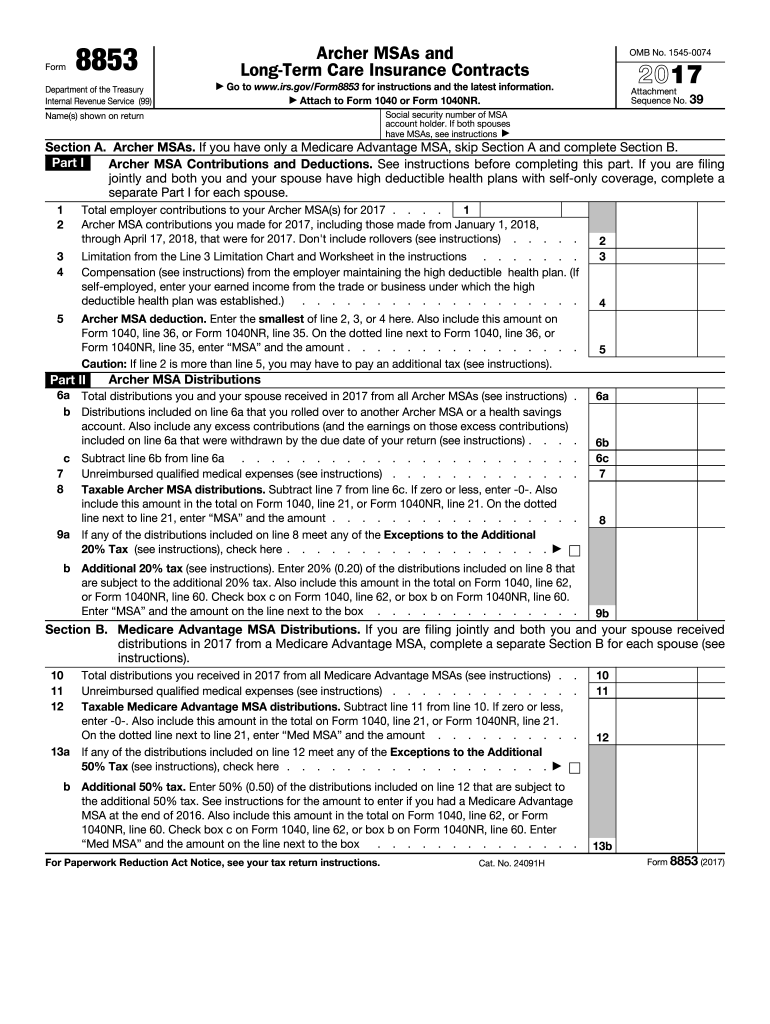

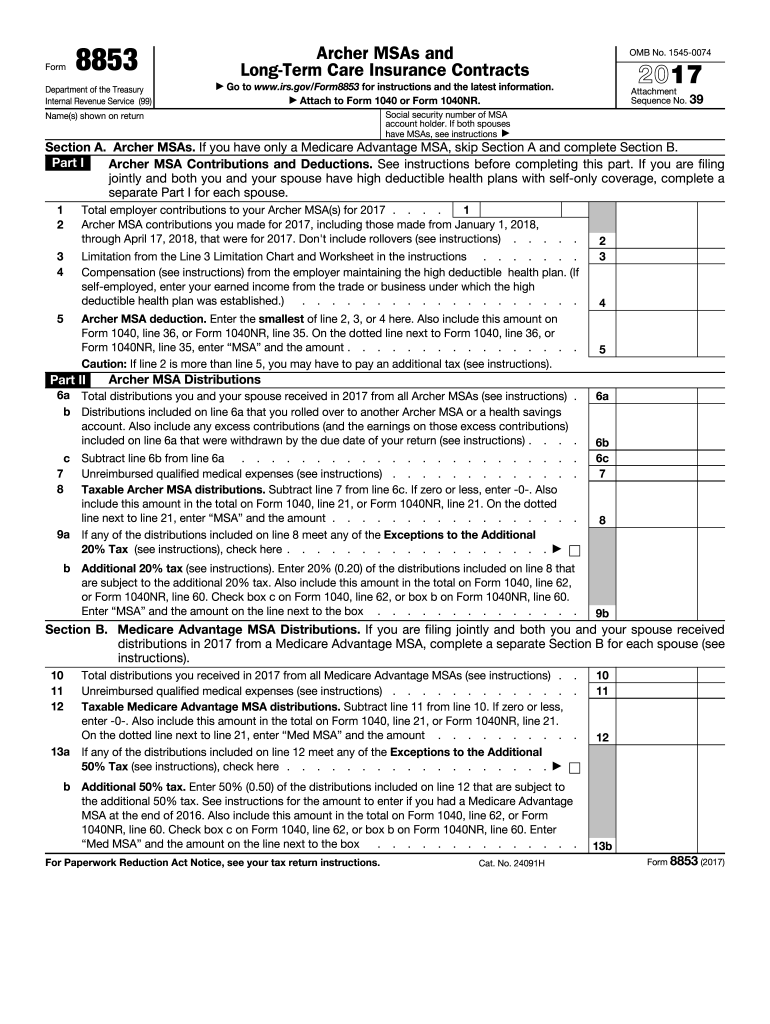

IRS 8853 2015 free printable template

Get, Create, Make and Sign IRS 8853

Editing IRS 8853 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8853 Form Versions

How to fill out IRS 8853

How to fill out IRS 8853

Who needs IRS 8853?

Instructions and Help about IRS 8853

As you can see from the sticker here we're at South old peachtree 717 841 alpha we're in the process of looking at the crossing here and Duluth Georgia and trying to show the cultural aspects of the line and potentially waiting for a train to pass through the date is currently the 5th of January 2015 we're looking north into the downtown district of Duluth Georgia with some of the signage and the signaling apparent at this time this is looking southbound towards Norcross and then Atlanta you

People Also Ask about

Do I need to fill out Form 8853?

What is the 8853 form used for?

What is Form 8853 used for?

Do I need to file Form 8853?

What is IRS Form 8853 used for?

Do I need to file 8853?

Do you report 1099 LTC on tax return?

Are long-term care and accelerated death benefits taxable?

Are long-term care insurance distributions taxable?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 8853 on a smartphone?

How do I fill out the IRS 8853 form on my smartphone?

How can I fill out IRS 8853 on an iOS device?

What is IRS 8853?

Who is required to file IRS 8853?

How to fill out IRS 8853?

What is the purpose of IRS 8853?

What information must be reported on IRS 8853?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.