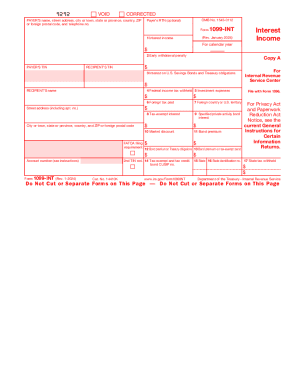

IRS 1099-INT 2017 free printable template

Show details

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scalable,

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-INT

How to edit IRS 1099-INT

How to fill out IRS 1099-INT

Instructions and Help about IRS 1099-INT

How to edit IRS 1099-INT

To edit the IRS 1099-INT form, you can use pdfFiller's tools which allow you to fill out, sign, and submit the form easily. Start by uploading your existing form to pdfFiller. Once uploaded, use the editing features to make the necessary changes. After making the edits, review all information for accuracy before saving or printing the final version.

How to fill out IRS 1099-INT

Filling out the IRS 1099-INT form involves a few key steps. First, ensure you have all essential information, including your name, address, and the recipient's details. Next, identify any interest payments made that need to be reported. Enter these amounts in the appropriate boxes on the form. Finally, review your entries for compliance with IRS requirements before submitting the form.

About IRS 1099-INT 2017 previous version

What is IRS 1099-INT?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-INT 2017 previous version

What is IRS 1099-INT?

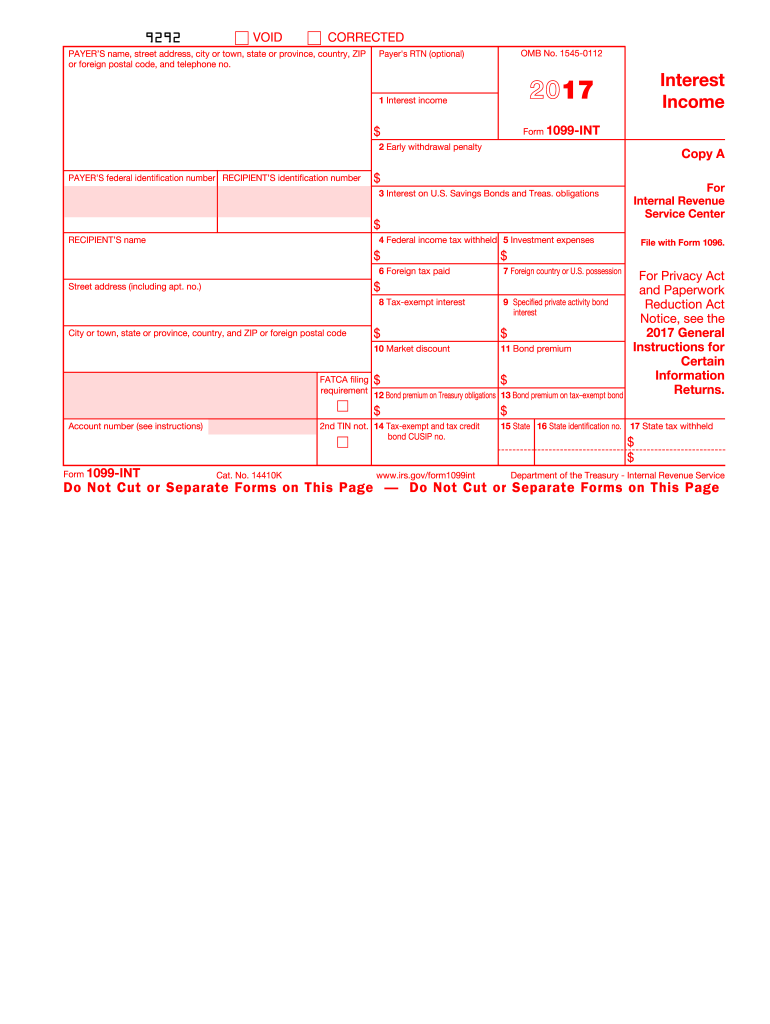

The IRS 1099-INT form is a tax document used to report interest income earned during the calendar year. Financial institutions, such as banks and credit unions, must issue this form to taxpayers who receive at least $10 in interest. The information provided helps both the taxpayer and the IRS track income for accurate tax reporting.

What is the purpose of this form?

The purpose of the IRS 1099-INT form is to report interest earnings from various sources. It ensures that taxpayers correctly declare interest income on their tax returns, aiding in compliance with tax obligations. This form also allows the IRS to verify that taxpayers report income accurately, as it matches the information provided by financial institutions.

Who needs the form?

Taxpayers who earn interest income from banks, savings accounts, or other financial institutions need the IRS 1099-INT form. Typically, anyone receiving more than $10 in interest during the year will receive this form. Additionally, businesses and organizations issuing interest payments are required to complete and send this form to the IRS and the recipient.

When am I exempt from filling out this form?

Individuals are exempt from filling out the IRS 1099-INT form if they do not receive any interest income during the year, or if the total interest earned is less than $10. Additionally, certain types of interest payments, such as those from tax-exempt bonds, may not require reporting on this form. However, it is essential to review IRS guidelines to ensure compliance.

Components of the form

The IRS 1099-INT form consists of several key components. These include the payer’s information, including name and Tax Identification Number (TIN), the recipient’s name and TIN, along with the total amount of interest paid. Additional boxes are available for reporting any penalties for early withdrawal, accrued interest on U.S. savings bonds, and foreign tax paid.

What are the penalties for not issuing the form?

Failing to issue the IRS 1099-INT form when required can lead to significant penalties. The IRS imposes fines, which can vary based on how late the form is filed, ranging from $50 to $270 per form. Furthermore, repeated non-compliance can escalate these penalties, and the IRS may pursue additional enforcement actions.

What information do you need when you file the form?

When filing the IRS 1099-INT form, you will need specific information, including both the payer's and recipient’s names, addresses, and TINs. Additionally, total interest payments and details regarding any withholdings are necessary. Ensure that all figures are accurate to avoid discrepancies and penalties.

Is the form accompanied by other forms?

The IRS 1099-INT form is typically filed alone, but it may need to be accompanied by other forms when submitted as part of a more extensive tax return. For businesses, a copy may be included with corporate tax returns, whereas individuals may file other related forms, depending on their overall tax situation.

Where do I send the form?

The IRS 1099-INT form must be sent to the IRS at the designated address, which varies depending on the state of the taxpayer. Additionally, a copy should be provided directly to the recipient. It’s crucial to check the IRS website for the most current mailing address to ensure compliance and avoid delays.

See what our users say

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.