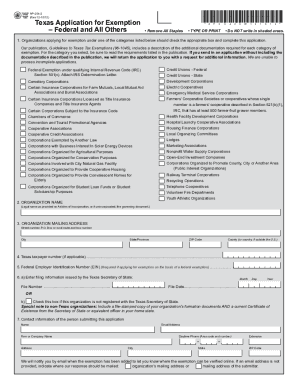

TX Comptroller AP-204 2015 free printable template

Show details

Please use this application Form AP-204 to apply for exemption if you are applying on the basis of the organization s designation as a qualifying 501 c organization or applying on any basis OTHER THAN as a religious charitable educational organization or a homeowners association. Separate applications are available for organizations applying for exemption as a religious Form AP-209 charitable Form AP-205 educational Form AP-207 or homeowners association Form AP-206. The applications laws...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-204

Edit your TX Comptroller AP-204 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-204 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller AP-204 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Comptroller AP-204. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-204 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-204

How to fill out TX Comptroller AP-204

01

Obtain the TX Comptroller AP-204 form from the Texas Comptroller's website or a local office.

02

Fill in the applicant's name in the appropriate field.

03

Provide the applicant's address and contact information.

04

Indicate the type of exemption being requested.

05

Enter the description of the property for which the exemption is sought.

06

Include any relevant identification numbers, such as a driver's license or tax ID.

07

Sign and date the form at the bottom.

Who needs TX Comptroller AP-204?

01

Individuals or businesses seeking a tax exemption in Texas.

02

Property owners applying for specific exemptions related to property taxes.

03

Organizations that qualify for tax exemptions under Texas law.

Fill

form

: Try Risk Free

People Also Ask about

Does Texas have a tax exemption certificate?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

What tax exemptions are available in Texas?

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.

How do I get a sales tax exemption certificate in Texas?

To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

How do you qualify for Texas exemptions?

You are eligible for a homestead exemption if you (1) own your home (partial ownership counts), (2) the home is your principal residence, and (3) you have a Texas driver's license or Texas-issued personal identification certificate (your I.D. card address must match your principal residence address).

What qualifies for sales tax exemption in Texas?

What purchases are exempt from the Texas sales tax? Clothing. 6.25% Groceries. EXEMPT. Prepared Food. 6.25% Prescription Drugs. EXEMPT. OTC Drugs. EXEMPT.

What is a Texas exemption certificate?

Exemption Certificates. (a) Definition. Exemption certificate--A document that, when properly executed, allows the tax-free purchase of an item that would otherwise be subject to tax.

Who qualifies for property tax exemption in Texas?

To qualify, a home must meet the definition of a residence homestead: The home's owner must be an individual (for example: not a corporation or other business entity) and use the home as his or her principal residence on Jan. 1 of the tax year. An age 65 or older or disabled exemption is effective as of Jan.

How to get exempt from COVID vaccine in Texas?

Step 1: Please submit the HCPC COVID-19 Vaccination Exemption Request Form. Step 2: Diversity & Equal Opportunity will review your request and provide you with notice of approval or denial of your request.

Can a child attend school without vaccines in Texas?

(a) The law requires that students be fully vaccinated against the specified diseases. A student may be enrolled provisionally if the student has an immunization record that indicates the student has received at least one dose of each specified age-appropriate vaccine required by this rule.

Does Texas have a sales tax exemption form?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

How do I get a Texas sales tax exemption certificate?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What exemptions are allowed in Texas?

Texas Personal Property Exemptions Home furnishings, including family heirlooms. Clothing and food. Farming and ranching vehicles and implements. Tools of the trade, books, equipment, commercial boat, or vehicles. Jewelry is limited to $12,500 for a single filer and $25,000 for a family. Two firearms.

Do I need a sales tax exemption certificate in Texas?

Texas Sales Tax Exemption / Resale Forms. If you are a retailer making purchases for resale, or need to make a purchase that is exempt from the Texas sales tax, you need the appropriate Texas sales tax exemption certificate before you can begin making tax-free purchases.

How do I get an exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX Comptroller AP-204 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your TX Comptroller AP-204 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute TX Comptroller AP-204 online?

pdfFiller makes it easy to finish and sign TX Comptroller AP-204 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit TX Comptroller AP-204 on an Android device?

You can edit, sign, and distribute TX Comptroller AP-204 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is TX Comptroller AP-204?

TX Comptroller AP-204 is a form used by the Texas Comptroller of Public Accounts for reporting sales and use tax due from businesses operating in Texas.

Who is required to file TX Comptroller AP-204?

Businesses in Texas that make sales of taxable goods or services and are liable for collecting sales and use tax are required to file the TX Comptroller AP-204 form.

How to fill out TX Comptroller AP-204?

To fill out TX Comptroller AP-204, taxpayers must provide their business identification information, detail the sales made, calculate the total tax owed, and submit the form along with payment for the taxes due.

What is the purpose of TX Comptroller AP-204?

The purpose of TX Comptroller AP-204 is to report and remit the sales and use tax collected by businesses to the Texas Comptroller’s office.

What information must be reported on TX Comptroller AP-204?

TX Comptroller AP-204 requires reporting information such as total sales, exempt sales, taxable sales, the rate of tax applied, and the total tax collected for the reporting period.

Fill out your TX Comptroller AP-204 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-204 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.