Get the free ftb 2924

Show details

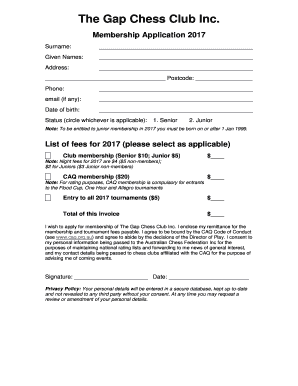

Print and Reset Form STATE OF CALIFORNIA FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA 942574040 Reset Form Reasonable Cause Business Entity Claim for Refund Complete the information below to request

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb 2924

Edit your ftb 2924 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 2924 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 2924 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ftb 2924. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb 2924

How to fill out CA FTB 2924

01

Obtain a copy of CA FTB 2924 form from the California Franchise Tax Board website.

02

Fill in your name and Social Security Number (or Individual Taxpayer Identification Number) at the top of the form.

03

Provide your current mailing address in the designated section.

04

Indicate the tax year for which you are filing the form.

05

Complete the section related to the payments made or taxes withheld.

06

Review all entered information for accuracy.

07

Sign and date the form before submission.

08

Submit the completed form according to the instructions provided on the form.

Who needs CA FTB 2924?

01

Individuals or entities who are applying for or claiming a refund on California state taxes.

02

Taxpayers who have made overpayments or are eligible for credits that need to be documented.

03

Any person or business that receives correspondence from the Franchise Tax Board requesting this form.

Fill

form

: Try Risk Free

People Also Ask about

How to avoid California tax underpayment penalty?

If you filed your income tax return or paid your income taxes after the due date, you received a penalty. To avoid penalties in the future, file or pay by the due date.

What is a reasonable cause for late filing?

Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What happens if you don't pay $800 California LLC tax?

California Franchise Tax is the annual tax for conducting business in California. For noncorporate entities, it is a flat fee of $800. For corporate entities, the fee is a minimum of $800. Failure to pay the franchise tax will result in a minimum penalty of 5% and a maximum penalty of 25% of the unpaid tax.

Do you have to pay the $800 California LLC fee?

If you start to operate an LLC business in California, you need to pay the first $800 fee in the 4th month after the approval of your LLC. After that, you will also need to pay another $800 in annual tax due date on April 15th every year. To pay that, you need to file Form 3522, called the annual LLC Tax Voucher.

Do you have to pay the $800 California LLC fee the first year?

If you start to operate an LLC business in California, you need to pay the first $800 fee in the 4th month after the approval of your LLC. After that, you will also need to pay another $800 in annual tax due date on April 15th every year. To pay that, you need to file Form 3522, called the annual LLC Tax Voucher.

Why is the franchise tax board charging me?

We impose a fee on individuals or businesses to cover costs to collect their delinquent taxes from the Federal Treasury Offset Program 29.

What is a good reasonable cause for penalty abatement?

Failure to File or Pay Penalties Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What is reasonable cause for FTB penalty abatement?

Penalties eligible for One-Time Penalty Abatement include: Failure to File - You did not pay by the due date of the tax return and did not file your tax return by the extended due date. Failure to Pay - You did not pay the entire amount due by your payment due date.

What is a reasonable cause for penalty abatement California?

CA FTB Penalty Abatement The FTB defines “reasonable cause” to mean that the taxpayer exercised ordinary business care and prudence in meeting their tax obligations but failed to comply.

How do I claim my FTB refund?

Provide us a written statement with supporting documents listing the facts to support your claim. Use one of the following forms to file a reasonable cause claim for refund: Reasonable Cause - Individual and Fiduciary Claim for Refund (FTB 2917) Reasonable Cause - Business Entity Claim for Refund (FTB 2924)

How to avoid California underpayment penalty?

If you filed your income tax return or paid your income taxes after the due date, you received a penalty. To avoid penalties in the future, file or pay by the due date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ftb 2924?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ftb 2924 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit ftb 2924 on an Android device?

You can make any changes to PDF files, such as ftb 2924, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out ftb 2924 on an Android device?

Use the pdfFiller mobile app and complete your ftb 2924 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA FTB 2924?

CA FTB 2924 is a form used by the California Franchise Tax Board (FTB) to report an individual's or entity's tax information, specifically related to California income tax obligations.

Who is required to file CA FTB 2924?

Individuals or entities that have certain types of income or tax liabilities in California may be required to file CA FTB 2924, particularly those who meet specific thresholds in income or have tax credits to claim.

How to fill out CA FTB 2924?

To fill out CA FTB 2924, you need to provide personal or entity information, details about income earned, deductions claimed, and any applicable tax credits. Instructions provided on the form should be followed carefully.

What is the purpose of CA FTB 2924?

The purpose of CA FTB 2924 is to collect necessary tax information to determine an individual's or entity's tax liabilities for the state of California, ensuring compliance with state tax laws.

What information must be reported on CA FTB 2924?

The information that must be reported on CA FTB 2924 includes identification details, reportable income, deductions, tax credits, and any other relevant financial data necessary for tax assessment.

Fill out your ftb 2924 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 2924 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.