OH ALC 37 2021 free printable template

Show details

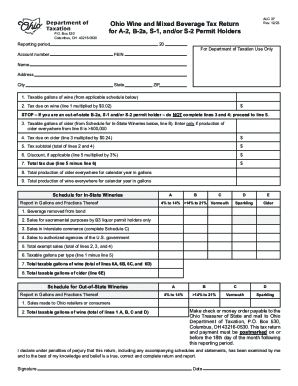

Department of

Taxation. O. Box 530

Columbus, OH 432160530ALC 37

Rev. 9/21Ohio Wine and Mixed Beverage Tax Return

for A2, B2a, S1, and/or S2 Permit HoldersReporting period20Account number Department

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH ALC 37

Edit your OH ALC 37 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH ALC 37 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH ALC 37 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OH ALC 37. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ALC 37 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH ALC 37

How to fill out OH ALC 37

01

Obtain the OH ALC 37 form from the official website or designated office.

02

Review the instructions provided with the form for clarity.

03

Fill in your personal information in the designated sections, including name, address, and contact details.

04

Provide any required identification numbers, such as Social Security or tax identification numbers.

05

Complete the sections related to your financial information, ensuring you have accurate and up-to-date figures.

06

Sign and date the form where indicated.

07

Review the form for completeness and accuracy.

08

Submit the completed form by the specified method (online, by mail, or in-person) before the deadline.

Who needs OH ALC 37?

01

Individuals applying for assistance programs or benefits related to alcohol and drug services.

02

Organizations that provide treatment or support for substance abuse issues.

03

Healthcare providers who need to report data or seek funding related to alcohol and substance abuse.

Fill

form

: Try Risk Free

People Also Ask about

How much tax is added to alcohol?

Table 1. All beveragesStatesSales TaxProportion from excise taxArizona✓19.6%Arkansas✓11.5%California✓15.9%32 more rows • Sep 10, 2019

How much is the tax on alcohol in Ohio?

Ohio Liquor Tax - STATE-CONTROLLED ✔ Ohio's general sales tax of 5.75% also applies to the purchase of liquor.

What is the excise tax in Ohio?

Ohio has a 5.75 percent state sales tax rate, a max local sales tax rate of 2.25 percent, and an average combined state and local sales tax rate of 7.24 percent.

How much is liquor tax in California?

California ranks among the lowest states in taxing distilled spirits (whiskey, vodka, tequila, etc.), wine and beer. For instance, our distilled spirits tax rate, $3.30 a gallon, stands in sharp contrast to other states, including Washington at $32.52 and Oregon at $21.98.

Is there sales tax on alcohol in Ohio?

Beer and malt beverages are taxed at $1 per barrel. Wine is taxed at 10 percent of retail price. malt beverages is set at 0.75 cent(s) per each six ounces or fractional share thereof. 1935 Mixed beverages are taxed at 10 percent of retail price.

What is the alcohol tax in Cuyahoga County?

Cuyahoga County's rates are 16 cents per gallon of beer, 32 cents per gallon of wine and 24 cents per gallon of cider. The alcoholic beverage tax does not apply to: • Sacramental wine used in religious rites.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my OH ALC 37 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your OH ALC 37 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the OH ALC 37 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your OH ALC 37 in seconds.

Can I create an electronic signature for signing my OH ALC 37 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your OH ALC 37 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is OH ALC 37?

OH ALC 37 is a form used by businesses in Ohio to report and account for specific tax information related to alcohol manufacturers and distributors.

Who is required to file OH ALC 37?

Businesses that manufacture or distribute alcoholic beverages in Ohio are required to file OH ALC 37.

How to fill out OH ALC 37?

To fill out OH ALC 37, businesses must provide information such as their business name, address, type of alcohol handled, quantity of alcohol produced or distributed, and other relevant financial details.

What is the purpose of OH ALC 37?

The purpose of OH ALC 37 is to ensure compliance with state laws governing the production and sale of alcoholic beverages and to facilitate the collection of appropriate taxes.

What information must be reported on OH ALC 37?

The information that must be reported on OH ALC 37 includes business identification, types and quantities of alcoholic beverages, sales figures, and any applicable deductions or exemptions.

Fill out your OH ALC 37 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH ALC 37 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.