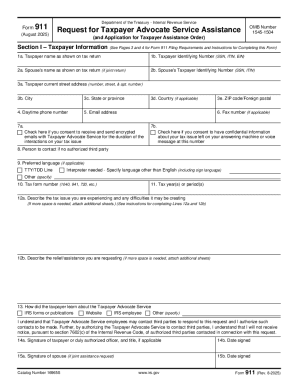

IRS 911 2015 free printable template

Instructions and Help about IRS 911

How to edit IRS 911

How to fill out IRS 911

About IRS previous version

What is IRS 911?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 911

What should I do if I realize I made a mistake after submitting form 911 2015-2019?

If you discover an error after submitting form 911 2015-2019, you should file an amended version of the form. Clearly indicate corrections and provide a brief explanation of the changes made. This process ensures that your information is accurate and up-to-date with the relevant authorities.

How can I check the status of my submitted form 911 2015-2019?

To check the status of your form 911 2015-2019, you may visit the IRS website or contact their customer service directly. Common e-file rejection codes can be found on their site, and if your submission is rejected, you will need to address the specific issue and resubmit your form promptly.

What privacy measures should I consider when filing form 911 2015-2019 electronically?

When e-filing form 911 2015-2019, ensure that you use secure and trusted software. Check if the e-filing platform complies with data security regulations to protect your personal information. Retain records of your submission for the required period to safeguard against future inquiries.

What if I need to file form 911 2015-2019 for a nonresident or foreign payee?

Filing form 911 2015-2019 for nonresidents or foreign payees requires attention to specific tax treaties and regulations that may apply. Ensure that all required information is accurately provided for these types of filers, as they often have unique requirements compared to domestic individuals.

Are there service fees associated with e-filing form 911 2015-2019?

There may be service fees when e-filing form 911 2015-2019 through certain online platforms. Review the pricing details before proceeding, as well as the policies regarding refunds if your submission is rejected. It's essential to choose a service that meets both your budget and filing needs.

See what our users say