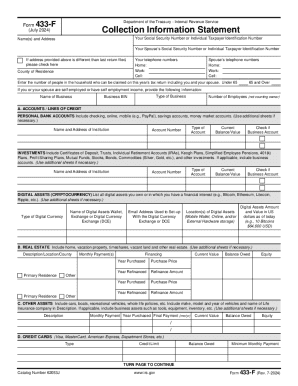

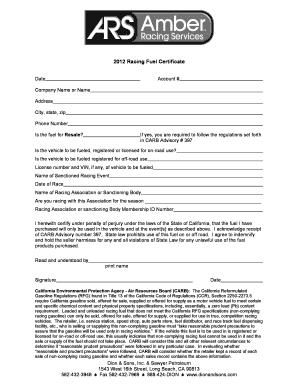

IRS 433-F 2013 free printable template

Instructions and Help about IRS 433-F

How to edit IRS 433-F

How to fill out IRS 433-F

About IRS 433-F 2013 previous version

What is IRS 433-F?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

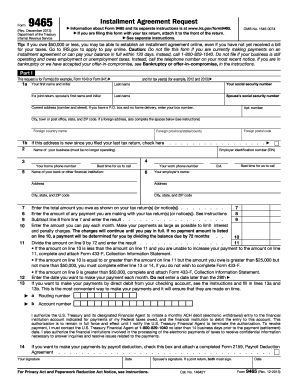

Is the form accompanied by other forms?

FAQ about IRS 433-F

What should I do if I discover an error after submitting my richfield college online application?

If you find a mistake in your richfield college online application after submission, you can typically submit an amended application to correct the errors. Be sure to follow the specific guidelines provided by the college for amendments and keep records of your submissions.

How can I check the status of my richfield college online application?

To verify the status of your richfield college online application, visit the college's application portal. You may also receive email notifications regarding the processing of your application and any issues that may arise during the review process.

What should I do if my richfield college online application is rejected?

If your richfield college online application is rejected, carefully read the rejection notice to understand the reasons. Depending on the circumstances, you may have the opportunity to correct any issues and resubmit your application, so be sure to consult the college’s guidelines.

Are e-signatures accepted for the richfield college online application?

Yes, e-signatures are typically accepted for the richfield college online application. However, it’s essential to confirm the specific requirements stated by the college to ensure compliance with their application processes.

See what our users say