OK Sales Tax Exemption Packet E 2020 free printable template

Show details

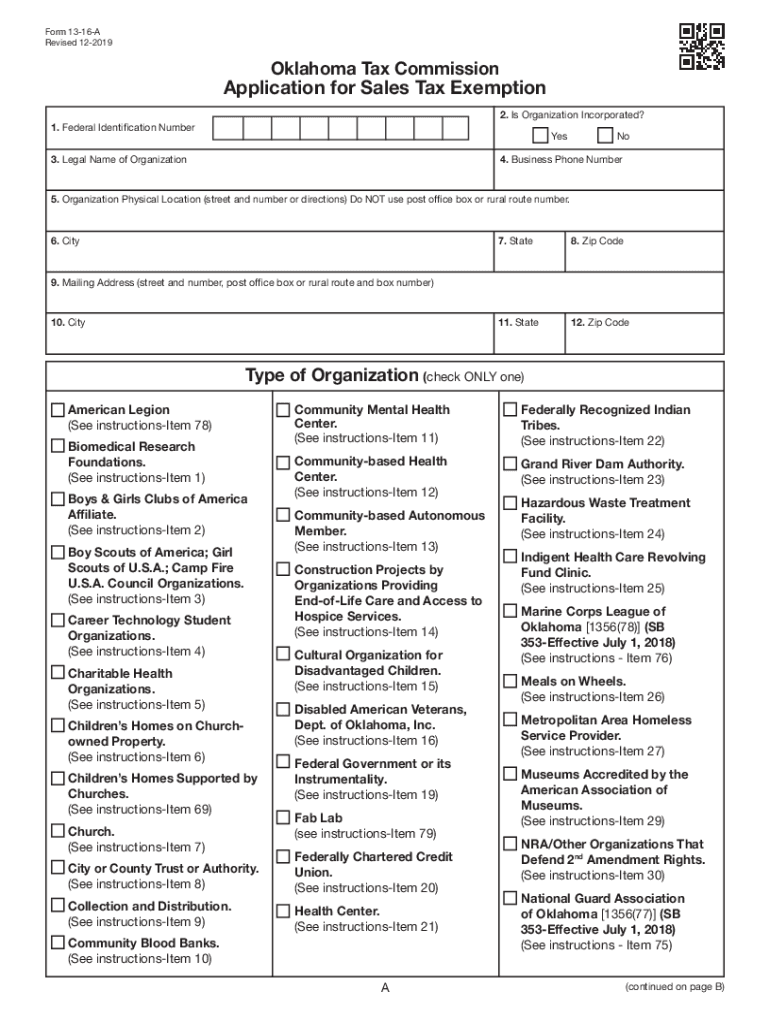

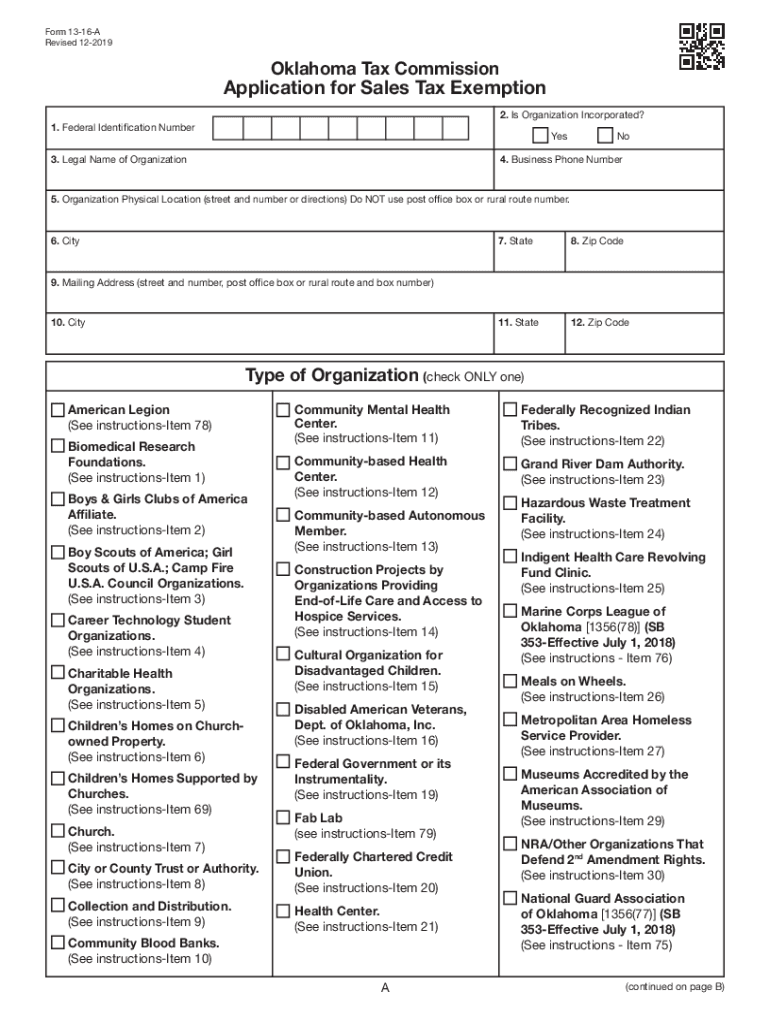

Sales Tax Exemption Do You Need to Apply for Sales Tax Exemption in Oklahoma? Oklahoma Sales Tax Exemption Packet Entities that qualify for sales tax exemption in Oklahoma are specifically legislated.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Sales Tax Exemption Packet E

Edit your OK Sales Tax Exemption Packet E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Sales Tax Exemption Packet E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Sales Tax Exemption Packet E online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK Sales Tax Exemption Packet E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Sales Tax Exemption Packet E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Sales Tax Exemption Packet E

How to fill out OK Sales Tax Exemption Packet E

01

Obtain the OK Sales Tax Exemption Packet E from the Oklahoma Tax Commission website or local office.

02

Fill in your business name and address at the top of the first page.

03

Provide your Oklahoma Sales Tax Permit number.

04

Indicate the reason for the exemption in the designated section.

05

List the items being purchased or the purpose for the exemption.

06

Include the name of the purchaser or authorized representative.

07

Sign and date the form where indicated.

08

Submit the completed form to the vendor at the time of purchase.

Who needs OK Sales Tax Exemption Packet E?

01

Businesses or individuals making tax-exempt purchases in Oklahoma.

02

Organizations that qualify for sales tax exemptions, such as nonprofit entities.

03

Developers or contractors purchasing materials for tax-exempt projects.

Fill

form

: Try Risk Free

People Also Ask about

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Does Oklahoma have a tax exemption certificate?

The state of Oklahoma provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. The "Certificate of Exemption" is utilized for the majority of tax exempt purchasing procedures, and the "Blanket Exemption Certificate" is the blanket version of this form.

Who is exempt from oil and gas sales tax in Oklahoma?

Individuals severing oil and gas for personal use and not for commercial sale are exempt from tax. Use 5% of sales price.

Do you get a W-2 if you are exempt?

The employee is exempt from taxes, but not taxable wages. All wages earned by the employee should be reported on the W-2.

What is exempt from Oklahoma state sales tax?

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

How do I get a tax-exempt certificate in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying.

What form is exempt on taxes?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

How do I claim exempt on my taxes?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

Should I claim 1 or 0?

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

What is exempt from state of Oklahoma tax?

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OK Sales Tax Exemption Packet E in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your OK Sales Tax Exemption Packet E and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit OK Sales Tax Exemption Packet E on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing OK Sales Tax Exemption Packet E.

How do I fill out OK Sales Tax Exemption Packet E on an Android device?

Use the pdfFiller mobile app to complete your OK Sales Tax Exemption Packet E on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is OK Sales Tax Exemption Packet E?

OK Sales Tax Exemption Packet E is a form used in Oklahoma to claim a sales tax exemption for certain purchases made by qualified organizations.

Who is required to file OK Sales Tax Exemption Packet E?

Qualified organizations such as non-profits, government entities, and certain educational institutions are required to file OK Sales Tax Exemption Packet E.

How to fill out OK Sales Tax Exemption Packet E?

To fill out OK Sales Tax Exemption Packet E, obtain the form, provide the organization's details, describe the purchase, and include a signature from an authorized representative.

What is the purpose of OK Sales Tax Exemption Packet E?

The purpose of OK Sales Tax Exemption Packet E is to enable eligible entities to purchase items without having to pay sales tax, supporting non-profit activities and other exempt purposes.

What information must be reported on OK Sales Tax Exemption Packet E?

The information that must be reported includes the organization name, tax identification number, details of the exempt purchase, and certification from an authorized official.

Fill out your OK Sales Tax Exemption Packet E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Sales Tax Exemption Packet E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.