OK OW-8-ES 2020 free printable template

Show details

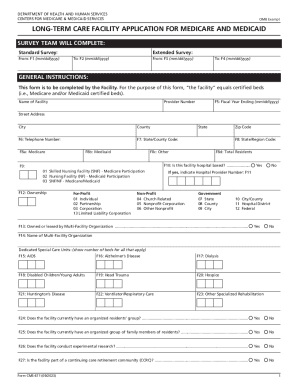

See Form OW-8-ES-SUP for details. Form OW-8-ES-SUP may be downloaded at www. tax. ok. gov. When To File and Pay A declaration of estimated tax should be filed and the first installment paid by April 15th for calendar year taxpayers. Oklahoma Individual Estimated Tax ITE OW-8-ES Tax Year 2017 Worksheet for Individuals Revised 8-2016 See the general instructions for additional filing information. 1 Estimated total income for tax year less income exempt by statute. Do not fold staple or paper...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OW-8-ES

Edit your OK OW-8-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OW-8-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OW-8-ES online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK OW-8-ES. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OW-8-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OW-8-ES

How to fill out OK OW-8-ES

01

Download the OK OW-8-ES form from the official website or obtain a physical copy.

02

Fill out your personal information, including your name, address, and social security number at the top of the form.

03

Provide any relevant information about your income and employment status in the designated sections.

04

If applicable, report any deductions or credits you qualify for.

05

Carefully review the form for accuracy before signing and dating it.

06

Submit the completed form by mail or electronically as instructed.

Who needs OK OW-8-ES?

01

Individuals who are residents in Oklahoma and need to report their income for tax purposes.

02

Anyone who has had withholding from their income and seeks a refund or credit.

03

People who qualify for specific credits or tax relief programs offered by the state.

Instructions and Help about OK OW-8-ES

Fill

form

: Try Risk Free

People Also Ask about

How do I report estimated tax payments?

If you made estimated or quarterly tax payments in 2021 toward your federal, state, or local taxes, enter them in the Estimated and Other Income Taxes Paid section.

Do I need to submit a form with estimated taxes?

Generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/RDP filing separately) in tax for 2022 (after subtracting withholding and credits) and you expect your withholding and credits to be less than the smaller of: 90% of the tax shown on your 2022 tax return; or.

Do you get a form for estimated tax payments?

This form can be manually completed and filed quarterly during the year. Form 1040-ES can be generated by tax software. Once your estimated tax payment has been calculated, the current payment voucher must be sent to the correct IRS address based on the state where you live.

Can I make an estimated tax payment anytime?

You can do this at any time during the year. Remember, the schedule set by the IRS is a series of deadlines. You can always make a payment before a set date, and you can cover your entire liability in one payment if you want to. You don't have to divide up what you might owe into a series of four quarterly payments.

What form do I use to pay quarterly taxes?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Does Oklahoma require estimated tax payments?

You are not required to make estimated tax payments.) * The following applies to part-year and nonresident taxpayers who will be filing Form 511-NR. Lines 1 through 5 shall be calculated as if all income were earned in Oklahoma.

When can I pay 2021 estimated taxes?

The final two deadlines for paying 2021 estimated payments are September 15, 2021 and January 15, 2022. Taxpayers can check out these forms for details on how to figure their payments: Form 1040-ES, Estimated Tax for IndividualsPDF.

What is the easiest way to pay estimated taxes?

Making payments online is the fastest, easiest way to pay quarterly taxes. If you prefer, you can also make payments by mail. To avoid any tax penalties, take time to learn how much you'll need to pay in quarterly taxes, when quarterly tax payments are due and how to make your payments to the IRS.

How do I make estimated tax payments for 2021?

Important: Make your estimated tax payments directly to the IRS online so you do not have to mail Form 1040-ES. On the IRS payment page, select Estimated Tax and the platform will select 1040-ES so you can submit the 1040-ES tax payment online without having to mail a check or fill in any forms.

How do I make estimated tax payments automatically?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

Do I have to make 1040-ES payments?

If you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using Form 1040-ES, or else face a penalty for underpayment.

Can I pay estimated taxes all at once?

Many people wonder, “can I make estimated tax payments all at once?” or pay a quarter up front? Because people might think it's a nuisance to file taxes quarterly, this is a common question. The answer is no.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OK OW-8-ES without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your OK OW-8-ES into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete OK OW-8-ES online?

With pdfFiller, you may easily complete and sign OK OW-8-ES online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit OK OW-8-ES straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing OK OW-8-ES, you need to install and log in to the app.

What is OK OW-8-ES?

OK OW-8-ES is a form used in Oklahoma for reporting estimated income tax payments for individuals or businesses.

Who is required to file OK OW-8-ES?

Taxpayers who expect to owe more than $1,000 in state tax after withholding and credits must file OK OW-8-ES.

How to fill out OK OW-8-ES?

To fill out OK OW-8-ES, provide your personal information, estimate your income, calculate your expected tax liability, and report your payment amounts.

What is the purpose of OK OW-8-ES?

The purpose of OK OW-8-ES is to facilitate the payment of estimated taxes by individuals and businesses to avoid underpayment penalties.

What information must be reported on OK OW-8-ES?

Information that must be reported on OK OW-8-ES includes taxpayer identification, estimated income, calculated tax liability, and payment details.

Fill out your OK OW-8-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OW-8-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.