IRS 8853 2025-2026 free printable template

Get, Create, Make and Sign IRS 8853

How to edit IRS 8853 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8853 Form Versions

How to fill out IRS 8853

How to fill out 2025 form 8853

Who needs 2025 form 8853?

Understanding the 2025 Form 8853: A Comprehensive Guide

Understanding Form 8853: An overview

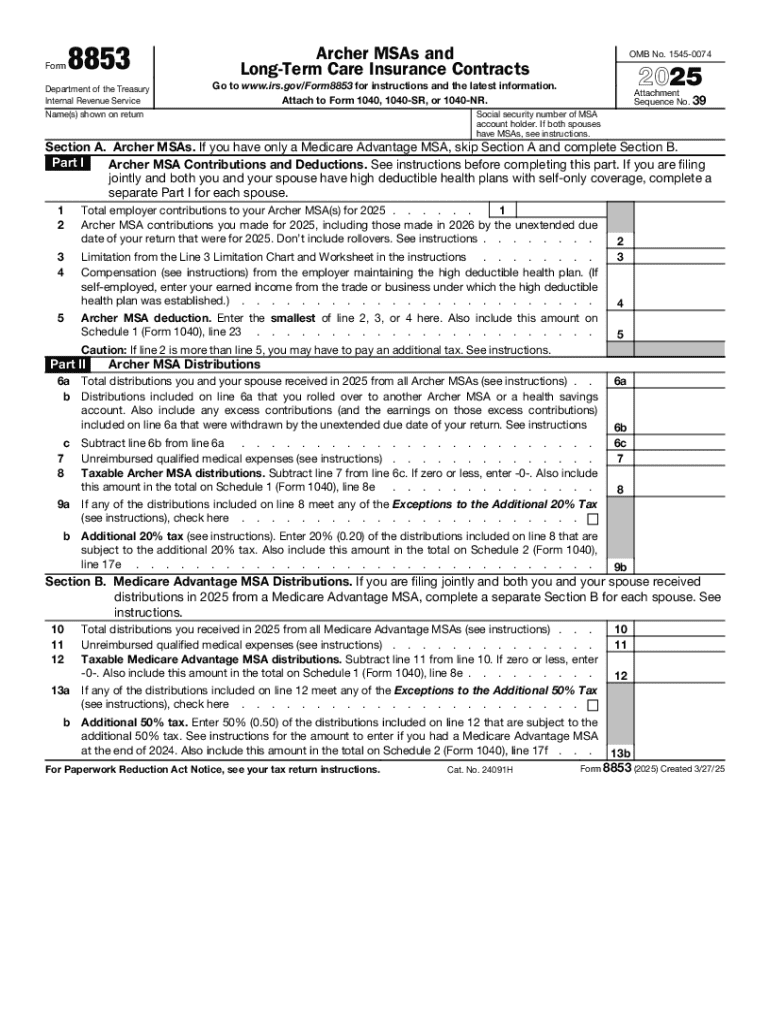

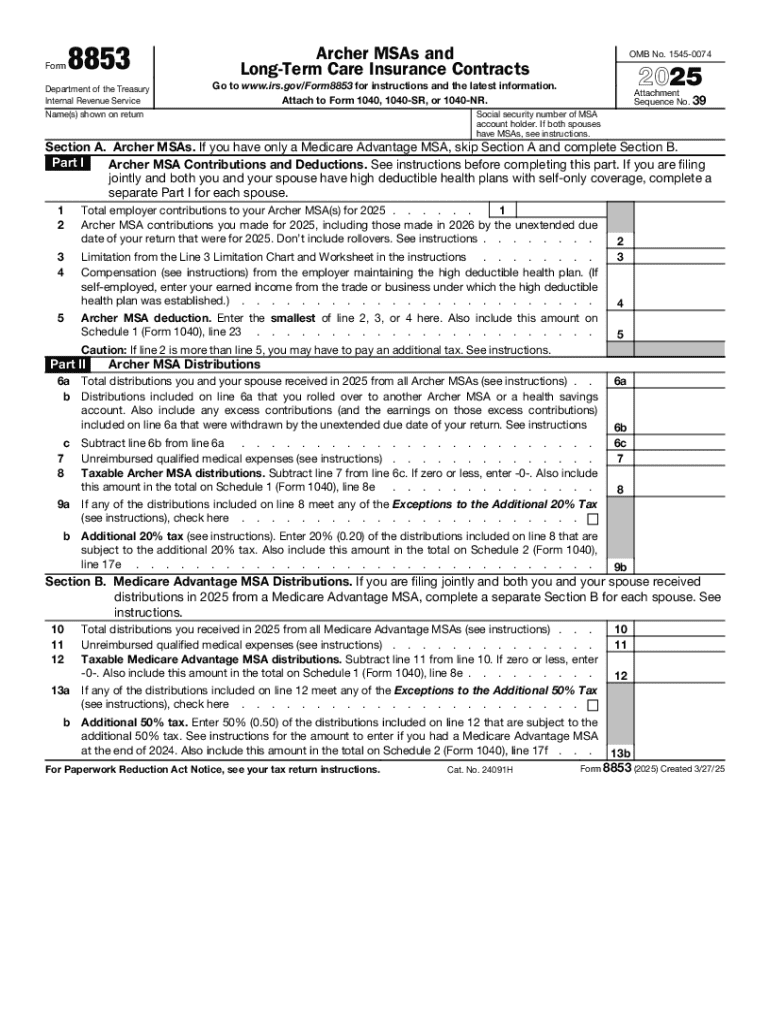

The 2025 form 8853 is an essential document for taxpayers utilizing medical savings accounts. Specifically designed to report contributions and withdrawals related to Archer Medical Savings Accounts (MSAs) and Health Savings Accounts (HSAs), this form helps ensure compliance with Internal Revenue Service (IRS) regulations. Understanding the intricacies of Form 8853 is crucial for individuals navigating the tax implications of their health savings strategies.

The primary purpose of Form 8853 is to provide the IRS with a comprehensive view of contributions made to MSAs and HSAs. Proper filing not only ensures accurate tax reporting but also allows taxpayers to claim deductions associated with these accounts. Individuals who have made contributions or withdrawals from either of these types of accounts during the tax year must file this form to avoid any potential pitfalls related to tax obligations.

Who needs to file Form 8853? Generally, taxpayers who have funded an Archer MSA or HSA must submit this form. This includes both individual account holders and employers who sponsor HSAs, making it imperative for anyone making use of these financial instruments to understand the filing requirements outlined by the IRS.

Key components of Form 8853

The 2025 form 8853 consists of several sections, each designed to capture key information regarding medical savings contributions and related transactions. Let's break down the major parts:

Within these sections, it's essential to grasp important definitions that impact your filing. For example, an 'eligible individual' is someone who meets specific criteria set by the IRS for making contributions. 'Qualified medical expenses' further define what types of expenditures can be covered through these accounts, reinforcing the importance of accurate record-keeping and thoughtful financial planning.

Step-by-step instructions for completing Form 8853

Filling out the 2025 form 8853 requires careful attention and preparation. Before diving into the details, gather the necessary information and documents, such as previous tax returns, records of contributions and withdrawals, and any pertinent health insurance documents. Creating a checklist of these materials can greatly enhance the efficiency of completing the form.

Here's a detailed walkthrough for each section of the form:

Taking meticulous care to follow these steps not only reflects well on your filing but also minimizes the risk of audit issues in the future.

Common mistakes to avoid when filing Form 8853

Navigating the financial landscape associated with medical savings accounts can be daunting, and some common errors could lead to complications with tax returns. Here are some critical mistakes to avoid when filing the 2025 form 8853:

Avoiding these common pitfalls will ease the tax filing process and ensure compliance with IRS regulations regarding the 2025 form 8853.

Examples and scenarios utilizing Form 8853

Understanding the application of the 2025 form 8853 can be significantly enhanced through real-world examples and scenarios. For instance, consider an example of a completed form, illustrating what accurate entries look like based on hypothetical contributions and withdrawals.

Imagine a taxpayer with both an Archer MSA and an HSA who has made various contributions throughout the year. They would need to provide details specific to each account while ensuring that their reporting reflects any interactions, including employer contributions and withdrawals for qualified medical expenses.

Frequently asked questions (FAQs) about Form 8853

As with any regulatory form, taxpayers often have lingering questions that can clarify confusion regarding the 2025 form 8853. Here are some of the most frequently asked questions:

Addressing these concerns can alleviate mental burdens and empower taxpayers to act confidently when managing their financial documentation.

Utilizing pdfFiller for Form 8853

When managing the 2025 form 8853, ease of use and accessibility are paramount. pdfFiller offers users a cloud-based solution that simplifies the process of creating, editing, and signing this tax document. The platform allows for seamless collaboration, ensuring users can efficiently manage their tax forms from anywhere.

The following steps outline how to effectively edit and sign Form 8853 using pdfFiller:

The advantages of using pdfFiller extend beyond mere convenience; the platform empowers users with comprehensive tools to simplify tax form management.

Best practices for managing tax forms and keeping records

Maintaining an effective organization strategy for your tax documents, including the 2025 form 8853, enables seamless access and minimizes the likelihood of delays or compliance issues. Here are some best practices to consider:

By implementing these best practices, individuals can manage their tax obligations with confidence and ease.

Final thoughts on Form 8853 for 2025

Navigating the complexities of tax forms like the 2025 form 8853 requires diligence and a proactive approach. Being informed about the requirements will empower individuals to file accurately and efficiently. As changes continue to occur within tax regulations, leveraging technology—especially platforms like pdfFiller—will simplify the management of these essential documents.

Ultimately, engaging with tax forms proactively, practicing organized document management, and utilizing the right tools will lead to a more streamlined experience during tax filing season. Equip yourself with the proper knowledge and resources to navigate Form 8853 and maximize the benefits associated with your medical savings accounts.

People Also Ask about

Do I need to fill out Form 8853?

What is the 8853 form used for?

What is Form 8853 used for?

Do I need to file Form 8853?

What is IRS Form 8853 used for?

Do I need to file 8853?

Do you report 1099 LTC on tax return?

Are long-term care and accelerated death benefits taxable?

Are long-term care insurance distributions taxable?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 8853?

How do I execute IRS 8853 online?

Can I sign the IRS 8853 electronically in Chrome?

What is 2025 form 8853?

Who is required to file 2025 form 8853?

How to fill out 2025 form 8853?

What is the purpose of 2025 form 8853?

What information must be reported on 2025 form 8853?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.