IRS 2350 2015 free printable template

Show details

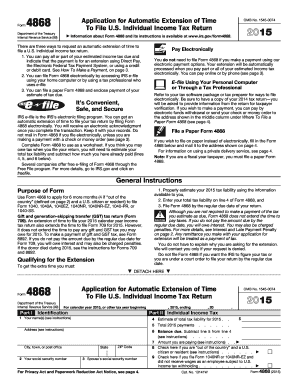

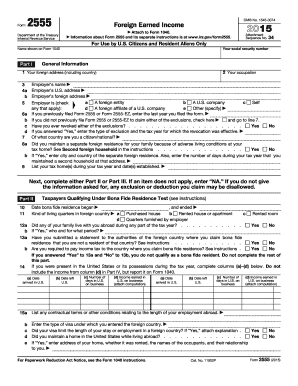

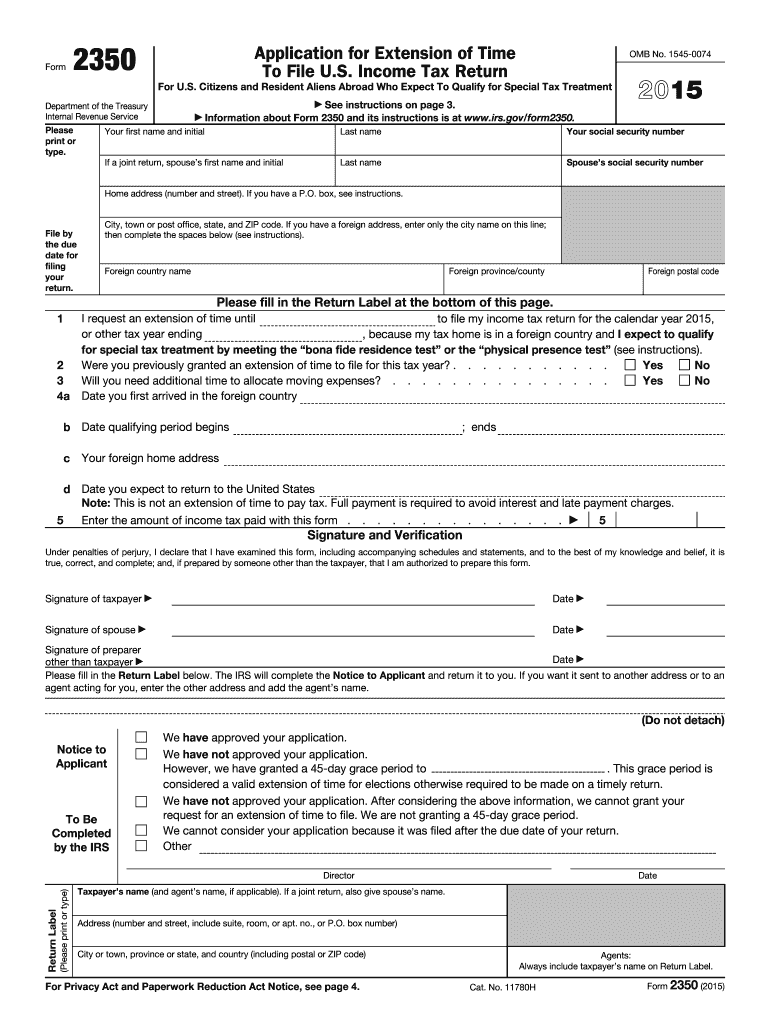

Make your check or money order payable to the United States Treasury. Do not send cash. Write your social security number daytime phone number and 2015 Form 2350 on your check or money order. 54 and other forms and publications at www.irs.gov/formspubs. When To File File Form 2350 on or before the due date of your Form 1040. For a 2015 calendar year return this is April 18 2016 April 19 2016 if you live in Maine or Massachusetts. For a 2015 calendar year return this is April 18 2016 April 19...2016 if you live in Maine or Massachusetts. However if you have 2 extra months to file your return because you were out of the country defined next file Form 2350 on or before June 15 2016. Agents Always include taxpayer s name on Return Label. Cat. No. 11780H Form 2350 2015 This page left blank intentionally Page 3 It s Convenient Safe and Secure IRS e-file is the IRS s electronic filing program. You can get an extension of time to file your tax return by filing Form 2350 electronically. Form...Application for Extension of Time To File U*S* Income Tax Return OMB No* 1545-0074 For U*S* Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment See instructions on page 3. Information about Form 2350 and its instructions is at www*irs*gov/form2350. Department of the Treasury Internal Revenue Service Please print or type. Your first name and initial Last name Your social security number If a joint return spouse s first name and initial Spouse s social security...number Home address number and street. If you have a P. O. box see instructions. File by the due date for filing your return* City town or post office state and ZIP code. If you have a foreign address enter only the city name on this line then complete the spaces below see instructions. Foreign country name Foreign province/county Foreign postal code Please fill in the Return Label at the bottom of this page. 4a I request an extension of time until to file my income tax return for the calendar...year 2015 or other tax year ending because my tax home is in a foreign country and I expect to qualify for special tax treatment by meeting the bona fide residence test or the physical presence test see instructions. Were you previously granted an extension of time to file for this tax year. Yes No Will you need additional time to allocate moving expenses. Date you first arrived in the foreign country b Date qualifying period begins c ends Your foreign home address d Date you expect to return...to the United States Note This is not an extension of time to pay tax. Full payment is required to avoid interest and late payment charges. Enter the amount of income tax paid with this form. Signature and Verification Under penalties of perjury I declare that I have examined this form including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete and if prepared by someone other than the taxpayer that I am authorized to prepare this...form* Signature of taxpayer Date Signature of spouse Signature of preparer other than taxpayer agent acting for you enter the other address and add the agent s name.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2350

How to edit IRS 2350

How to fill out IRS 2350

Instructions and Help about IRS 2350

How to edit IRS 2350

To edit IRS 2350, you can use pdfFiller's editing tools. Follow these steps to complete your form accurately:

01

Visit the pdfFiller website and search for IRS 2350.

02

Upload your IRS 2350 form in PDF format.

03

Utilize the editing features to fill out the required fields.

04

Save the changes once you have completed the form.

How to fill out IRS 2350

Filling out IRS 2350 involves several key steps to ensure accuracy and compliance with tax laws. Follow this guide to help you complete the form:

01

Begin by providing your name, address, and Social Security number at the top of the form.

02

Indicate the reason why you are requesting a filing extension.

03

Fill in the date for which you are requesting the extension.

04

Review all entries for accuracy before submitting the form.

About IRS 2 previous version

What is IRS 2350?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2350?

IRS 2350 is the official form used by U.S. taxpayers to request an extension of time to file certain tax returns. This form is specifically applicable if you are an expatriate or a U.S. citizen living abroad and need additional time to meet your tax obligations.

What is the purpose of this form?

The purpose of IRS 2350 is to provide taxpayers with an extension beyond the standard filing deadline. This is especially useful for individuals who may face challenges in gathering necessary information or meeting deadlines due to living outside the United States.

Who needs the form?

Taxpayers who qualify as U.S. citizens or resident aliens living abroad and who need extra time to file their tax return should use IRS 2350. This includes expatriates who may experience delays in accessing financial records or other documentation required for accurate tax filing.

When am I exempt from filling out this form?

You may be exempt from filing IRS 2350 if you are not required to file a tax return or if you are eligible for an automatic extension by other means, such as the standard six months issued by the IRS for U.S. residents.

Components of the form

IRS 2350 consists of several sections that must be filled out, including personal identification details, the reason for requesting the extension, and specific information regarding the tax year. Each section is crucial to ensure that the IRS processes your request accurately.

Due date

The due date for IRS 2350 typically aligns with the tax return filing deadline. For instance, if you are filing for the 2015 tax year, the form must be completed and submitted by the original due date of the tax return in order to avoid penalties.

What are the penalties for not issuing the form?

If you fail to submit IRS 2350 when required, you may incur penalties such as late fees or interest on any taxes owed. Additionally, not filing could result in an IRS audit or other enforcement actions.

What information do you need when you file the form?

When filing IRS 2350, collect all necessary information including your Social Security number, details of your income, and the reasons for requesting an extension. Accurate and complete information is vital to avoid complications.

Is the form accompanied by other forms?

IRS 2350 is usually submitted alongside your tax return. Depending on your financial situation or the type of tax return you are filing, other forms may be required to complement your submission.

Where do I send the form?

After completing IRS 2350, it should be mailed to the address specified in the form's instructions. This may vary depending on your location, so ensure you check the latest guidelines for submission.

See what our users say