SC SCH.TC-18 2019-2025 free printable template

Show details

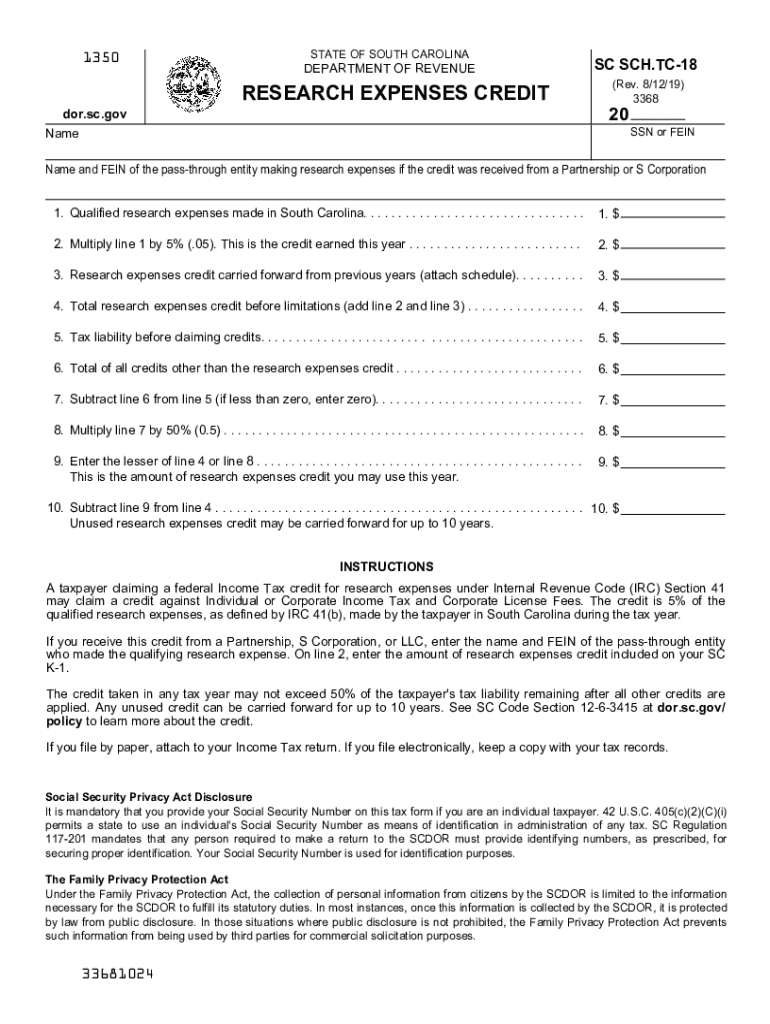

1350STATE OF SOUTH CAROLINADEPARTMENT OF REVENUERESEARCH EXPENSES CREDIT Attach to your Income Tax or Corporate License Fee Return Name As Shown On Tax Returns SCH.TC18 (Rev. 1/12/16) 336820 SSN or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sch tc 18 form

Edit your sc sch tc 18 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc sch tc 18 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc sch tc 18 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sc sch tc 18. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SCH.TC-18 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc sch tc 18

How to fill out SC SCH.TC-18

01

Start by obtaining a blank SC SCH.TC-18 form, which is usually available online or from relevant authorities.

02

Fill out the name and address section with accurate information for the person filing.

03

Provide the Social Security Number (SSN) in the designated field.

04

Indicate the filing status by checking the appropriate box (e.g., Single, Married Filing Jointly).

05

List all sources of income and corresponding amounts on the income section of the form.

06

Include deductions and credits, ensuring to provide necessary documentation or explanations.

07

Calculate the total tax owed or refund due according to the instructions provided in the form.

08

Sign and date the form at the bottom to certify that the information is accurate.

Who needs SC SCH.TC-18?

01

Individuals who are required to report certain types of income or claim specific deductions for state tax purposes.

02

Taxpayers who need to reconcile tax credits or adjustments in their income reporting.

03

Professionals and businesses that are subject to specific tax filing requirements under state law.

Fill

form

: Try Risk Free

People Also Ask about

What is the SC tuition tax credit?

What is the credit limit for 2021 if the student attends a 2-year and 4-year college or university within the 2021 tax year? A student who qualifies to include credit hours from a 2-year and 4-year college or university within the same taxable year is eligible for a maximum credit amount of $1,500.

Are we getting another child tax credit in 2023?

The 2017 tax overhaul doubled the maximum child tax credit to $2,000 from $1,000 for each child in a family under age 17 at year-end. It applies for both 2022 and 2023.

How much is child tax credit in SC 2023?

Child and dependent care credit The maximum credit allowed is $210 for one child or $420 for two or more children. The federal credit offers a maximum of $2,100 this year instead of the $8,000 offered last year. Taxpayers cannot claim this credit if they are using a married filing separately status on their returns.

What is the SC new jobs tax credit?

The Jobs Tax Credit is a valuable financial incentive that rewards new and expanding companies for creating jobs in South Carolina. In order to qualify, companies must create and maintain a certain number of net new jobs in a taxable year.

What is the child tax credit for 2023 in SC?

Child and dependent care credit The maximum credit allowed is $210 for one child or $420 for two or more children. The federal credit offers a maximum of $2,100 this year instead of the $8,000 offered last year. Taxpayers cannot claim this credit if they are using a married filing separately status on their returns.

What is the tax refund for 2023?

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2022). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

What is SC classroom teacher expense credit?

Classroom Teachers Expenses Credit: Classroom teachers in public or private schools who are not reimbursed by their counties for teaching supplies and materials can claim up to $300 in this refundable credit on their tax year 2022 returns, which are the returns due in 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sc sch tc 18 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign sc sch tc 18 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit sc sch tc 18 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing sc sch tc 18.

How do I fill out sc sch tc 18 on an Android device?

Complete your sc sch tc 18 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is SC SCH.TC-18?

SC SCH.TC-18 is a tax form used in South Carolina for reporting certain tax credits related to taxes owed in the state.

Who is required to file SC SCH.TC-18?

Taxpayers who are claiming specific tax credits, such as the credits for taxes paid to other states or for a portion of their business taxes, are required to file SC SCH.TC-18.

How to fill out SC SCH.TC-18?

To fill out SC SCH.TC-18, taxpayers need to complete the required sections by providing their identification information, detailing the credits being claimed, and attaching any necessary documentation that supports the claim.

What is the purpose of SC SCH.TC-18?

The purpose of SC SCH.TC-18 is to allow taxpayers to correctly report and claim eligible tax credits, ensuring compliance with South Carolina tax laws.

What information must be reported on SC SCH.TC-18?

On SC SCH.TC-18, taxpayers must report their personal information, the specific tax credits being claimed, and any relevant financial details that validate the credits.

Fill out your sc sch tc 18 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Sch Tc 18 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.