Get the free Travel Allowances - cpol army

Show details

This document provides detailed regulations and guidance regarding the travel allowances for Department of the Army civilian employees and eligible family members during evacuation from overseas duty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign travel allowances - cpol

Edit your travel allowances - cpol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your travel allowances - cpol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing travel allowances - cpol online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit travel allowances - cpol. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out travel allowances - cpol

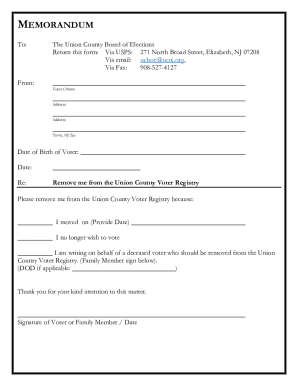

How to fill out Travel Allowances

01

Start by gathering all relevant travel details including destination, purpose of travel, and duration.

02

Fill out your personal information such as name, employee ID, and department.

03

Itemize travel expenses including transportation, lodging, meals, and any other incidental expenses.

04

Ensure to include dates and descriptions for each expense item.

05

Attach any necessary receipts or documentation to support your claims.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed Travel Allowance form to your immediate supervisor or finance department.

Who needs Travel Allowances?

01

Employees who travel for business purposes.

02

Staff attending conferences, meetings, or client engagements that incur travel-related expenses.

03

Any personnel who require reimbursement for travel costs aligned with company policies.

Fill

form

: Try Risk Free

People Also Ask about

Is allowance the same as reimbursement?

A popular question from business leaders and employees is about the difference between reimbursements and allowances. The first difference involves timing. A payroll allowance is typically used for future expenses or purchases, while an employee reimbursement is used for expenses which have already been incurred.

What is the difference between travel allowance and reimbursement?

When you travel as part of your job, employers generally pay for the travel expenses. They may be covered at the time of the expense by providing an allowance, an employee credit card, or a prepaid card. However, some businesses may have you pay the expenses and reimburse you after.

What is the difference between mileage reimbursement and travel allowance?

mileage reimbursement – What's the difference? A car allowance is a periodic stipend paid to an employee for using a vehicle. It is usually taxable. A mileage reimbursement is a cents-per-mile rate multiplied by the employee's monthly mileage amount.

What does travel allowance mean?

IRS rules on travel expenses Most business travel expenses are deductible if you travel outside your tax home. To claim travel expenses, you must be traveling outside of the area of your tax home for longer than a work day. Additionally, the trip must be long enough to necessitate rest in order to work on your trip.

What is travel expenses in English?

Meaning of travel expense in English one of the costs for flights, hotels, meals, etc. for an organization's employees when they travel on business: Staff travel expenses are provided throughout the project.

What is the allowance for travel?

Travel allowance is a type of compensation employers provide to cover employee travel expenses incurred when traveling for business purposes. It helps with employee travel costs, such as transportation, lodging, meals, and other incidentals while on the job.

How to ask for travel allowance?

Table of contents Reply to the Person Who Arranged the Interview. Use a Clear and Precise Subject Line. Include Interview Details in Bold. Open with a Formal Greeting. Politely Request Reimbursement. Emphasise Cost-Efficient Travel Plans. Acknowledge the Employer's Policy (If Applicable) Close with a Polite Sign-Off.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Travel Allowances?

Travel allowances are funds provided to reimburse employees for expenses incurred while traveling for work-related purposes. This can include costs for transportation, accommodation, meals, and other travel-related expenses.

Who is required to file Travel Allowances?

Typically, employees who travel for business purposes and incur expenses related to that travel are required to file travel allowances. This includes traveling employees who seek reimbursement for their expenditures.

How to fill out Travel Allowances?

To fill out travel allowances, employees usually need to complete a travel allowance form that details dates of travel, purpose of the trip, and itemized expenses. Receipts and documentation must be attached to verify the expenses.

What is the purpose of Travel Allowances?

The purpose of travel allowances is to ensure that employees are compensated for out-of-pocket expenses incurred while conducting business. It helps facilitate business travel by alleviating personal financial burdens associated with work-related travel.

What information must be reported on Travel Allowances?

Travel allowances reports must include information such as the purpose of travel, dates of travel, destination, itemized list of expenses (transportation, lodging, meals, etc.), and any necessary receipts or supporting documents.

Fill out your travel allowances - cpol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Travel Allowances - Cpol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.