amounts for each payment period on the form.

What is the purpose of OK OW-8-ES?

The purpose of OK OW-8-ES is to allow taxpayers to report and remit estimated tax payments to Oklahoma in order to avoid penalties for underpayment at the end of the tax year.

What information must be reported on OK OW-8-ES?

Information that must be reported on OK OW-8-ES includes taxpayer identification, estimated income, deductions, credits, and the amount of tax owed for the current estimated payment period.

Fill out your OK OW-8-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OW-8-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.