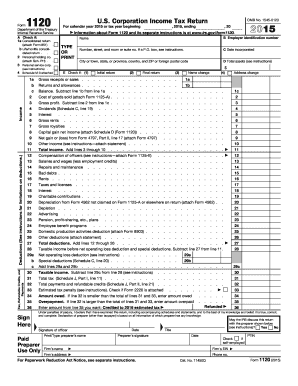

CT DRS CT-1120 2015 free printable template

Get, Create, Make and Sign CT DRS CT-1120

Editing CT DRS CT-1120 online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-1120 Form Versions

How to fill out CT DRS CT-1120

How to fill out CT DRS CT-1120

Who needs CT DRS CT-1120?

Instructions and Help about CT DRS CT-1120

In red three we are looking at regular US corporations or as we call them C corporations now all us C corporations they need to file form 11 ready with the IRS so from 1120 that's the U.S. corporation income tax return and I got an overview of this form right here on my board, so it starts with all the income of the C corporation totaling up, and then you can allow them a lot of deductions, so we have got ordinary deductions, so these are deductions for the trade of business expenses during the year let's say the C corporation has done some charity during the year they're going to be allowed deductions for the charitable contributions, but this one is going to be subject to a 10% limit, and we'll talk about that when we get there let's say the C corporation has domestic US production activities, and it's one of those eligible businesses they could take a domestic production activities deduction let's talk about NOT or net operating loss deduction now if you remember we talked about net operating losses also in reg one when we're talking about individuals and I told you for net operating losses for a particular year you can carry it back two years or carried forward 20 years same rules for corporations so if a corporation has a net operating loss it can either carry back or carried forward which means a net operating loss for a particular year could be deducted on tax returns of other years with a back or forward so let's say if you're looking at from 1124 particular year this is the net operating loss that's been carried over from other years to be deducted on this tax return, and then we will talk about a special deduction and this passion deduction is dividend received deduction so on the dividend income of the C corporation is included here in total income now a lot of the dividend may be eligible for a dividend the deduction the special deduction that I am talking about, and we cover this in a lot of detail when you get there so as you can understand you got total income less all these deductions gets you to taxable income then we can look at the corporation tax rates and the C corporation they would be paying income taxes to Uncle Sam so the way it works let me try to put it here, so we're looking at a C Corp which is got total income of let's say five million dollars during the year call it five thousand five thousand and three zeroes, and they've got all these deductions of let's say four million dollars the taxable income let's say is a million dollars and let's say the C cop they bought three shareholders so let me draw those three shareholders, so you got let's say x y and z and all these let's say are individuals so the C corporation they file form 1120 with the IRS so this was form 1120 and on that they would have paid taxes on these million dollars the differed so if their total income was five million dollars the deductions were four million dollars taxable income of a million dollars let's say they pay taxes a 30-person to keep it...

People Also Ask about

Do I need to file a form 1120 if the business has no income?

Where can I get hard copies of tax forms?

What address do I send mail to IRS?

Can I mail my corporate tax return?

How to file CT-1120 online?

Does CT have an efile form?

Can I mail form 1120?

Who must file CT-1120?

What is a CT-1120?

Can I file form 1120 electronically?

Who is required to file an 1120?

What is a CT-1120 form?

Can I file my CT income tax online?

What type of company is 1120?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT DRS CT-1120 online?

How do I edit CT DRS CT-1120 in Chrome?

Can I sign the CT DRS CT-1120 electronically in Chrome?

What is CT DRS CT-1120?

Who is required to file CT DRS CT-1120?

How to fill out CT DRS CT-1120?

What is the purpose of CT DRS CT-1120?

What information must be reported on CT DRS CT-1120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.