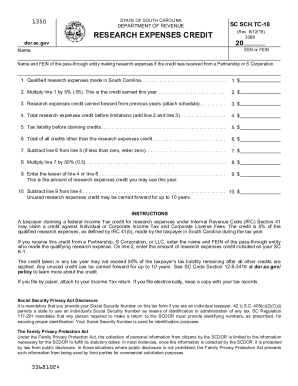

SC SCH.TC-18 2015 free printable template

Show details

Mar 5, 2015 ... Name As Shown On Tax Return. SSN or VEIN. 1. $. 2. $. 3. $. 4. $. 5. $. 6. $. 7. $. 8. $. 9. $. 10. $. GENERAL INSTRUCTIONS. Effective for tax ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SCHTC-18

Edit your SC SCHTC-18 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SCHTC-18 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC SCHTC-18 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC SCHTC-18. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SCH.TC-18 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SCHTC-18

How to fill out SC SCH.TC-18

01

Begin by obtaining the SC SCH.TC-18 form from the appropriate state tax department website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details on your income sources, including wages, self-employment income, and any other earnings.

04

List any deductions or credits you are eligible for that may reduce your taxable income.

05

Carefully review your entries for accuracy and completeness.

06

Sign and date the form to certify that the information provided is correct.

07

Submit the completed SC SCH.TC-18 form by the specified deadline, either electronically or via mail.

Who needs SC SCH.TC-18?

01

Individuals who have earned income in South Carolina and need to report their income for tax purposes.

02

Self-employed individuals who are required to complete additional tax forms.

03

Taxpayers seeking to claim specific deductions or credits on their state tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is the SC tuition tax credit?

What is the credit limit for 2021 if the student attends a 2-year and 4-year college or university within the 2021 tax year? A student who qualifies to include credit hours from a 2-year and 4-year college or university within the same taxable year is eligible for a maximum credit amount of $1,500.

Are we getting another child tax credit in 2023?

The 2017 tax overhaul doubled the maximum child tax credit to $2,000 from $1,000 for each child in a family under age 17 at year-end. It applies for both 2022 and 2023.

How much is child tax credit in SC 2023?

Child and dependent care credit The maximum credit allowed is $210 for one child or $420 for two or more children. The federal credit offers a maximum of $2,100 this year instead of the $8,000 offered last year. Taxpayers cannot claim this credit if they are using a married filing separately status on their returns.

What is the SC new jobs tax credit?

The Jobs Tax Credit is a valuable financial incentive that rewards new and expanding companies for creating jobs in South Carolina. In order to qualify, companies must create and maintain a certain number of net new jobs in a taxable year.

What is the child tax credit for 2023 in SC?

Child and dependent care credit The maximum credit allowed is $210 for one child or $420 for two or more children. The federal credit offers a maximum of $2,100 this year instead of the $8,000 offered last year. Taxpayers cannot claim this credit if they are using a married filing separately status on their returns.

What is the tax refund for 2023?

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2022). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

What is SC classroom teacher expense credit?

Classroom Teachers Expenses Credit: Classroom teachers in public or private schools who are not reimbursed by their counties for teaching supplies and materials can claim up to $300 in this refundable credit on their tax year 2022 returns, which are the returns due in 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit SC SCHTC-18 online?

The editing procedure is simple with pdfFiller. Open your SC SCHTC-18 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit SC SCHTC-18 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your SC SCHTC-18, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the SC SCHTC-18 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SC SCHTC-18 in seconds.

What is SC SCH.TC-18?

SC SCH.TC-18 is a tax form used by South Carolina taxpayers to report certain tax credits and claims.

Who is required to file SC SCH.TC-18?

Taxpayers who are claiming specific tax credits, such as the South Carolina Job Tax Credit, or other applicable credits are required to file SC SCH.TC-18.

How to fill out SC SCH.TC-18?

To fill out SC SCH.TC-18, taxpayers need to provide their personal information, details about the tax credits they are claiming, and any relevant documentation that supports their claims.

What is the purpose of SC SCH.TC-18?

The purpose of SC SCH.TC-18 is to facilitate the reporting and claiming of certain tax credits that assist taxpayers in reducing their tax liability.

What information must be reported on SC SCH.TC-18?

The information that must be reported on SC SCH.TC-18 includes taxpayer information, the specific tax credits being claimed, and any necessary calculations or supporting documentation relevant to those credits.

Fill out your SC SCHTC-18 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC SCHTC-18 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.