VT SUT-451 2020 free printable template

Show details

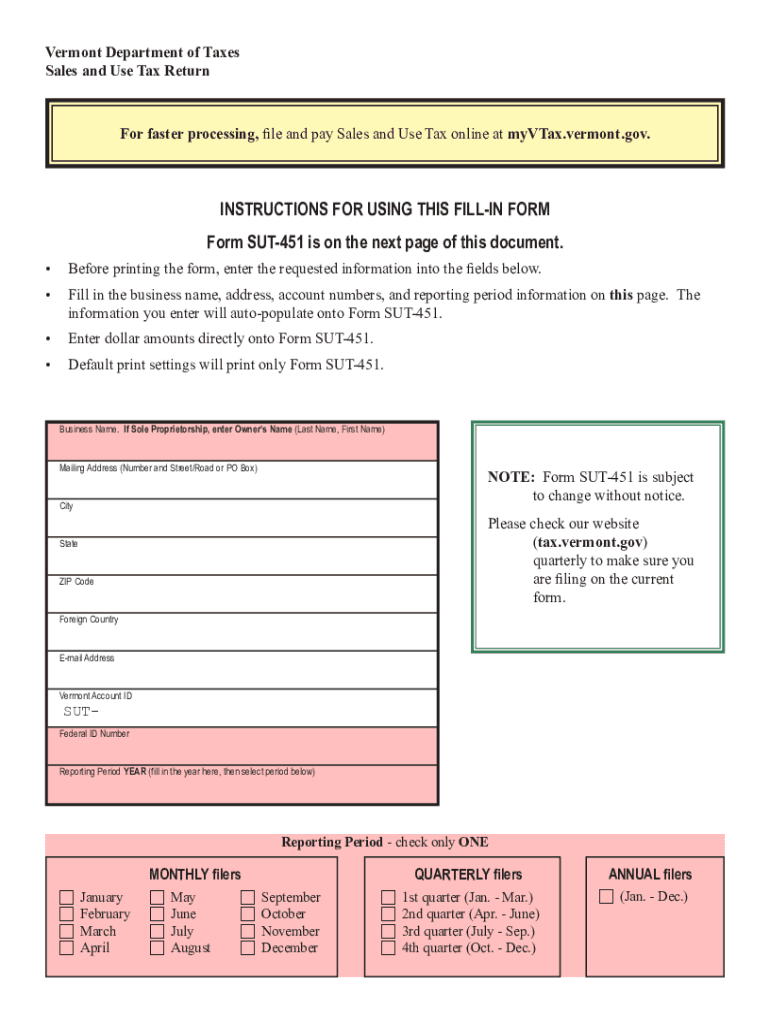

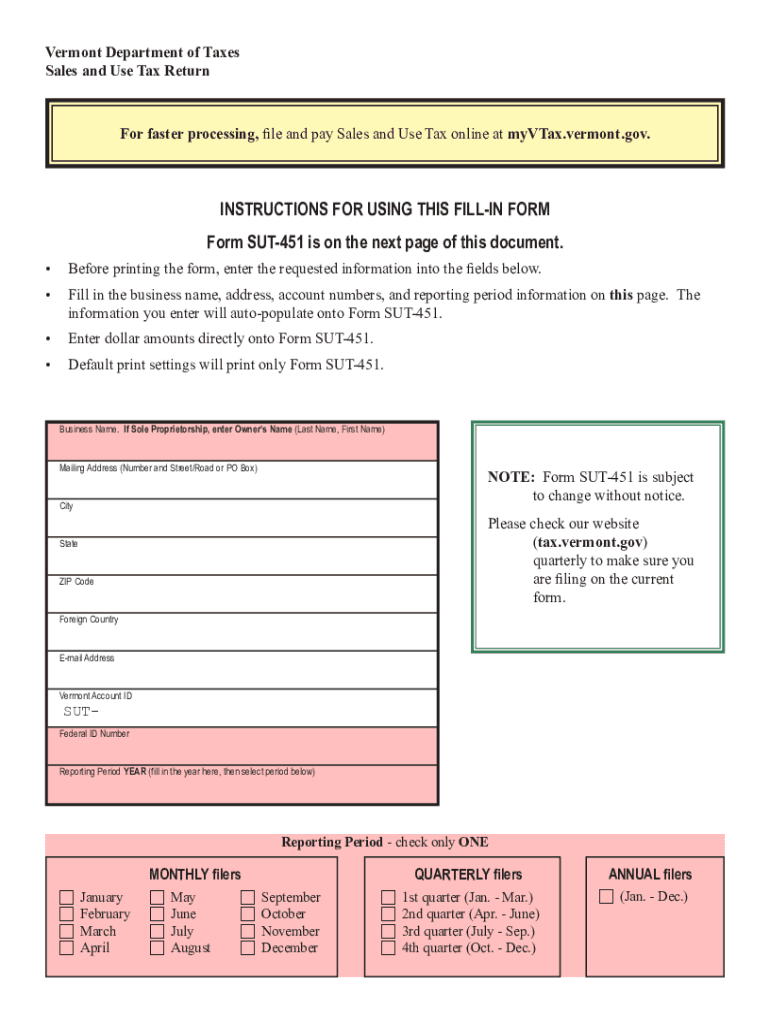

- Dec. ANNUAL filers c Jan. - Dec. Save and go to Important Printing Instructions Vermont Department of Taxes Phone 802 828-2551 VT Form SUT-451 PO Box 547 Montpelier VT 05601-0547 154511100 Tax returns must be filed even if no tax is due. Info will auto-populate onto Form SUT-451 page 2 of this document. Dollar amounts should be entered directly on the form page 2 of this document. Default print settings will print only page 2 Form SUT-451. Business Name. If Sole Proprietorship enter Owner s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VT SUT-451

Edit your VT SUT-451 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT SUT-451 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VT SUT-451 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit VT SUT-451. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT SUT-451 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT SUT-451

How to fill out VT SUT-451

01

Gather all necessary financial documents and information related to your sales and use tax exemptions.

02

Fill out your business information at the top of the form, including your name, address, and tax identification number.

03

In the appropriate sections, list the types of purchases for which you are claiming an exemption.

04

Provide details about each item or service purchased, including dates and amounts.

05

Ensure that you have the correct exemption certificate numbers and details, if applicable.

06

Review the completed form to check for accuracy and completeness.

07

Submit the form to the relevant tax authority by the specified deadline.

Who needs VT SUT-451?

01

Businesses or individuals who are eligible for sales and use tax exemptions in Vermont.

02

Tax professionals assisting clients with claiming sales and use tax exemptions.

03

Entities making purchases that qualify for exemption under Vermont law.

Instructions and Help about VT SUT-451

Fill

form

: Try Risk Free

People Also Ask about

Who has to file a Vermont income tax return?

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

Do I need to collect sales tax Vermont?

If your business is selling tangible personal property (TPP) that is taxable in Vermont, you must charge, collect, and remit sales tax to the Vermont Department of Taxes. Be sure to post your Vermont license authorizing you to collect sales tax in a place where customers can see it.

Do non residents have to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

What is the long term capital gains tax in Vermont?

Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion. Since 2014, taxpayers have been able to claim an exclusion of up to $5,000 on their federal net adjusted capital gains.

What is the capital gains exclusion in Vermont?

The Percentage Exclusion for capital gains is capped at $350,000. This means that any gain above $875,000 will be taxed at standard income tax rates.

Does Vermont have a non resident return?

Nonresidents with a filing requirement will file Form IN-111, Vermont Income Tax Return and Schedule IN-113, Income Adjustment Calculations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VT SUT-451 in Gmail?

VT SUT-451 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify VT SUT-451 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including VT SUT-451, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the VT SUT-451 in Gmail?

Create your eSignature using pdfFiller and then eSign your VT SUT-451 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is VT SUT-451?

VT SUT-451 is a sales and use tax return form used in Vermont to report and remit sales and use taxes.

Who is required to file VT SUT-451?

Businesses that collect sales tax from customers or owe use tax on taxable purchases are required to file VT SUT-451.

How to fill out VT SUT-451?

To fill out VT SUT-451, taxpayers must provide their business information, report total sales and taxable sales, calculate the sales tax due, and submit the form along with payment if applicable.

What is the purpose of VT SUT-451?

The purpose of VT SUT-451 is to facilitate the reporting of sales and use tax, ensuring businesses comply with state tax laws and remit the necessary tax revenue to the state.

What information must be reported on VT SUT-451?

The information that must be reported on VT SUT-451 includes the business name, address, total sales, taxable sales, total tax collected, and any deductions or exemptions claimed.

Fill out your VT SUT-451 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT SUT-451 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.