OH ALC 37 2015 free printable template

Show details

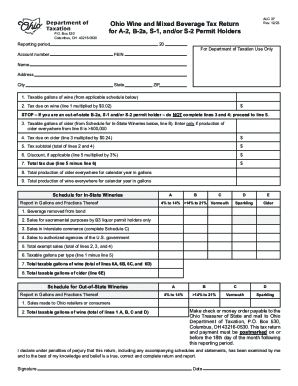

ALC 37 Rev. 5/15P. O. Box 530 Columbus, OH 432160530Ohio Wine and Mixed Beverage Tax Return for A2, B2a and/or S Permit Holders Reporting period20Account numberReturn is due on or before the 18th

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH ALC 37

Edit your OH ALC 37 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH ALC 37 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH ALC 37 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH ALC 37. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ALC 37 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH ALC 37

How to fill out OH ALC 37

01

Obtain the OH ALC 37 form from the appropriate authority or website.

02

Carefully read the instructions provided on the form.

03

Fill out personal information, including your name, address, and contact details.

04

Provide details regarding the specific action or request you are making.

05

Include any relevant dates, reference numbers, or identifiers.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the designated office or email it as instructed.

Who needs OH ALC 37?

01

Individuals or organizations that need to report specific activities or compliance information as required by Ohio's alcohol laws.

02

Businesses that hold an alcohol license and need to submit annual reports or updates.

03

Anyone involved in the production, distribution, or sale of alcoholic beverages in Ohio.

Fill

form

: Try Risk Free

People Also Ask about

How much tax is added to alcohol?

Table 1. All beveragesStatesSales TaxProportion from excise taxArizona✓19.6%Arkansas✓11.5%California✓15.9%32 more rows • Sep 10, 2019

How much is the tax on alcohol in Ohio?

Ohio Liquor Tax - STATE-CONTROLLED ✔ Ohio's general sales tax of 5.75% also applies to the purchase of liquor.

What is the excise tax in Ohio?

Ohio has a 5.75 percent state sales tax rate, a max local sales tax rate of 2.25 percent, and an average combined state and local sales tax rate of 7.24 percent.

How much is liquor tax in California?

California ranks among the lowest states in taxing distilled spirits (whiskey, vodka, tequila, etc.), wine and beer. For instance, our distilled spirits tax rate, $3.30 a gallon, stands in sharp contrast to other states, including Washington at $32.52 and Oregon at $21.98.

Is there sales tax on alcohol in Ohio?

Beer and malt beverages are taxed at $1 per barrel. Wine is taxed at 10 percent of retail price. malt beverages is set at 0.75 cent(s) per each six ounces or fractional share thereof. 1935 Mixed beverages are taxed at 10 percent of retail price.

What is the alcohol tax in Cuyahoga County?

Cuyahoga County's rates are 16 cents per gallon of beer, 32 cents per gallon of wine and 24 cents per gallon of cider. The alcoholic beverage tax does not apply to: • Sacramental wine used in religious rites.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH ALC 37 to be eSigned by others?

OH ALC 37 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit OH ALC 37 on an iOS device?

Create, modify, and share OH ALC 37 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out OH ALC 37 on an Android device?

Use the pdfFiller mobile app to complete your OH ALC 37 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is OH ALC 37?

OH ALC 37 is a form used in Ohio for reporting specific financial information related to alcoholic beverage sales and taxes.

Who is required to file OH ALC 37?

Businesses or individuals engaged in the sale of alcoholic beverages in Ohio are required to file the OH ALC 37 form.

How to fill out OH ALC 37?

To fill out OH ALC 37, one must provide accurate financial data on alcoholic beverage sales, expenses, and applicable taxes, along with the required signatures and dates.

What is the purpose of OH ALC 37?

The purpose of OH ALC 37 is to ensure compliance with state laws regarding the sale of alcoholic beverages and to aid in the proper collection of taxes.

What information must be reported on OH ALC 37?

OH ALC 37 requires reporting information such as total sales of alcoholic beverages, types of beverages sold, taxes collected, and any exemptions claimed.

Fill out your OH ALC 37 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH ALC 37 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.