OK Sales Tax Exemption Packet E 2015 free printable template

Show details

Be sure to visit us on our website at www.tax.ok.gov for all your tax needs including forms, publications, and answers to ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Sales Tax Exemption Packet E

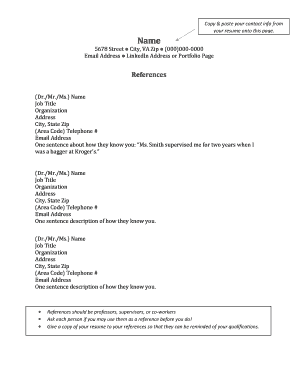

Edit your OK Sales Tax Exemption Packet E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Sales Tax Exemption Packet E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Sales Tax Exemption Packet E online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OK Sales Tax Exemption Packet E. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Sales Tax Exemption Packet E Form Versions

Version

Form Popularity

Fillable & printabley

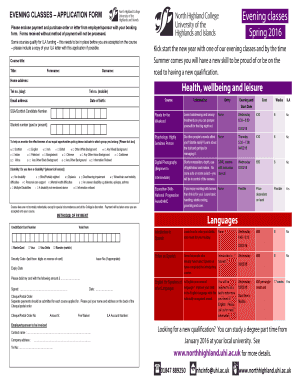

How to fill out OK Sales Tax Exemption Packet E

How to fill out OK Sales Tax Exemption Packet E

01

Download the OK Sales Tax Exemption Packet E from the Oklahoma Tax Commission website.

02

Read the instructions provided with the packet carefully.

03

Fill out the required personal information, including your name, address, and contact information.

04

Provide the name and address of the organization you represent, if applicable.

05

Indicate the reason for the exemption by selecting the appropriate box that applies to your situation.

06

Attach any necessary supporting documentation to validate your exemption claim.

07

Review the completed packet for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed packet to the appropriate taxing authority as instructed in the guidelines.

Who needs OK Sales Tax Exemption Packet E?

01

Individuals or organizations that are purchasing items for tax-exempt purposes in the state of Oklahoma.

02

Non-profit organizations that qualify for sales tax exemption.

03

Government entities making purchases that are exempt from sales tax.

04

Religious institutions purchasing goods necessary for their operations.

Fill

form

: Try Risk Free

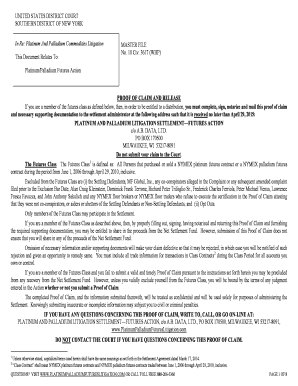

People Also Ask about

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Does Oklahoma have a tax exemption certificate?

The state of Oklahoma provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. The "Certificate of Exemption" is utilized for the majority of tax exempt purchasing procedures, and the "Blanket Exemption Certificate" is the blanket version of this form.

Who is exempt from oil and gas sales tax in Oklahoma?

Individuals severing oil and gas for personal use and not for commercial sale are exempt from tax. Use 5% of sales price.

Do you get a W-2 if you are exempt?

The employee is exempt from taxes, but not taxable wages. All wages earned by the employee should be reported on the W-2.

What is exempt from Oklahoma state sales tax?

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

How do I get a tax-exempt certificate in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying.

What form is exempt on taxes?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

How do I claim exempt on my taxes?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

Should I claim 1 or 0?

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

What is exempt from state of Oklahoma tax?

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in OK Sales Tax Exemption Packet E?

With pdfFiller, the editing process is straightforward. Open your OK Sales Tax Exemption Packet E in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the OK Sales Tax Exemption Packet E electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your OK Sales Tax Exemption Packet E.

How can I fill out OK Sales Tax Exemption Packet E on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your OK Sales Tax Exemption Packet E, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

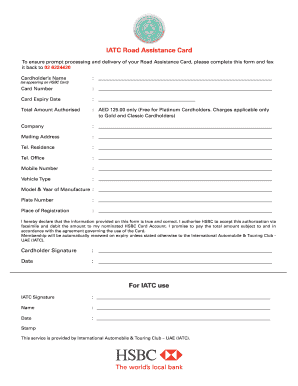

What is OK Sales Tax Exemption Packet E?

OK Sales Tax Exemption Packet E is a form used by nonprofit organizations in Oklahoma to claim sales tax exemption for qualifying purchases.

Who is required to file OK Sales Tax Exemption Packet E?

Nonprofit organizations that are seeking a sales tax exemption on their purchases in Oklahoma are required to file OK Sales Tax Exemption Packet E.

How to fill out OK Sales Tax Exemption Packet E?

To fill out OK Sales Tax Exemption Packet E, organizations must provide their identification information, describe the purpose of the exemption, and list the types of purchases for which they are claiming tax exemption.

What is the purpose of OK Sales Tax Exemption Packet E?

The purpose of OK Sales Tax Exemption Packet E is to allow eligible nonprofit organizations in Oklahoma to purchase goods and services without paying sales tax.

What information must be reported on OK Sales Tax Exemption Packet E?

The information that must be reported on OK Sales Tax Exemption Packet E includes the organization's name, tax ID number, description of its nonprofit activities, and the specific purchases for which the exemption is being requested.

Fill out your OK Sales Tax Exemption Packet E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Sales Tax Exemption Packet E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.