Canada FIN 355 2013 free printable template

Show details

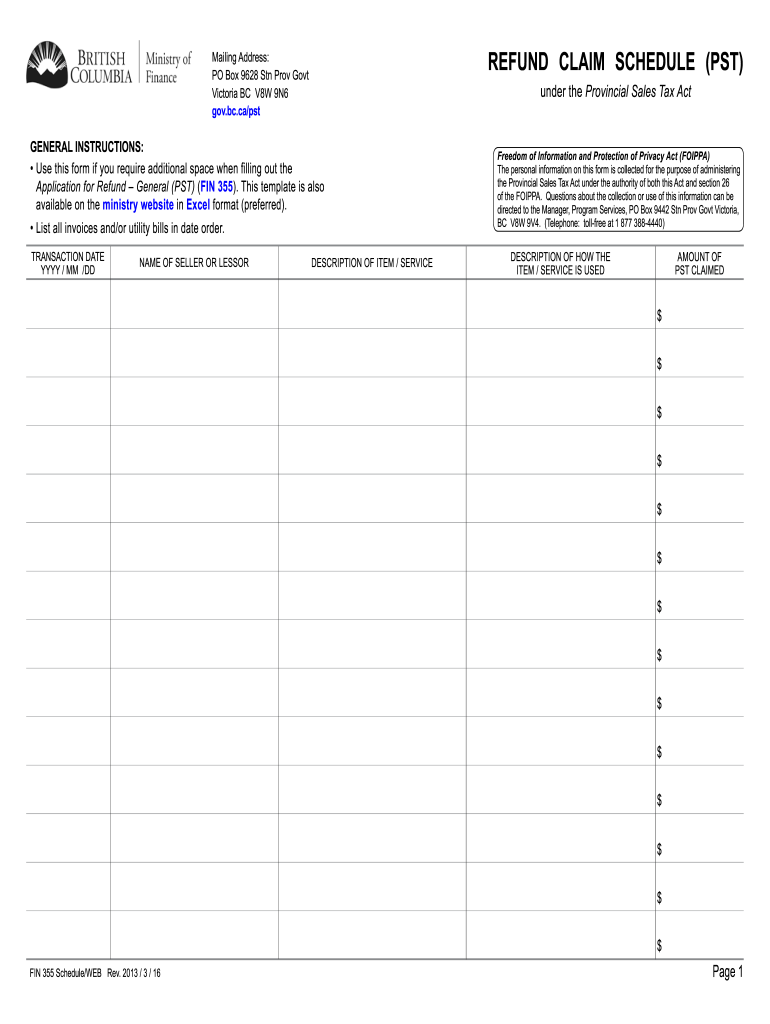

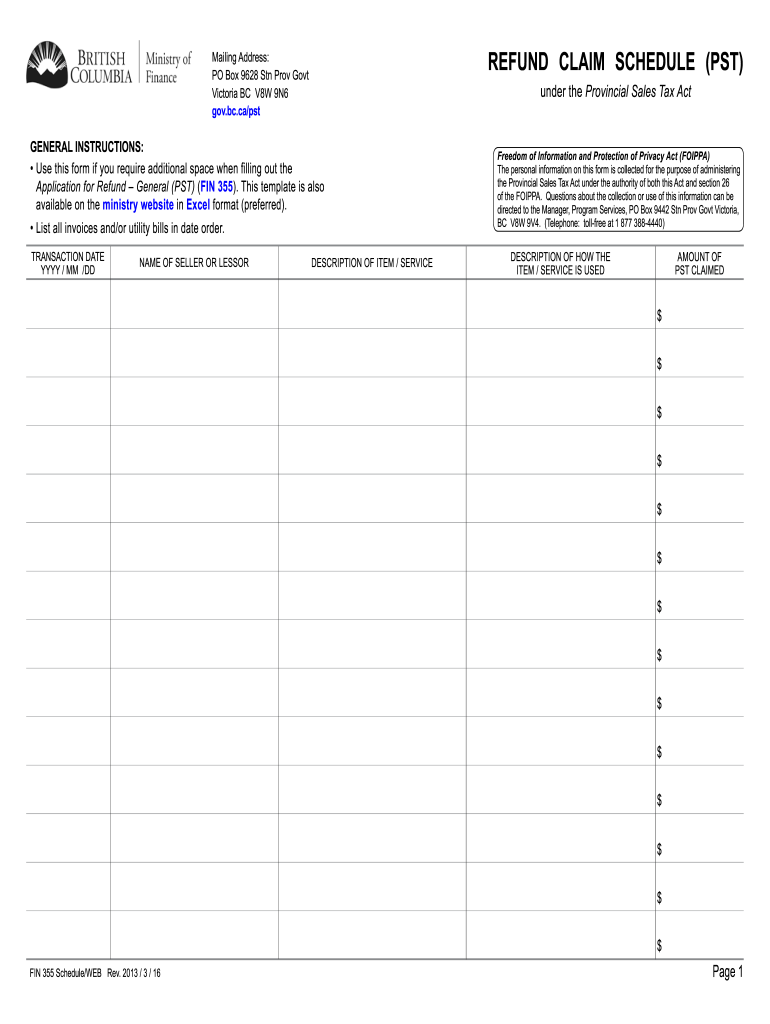

REFUND CLAIM SCHEDULE (PST) Mailing Address: PO Box 9628 STN Prov Govt Victoria BC v8w 9n6 gov.bc.ca/pst under the Provincial Sales Tax Act GENERAL Instructions: Use this form if you require additional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada FIN 355

Edit your Canada FIN 355 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FIN 355 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada FIN 355 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada FIN 355. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 355 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FIN 355

How to fill out Canada FIN 355

01

Obtain the Canada FIN 355 form from the official website or financial institution.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the applicable sections, including name, address, and contact details.

04

Provide the necessary financial information, including income sources and amounts.

05

Ensure that all information is accurate and complete to avoid delays.

06

Review the form for any errors before submission.

07

Submit the completed form to the relevant Canadian authority as instructed.

Who needs Canada FIN 355?

01

Individuals or entities that engage in certain financial activities in Canada may need to complete the Canada FIN 355 form.

02

It is typically required for those involved in reporting foreign financial accounts or transactions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my taxes back at the airport?

Refund Locations: Both US Citizens and non-US citizens can claim tax refunds at all major international airport terminals, they would have a Tax refund desk. Check the airport for the details on the terminal. Also, if you are a non-US citizen, then you can even claim tax refunds at certain mall locations in the state.

Is BC PST refundable?

If you paid PST and were not required to pay it, you are eligible for a refund of the PST paid. You may request a refund or credit directly from the collector within 180 days from the date you paid the PST.

Who is B.C. PST payable to?

You must report and pay to us all PST and municipal and regional district tax (MRDT) you have charged, whether or not you have actually collected it from your customer. This includes tax you may have charged incorrectly, such as: At an incorrect rate (for example, you charged 10% PST on general goods instead of 7%)

What is GST refund process?

The GST portal sends export details to the ICEGATE as disclosed on GSTR-1. Also, a confirmation that GSTR-3B was filed for the relevant tax period is sent. The Customs system compares the information on GSTR-1 to the information on their shipping bill and Export General Manifest (EGM) and then processes the refund.

What is the timeline for GST refund?

Yes, refund has to be sanctioned within 60 days from the date of receipt of application complete in all respects. If refund is not sanctioned within the said period of 60 days, interest at the rate notified not exceeding 6% will have to be paid in ance with section 56 of the CGST/TSGST Act.

Is B.C. sales tax recoverable?

If you overpaid PST or paid PST in error, you may be eligible for a refund of the PST you paid.

Who has to pay PST in BC?

Yes, you must charge PST on all taxable goods and services you sell in B.C., unless a specific exemption applies. There are no general exemptions that apply if you sell goods or services in B.C. to customers that live outside B.C. (e.g. tourists).

How do I check the status of my GST refund?

Login to the GST Portal. Navigate to Services > Track Application Status > Select the Refund option > Enter ARN or Filing Year > Click SEARCH to track your refund application after logging into the GST Portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Canada FIN 355 online?

With pdfFiller, you may easily complete and sign Canada FIN 355 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in Canada FIN 355?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada FIN 355 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit Canada FIN 355 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada FIN 355.

What is Canada FIN 355?

Canada FIN 355 is a tax form used for reporting foreign income and participation in foreign trusts and foreign corporations by Canadian residents.

Who is required to file Canada FIN 355?

Individuals, corporations, or partnerships that have foreign income, hold shares in foreign corporations, or are beneficiaries of foreign trusts are required to file Canada FIN 355.

How to fill out Canada FIN 355?

To fill out Canada FIN 355, taxpayers need to provide accurate information regarding their foreign income sources, details of any foreign trusts or corporations they are involved with, and attach supporting documents as required.

What is the purpose of Canada FIN 355?

The purpose of Canada FIN 355 is to ensure that Canadian taxpayers report and disclose their foreign income, interests in foreign trusts, and shareholdings in foreign corporations for compliance with Canadian tax laws.

What information must be reported on Canada FIN 355?

Information that must be reported on Canada FIN 355 includes details about foreign income, identification of foreign entities, ownership interests in foreign corporations or trusts, and any relevant financial transactions.

Fill out your Canada FIN 355 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FIN 355 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.