VT SUT-451 2015 free printable template

Show details

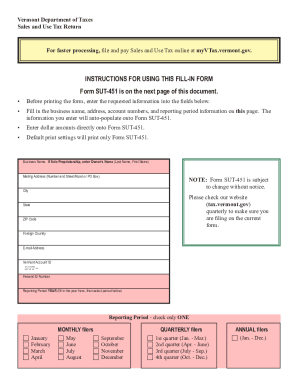

- Dec. ANNUAL filers c Jan. - Dec. Save and go to Important Printing Instructions Vermont Department of Taxes Phone 802 828-2551 VT Form SUT-451 PO Box 547 Montpelier VT 05601-0547 154511100 Tax returns must be filed even if no tax is due. Info will auto-populate onto Form SUT-451 page 2 of this document. Dollar amounts should be entered directly on the form page 2 of this document. Default print settings will print only page 2 Form SUT-451. Business Name. If Sole Proprietorship enter Owner s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VT SUT-451

Edit your VT SUT-451 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT SUT-451 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VT SUT-451 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VT SUT-451. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT SUT-451 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT SUT-451

How to fill out VT SUT-451

01

Begin by downloading the VT SUT-451 form from the Vermont Department of Taxes website.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Provide details of the income that you are reporting, including any relevant dates and amounts.

04

Indicate any deductions or credits you are claiming by following the instructions provided on the form.

05

Review the completed form for accuracy to avoid any errors.

06

Sign and date the form where indicated.

07

Submit the form electronically or send it via mail to the specified address in the instructions.

Who needs VT SUT-451?

01

Individuals or businesses in Vermont who need to report specific tax information.

02

Taxpayers who are claiming certain deductions or credits as outlined in the form.

03

Anyone who has received income that needs to be reported to the Vermont Department of Taxes.

Instructions and Help about VT SUT-451

Fill

form

: Try Risk Free

People Also Ask about

What is the first time penalty abatement in Vermont?

First Time Abatement (Removal) of Tax Penalties You may be able to get tax penalties removed if: This is the first time in three years you have had a penalty because of late filing or payment. You have filed all required tax returns. You have paid or made arrangements with the IRS to pay the taxes you owe.

Does Vermont have a state tax form?

To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed. The Department of Taxes recommends e-filing your federal and state taxes using commercial vendor software. The software will walk you through the process of completing federal and Vermont returns.

Where can tax forms be obtained?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What is the capital gains exclusion in Vermont?

The Percentage Exclusion for capital gains is capped at $350,000. This means that any gain above $875,000 will be taxed at standard income tax rates.

Do I need to collect sales tax Vermont?

If your business is selling tangible personal property (TPP) that is taxable in Vermont, you must charge, collect, and remit sales tax to the Vermont Department of Taxes. Be sure to post your Vermont license authorizing you to collect sales tax in a place where customers can see it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete VT SUT-451 online?

Completing and signing VT SUT-451 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my VT SUT-451 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your VT SUT-451 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete VT SUT-451 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your VT SUT-451. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

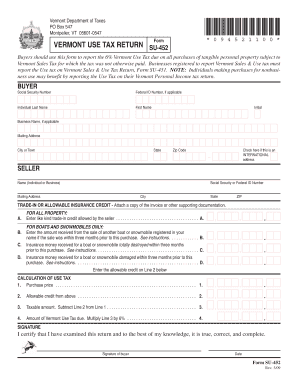

What is VT SUT-451?

VT SUT-451 is a form used in Vermont's taxation system for the collection of sales and use tax.

Who is required to file VT SUT-451?

Businesses and individuals who make taxable sales or purchases in Vermont are required to file VT SUT-451.

How to fill out VT SUT-451?

To fill out VT SUT-451, report your taxable sales, complete all required sections accurately, and submit the form by the specified due date.

What is the purpose of VT SUT-451?

The purpose of VT SUT-451 is to report sales and use tax liabilities and remit the collected tax to the state.

What information must be reported on VT SUT-451?

VT SUT-451 requires reporting of gross sales, exempt sales, taxable purchases, and the total sales and use tax collected.

Fill out your VT SUT-451 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT SUT-451 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.