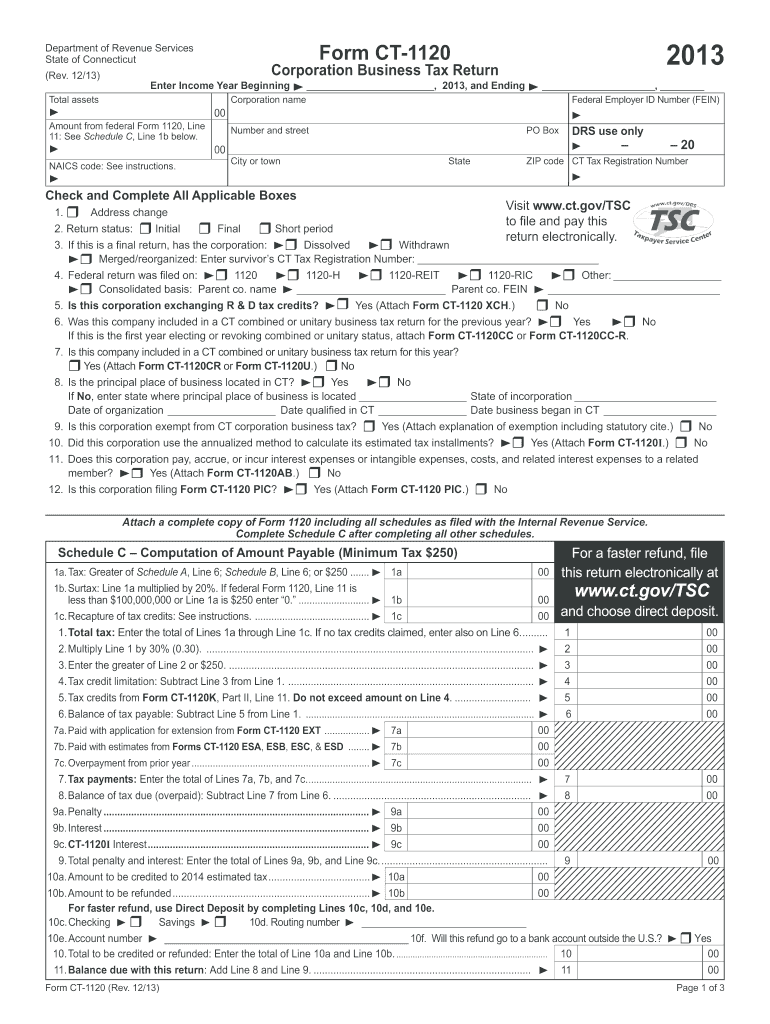

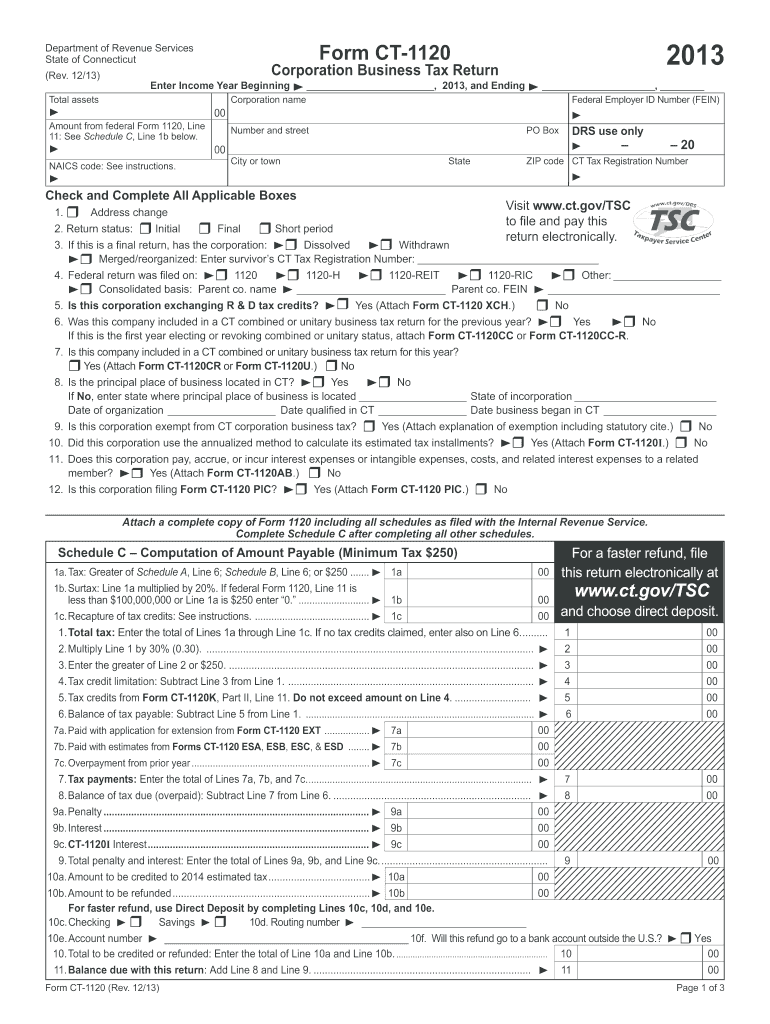

CT DRS CT-1120 2013 free printable template

Get, Create, Make and Sign CT DRS CT-1120

How to edit CT DRS CT-1120 online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-1120 Form Versions

How to fill out CT DRS CT-1120

How to fill out CT DRS CT-1120

Who needs CT DRS CT-1120?

Instructions and Help about CT DRS CT-1120

Laws calm legal forms guide form 1120 is a United States Internal Revenue Service tax form used for corporate tax returns of companies claiming C corporation tax designation the form 1120 can be obtained through the IRS s website or by obtaining the documents through a local tax office the tax form is to be filed by a corporate taxpayer in order to calculate corporate taxes for the year first provide the name of the corporation along with contact information in the top box of the form provide the employer identification number date of incorporation and total assets as required under the tax codes record the gross income of the corporation in lines one through ten include gross receipts goods sold gross profits dividends interests rents royalties capital gains net gains and any other income sources add all of this and put the total amount of gross income in line 11 next list all deductions from the year in lines 12 through 28 add the total amount of deductions and put that amount in line 29 calculate the total taxes paid and tax credits in lines 30 through 35 to calculate your tax obligation or tax refund the officer of the corporation can sign the tax return and the preparer must provide their information in the final box additional schedules will be required for attachment with your form 1120 if your company is deducting the cost of goods sold from gross income these amounts must be accounted for in Schedule A if dividends or special deductions have been claimed on the form 1120 they must be listed in Schedule C for the compensation of corporate officers these amounts must be accounted in Schedule E additionally schedules J and K must be attached indicating the accounting method used by the corporation and additional information that can affect the corporate tax rate fill out these schedules and attach them to your form 1120 finally attach schedules L M 1 and M 2 if you need to supply a balance sheet with your tax return form reconcile income lost or an analysis of unappropriated retained earnings once completed your form is ready for filing with the IRS retain a copy for the corporation's record to watch more videos please make sure to visit laws calm

People Also Ask about

What is CT-1120 form?

What is a CT 1065?

Does Connecticut tax partnerships?

Who must file a Connecticut partnership return?

What is the penalty for filing CT-1120 late?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS CT-1120 to be eSigned by others?

Can I create an electronic signature for the CT DRS CT-1120 in Chrome?

How do I fill out CT DRS CT-1120 on an Android device?

What is CT DRS CT-1120?

Who is required to file CT DRS CT-1120?

How to fill out CT DRS CT-1120?

What is the purpose of CT DRS CT-1120?

What information must be reported on CT DRS CT-1120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.