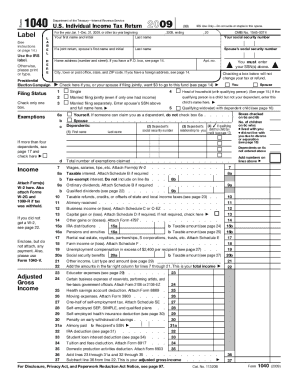

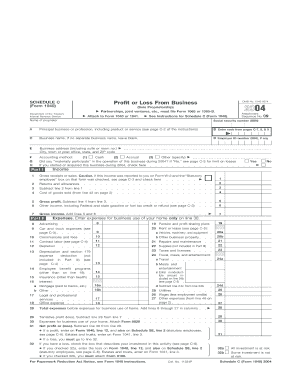

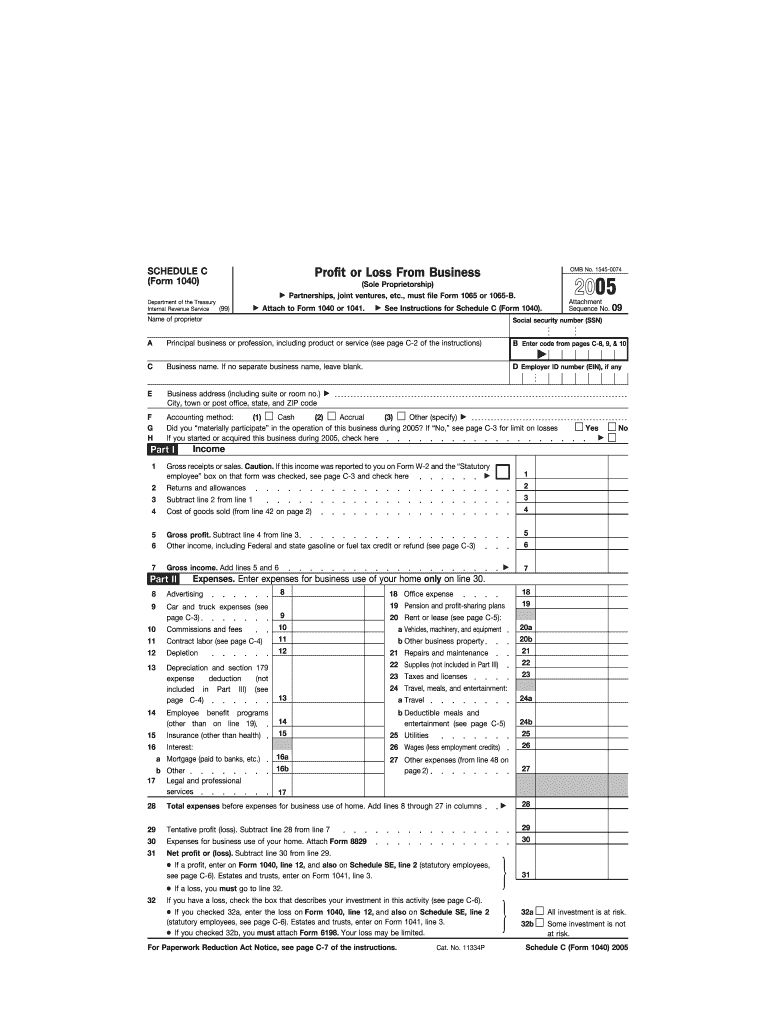

IRS 1040 - Schedule C 2005 free printable template

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

About IRS 1040 - Schedule C 2005 previous version

What is IRS 1040 - Schedule C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule C

What should I do if I realize I made an error on my 2005 1040 form after submitting it?

If you discover an error after filing your 2005 1040 form, you can submit an amended return using Form 1040X. Make sure to include any corrections and provide a clear explanation of the changes made. It's important to file the amendment as soon as possible to rectify any discrepancies.

How can I track the status of my 2005 1040 form after filing?

To track the status of your 2005 1040 form, you can use the IRS 'Where's My Refund?' tool, which gives updates on your refund status. Alternatively, you might receive notices from the IRS regarding the processing of your return, so keep an eye on your mail for any communications.

What privacy measures should I consider when submitting my 2005 1040 form online?

When submitting your 2005 1040 form online, ensure that you use secure connections and recognized software. Look for electronic signatures accepted by the IRS, and maintain your records in a secured location to prevent any unauthorized access to your sensitive information.

If I received an audit notice after filing my 2005 1040 form, how should I respond?

Upon receiving an audit notice related to your 2005 1040 form, carefully review the request and gather the necessary documentation to support your claims. It's advisable to respond in a timely manner and, if needed, consult a tax professional to assist you in navigating the audit process.

Are there common mistakes that filers make with the 2005 1040 form that I should be aware of?

Yes, common mistakes when filing the 2005 1040 form include incorrect Social Security numbers, omissions of income sources, and miscalculations of tax deductions. It's crucial to double-check all entries and consider using tax software or a professional to minimize errors.

See what our users say