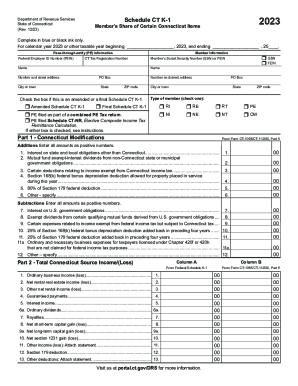

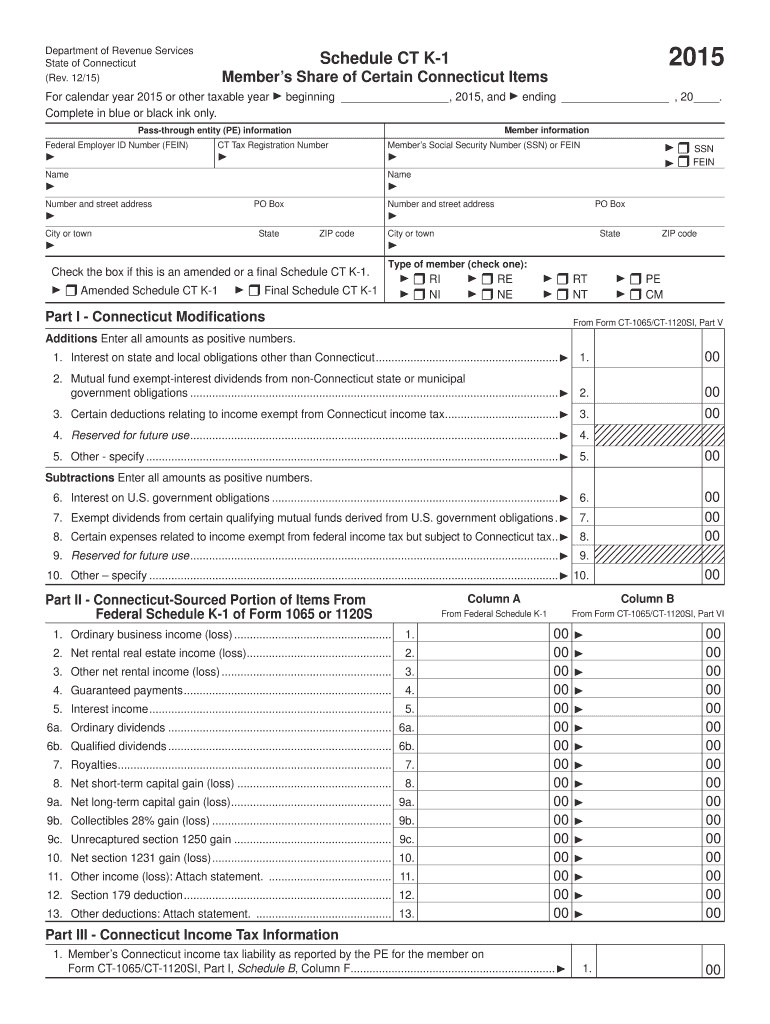

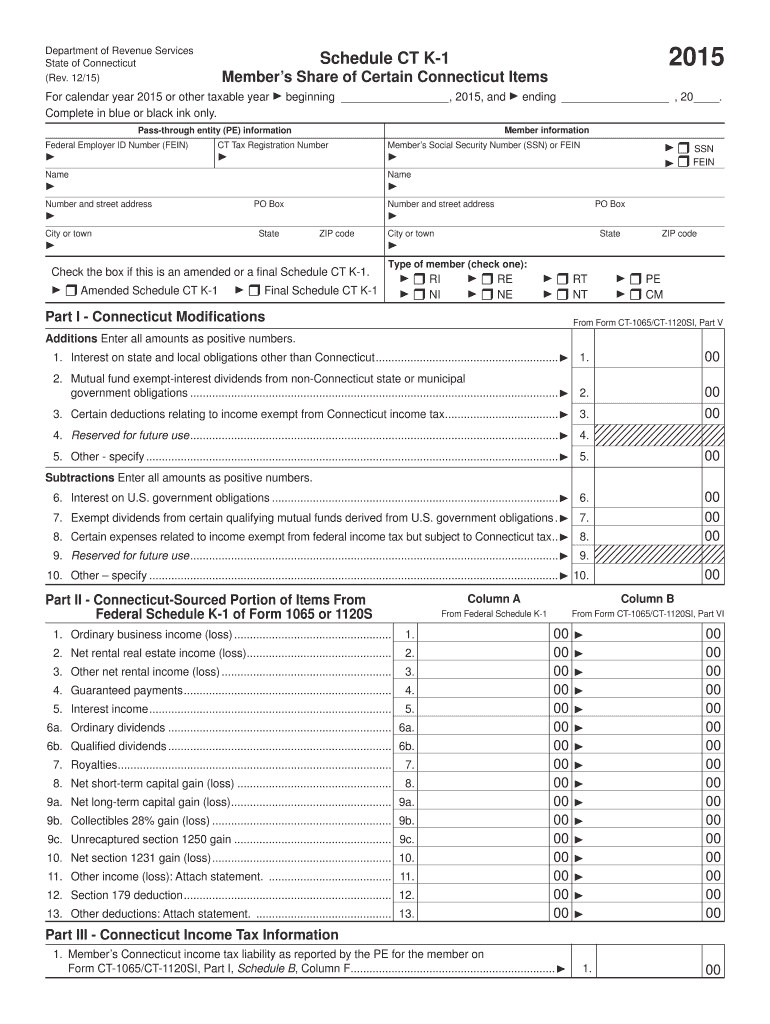

CT DRS Schedule CT K-1 2015 free printable template

Show details

Enter amounts from Schedule CT K-1 Part I Lines 6 through 10 on Form CT-1040NR/PY Lines 42 through 51. Use the PE information on the upper left hand section of Schedule CT K-1 to complete Schedule CT-IT Credit Part II. On the appropriate lines of Form CT-1040NR/PY Schedule CT-SI. Enter the amount from Schedule CT K-1 Part III Line 1 on Form Connecticut-sourced income. Enter amounts from Use the amounts from Schedule CT K-1 Part IV Column A to complete Schedule CT-IT Credit Part I Column C...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS Schedule CT K-1

Edit your CT DRS Schedule CT K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS Schedule CT K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS Schedule CT K-1 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT DRS Schedule CT K-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS Schedule CT K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS Schedule CT K-1

How to fill out CT DRS Schedule CT K-1

01

Gather all necessary financial documents related to the income, deductions, and credits of the partnership or entity.

02

Obtain the CT K-1 form from the entity that issued it, which outlines your share of income, deductions, and credits.

03

Fill out Section A with your identifying information, including your name, address, and taxpayer identification number.

04

Complete Section B by entering the partnership's or entity's details.

05

Report your distributed income, deductions, and credits in the appropriate fields, as outlined in the instructions provided with the form.

06

Double-check your entries for accuracy and completeness.

07

Submit the completed CT K-1 form along with your Connecticut state tax return.

Who needs CT DRS Schedule CT K-1?

01

Individuals who receive income from a partnership or limited liability company (LLC) operating in Connecticut.

02

Partners or shareholders who need to report their share of partnership income, deductions, and credits on their personal tax returns.

03

Anyone involved in a pass-through entity that distributes income to its members or partners.

Instructions and Help about CT DRS Schedule CT K-1

Fill

form

: Try Risk Free

People Also Ask about

What is the CT pass-through entity tax credit?

This legislation codifies that a pass‑through entity may file a composite income tax return on behalf of its nonresident members or partners. Pass-through entity (PE) means a partnership or an S corporation.

Does CT 1065 accept federal extension?

If the entity files a federal extension, the entity must still electronically file the CT-1065/CT-1120SI EXT. If the entity does not file a federal extension it can still file Form CT-1065/CT-1120SI EXT, but the entity must provide reasonable cause for requesting the extension.

What is Schedule CT K-1?

Connecticut income tax liability; or. • Each of the PEs from which the member receives Connecticut source income elects to remit composite income tax on the member's behalf. The amount of the payment remitted on your behalf is reported on Schedule CT K-1, Part IV.

What is a pass-through tax credit?

What Is the Pass-Through Business Deduction (Sec. 199A Deduction)? The Tax Cuts and Jobs Act created a deduction for households with income from sole proprietorships, partnerships, and S corporations, which allows taxpayers to exclude up to 20 percent of their pass-through business income from federal income tax.

What is pass-through entity tax benefit?

The pass-through entity will pay tax at a rate of 9.3% on the total of each consenting owner's pro-rata or distributive share of income subject to California personal income tax (beginning at RTC section 17001).

What is Form CT 1065 CT 1120SI?

Use Form CT-1065/CT-1120SI EXT, Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return, to request a six-month extension of time to file Form CT-1065/CT-1120SI, Connecticut Pass-Through Entity Tax Return, and the same six-month extension of time to furnish Schedule CT K-1, Member's Share

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CT DRS Schedule CT K-1 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your CT DRS Schedule CT K-1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find CT DRS Schedule CT K-1?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CT DRS Schedule CT K-1. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out CT DRS Schedule CT K-1 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your CT DRS Schedule CT K-1. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is CT DRS Schedule CT K-1?

CT DRS Schedule CT K-1 is a tax form used in Connecticut for reporting income, deductions, and credits allocated to partners in a partnership or members of an LLC.

Who is required to file CT DRS Schedule CT K-1?

Partnerships and limited liability companies (LLCs) operating in Connecticut are required to file CT DRS Schedule CT K-1 if they have income, deductions, or credits to report to their partners or members.

How to fill out CT DRS Schedule CT K-1?

To fill out CT DRS Schedule CT K-1, you must provide the entity's information, the partner's or member's information, and detail the allocated income, deductions, and credits for the tax year.

What is the purpose of CT DRS Schedule CT K-1?

The purpose of CT DRS Schedule CT K-1 is to provide a clear breakdown of each partner's or member's share of the income, deductions, and credits from the entity, ensuring accurate reporting on individual tax returns.

What information must be reported on CT DRS Schedule CT K-1?

CT DRS Schedule CT K-1 must report the partner's or member's name, address, identification number, share of income, deductions, credits, and any other relevant tax items for the reporting year.

Fill out your CT DRS Schedule CT K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS Schedule CT K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.